Penny stocks are those stocks which trade at a price less than A$1 and have low market capitalization. In this article we would see the recent updates on three penny stocks.

GBST Holdings Limited

About the Company: GBST Holdings Limited (ASX: GBT) is a financial technology company which provides transactions technology solutions for the financial services industry in the APAC region. GBT caters to the retail wealth management organizations and global and regional investment banks via its administration as well as transaction processing software.

Recent Update/s: On 1 July 2019, the company received a non-binding indicative proposal from SS&C Technologies, Inc to acquire all of the shares in GBST at a price of A$3.25 cash per share by means of a scheme of arrangement.

SS&C Technologies is a Nasdaq listed company addressing the needs of healthcare industries and financial services sector, based out of Windsor, Connecticut. There are around 18k financial services as well as health care companies who manage and account for their investments using the products and services of SS&C.

The proposal represents 64.6% premium to the undisturbed closing price of shares of GBT on 11 April 2019, which was A$1.975. However, the proposal is subjected to due diligence undertaken by SS&C along with a CFO session and management presentation. The proposal depends on several matters such as satisfactory completion of positive due diligence followed by the signing of the mutually acceptable transaction papers, including the scheme implementation contract.

The proposal is anticipated to be conditional on obtaining all necessary regulatory approvals apart from other usual scheme conditions such as court and shareholder approval and not subject to any sort of financing condition.

The board also consulted the professional advisers and concluded that it is in the best interest of the shareholders to give permission to SS&C to commence due diligence and also participate with SS&C for determining whether the transaction capable of Board recommendation can be developed as well as presented to shareholders or not.

Once the process of due diligence gets completed, both the parties would be entering into the binding scheme implementation agreement as per the terms and condition that is consistent with the Proposal.

On 3 July 2019, the company announced that it received another two non-binding indicative proposals for acquiring 100% ownership of GBST. The first non-binding indicative proposal was from Kiwi Holdco CayCo, Ltd as the group holding company of the FNZ Group at a cash price of A$3.50 per share which the company received on 1 July 2019 along with the form of process and exclusivity deed on terms which was different from SS&C Process and Exclusivity Deed. It followed an initial non-binding indicative proposal of A$3.15 per share that was received from FNZ on June 28, 2019 as part of a formal process run at the time. However, the board could not proceed with this further as the indicative offer price was materially lower than the initial proposal made by SS&C.

The second proposal came from SS&C which had previously made an offer to acquire 100% of GBT at A$3.25 cash per share by means of a scheme of arrangement. SS&C revised the offer to A$3.60 an increase of ~11% as compared to its previous offer.

Details of the revised Proposal updates: The new proposal of A$3.60 per share values GBST at ~ A$244 million, implying an 82.3% premium to the undisturbed closing price of shares of GBT on 11 April 2019.

Further, SS&C has indicated that it is comfortable with GBST paying a fully franked special dividend of up to A$0.35 per share ahead of completion where the indicative offer price per GBST share would get reduced by the value of that dividend.

It is to be noted that previously GBST had received a proposal from Bravura Solutions Limited (ASX: BVS) to acquire 100% of its shares, however that proposal fell through and the details of the same could be read here.

Stock Performance: The shares of GBT have given a YTD return of 130.97%. The shares are trading at A$3.600 up by 0.559% as compared to its previous closing price. GBT holds a market capitalization of A$243.13 million and approximately 67.91 million outstanding shares. (as at AEST: 1:21 PM, 05 July 2019)

IntelliHR Holdings Limited

About the company: IntelliHR Holdings Limited (ASX:IHR) is an ASX listed HR technology business which develops and markets a next-generation cloud-based people management as well as a data analytics platform. Its all-in-one HR and People Management automation tool is delivered via a SaaS business model. It automates a wide range of manual task, eliminates low-value tasks along with the administration time for HR teams, leaders as well as the staffs.

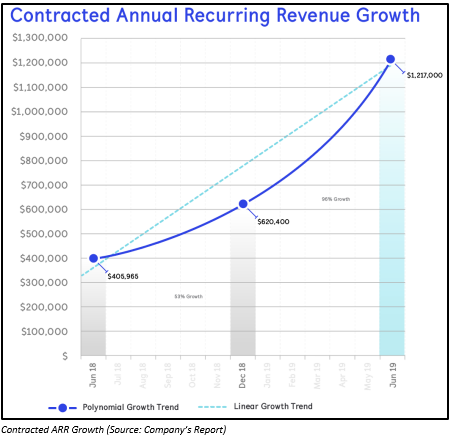

Recent Update/s: On 3 July 2019, the company announced that it had recorded its strongest 12-month period of subscriber and ARR growth since listing on the ASX. The ARR growth was driven by the investment of the company into the growth of the sales pipeline along with the continuous optimization of the sales process in order to win new business faster in the mid-market. Apart from this, the company also enhanced its product and market focus on people management so as to utilize the competitiveness of its Performance HR capabilities.

More than 9,450 subscribers were contracted during the period with the milestone of 10,000 in view. There was an increase in the contracted subscriber by 188%. Around 6,167 contracted subscribers were added during the entire FY2019. The contracted Annual Recurring Revenue (ARR) exceeded by $1.2 million. The contracted Monthly Recurring Revenue (MRR) reached $100k.

The company highlighted that the potential total ARR from sales pipeline is estimated to be in excess of $15 million. Interestingly, the companyâs sales performance is now churning circa $6.11 for every $1 invested in sales and marketing.

The company announced to the exchange that a general meeting would be held on 5 August 2019.

Stock Performance: In the previous five days, the shares of IHR have given a return of -2.60%. IHR was last traded on 4 July 2019 at A$0.075. IHR holds a market capitalization of A$9.98 million and approximately 133.04 million outstanding shares.

NOVONIX Limited

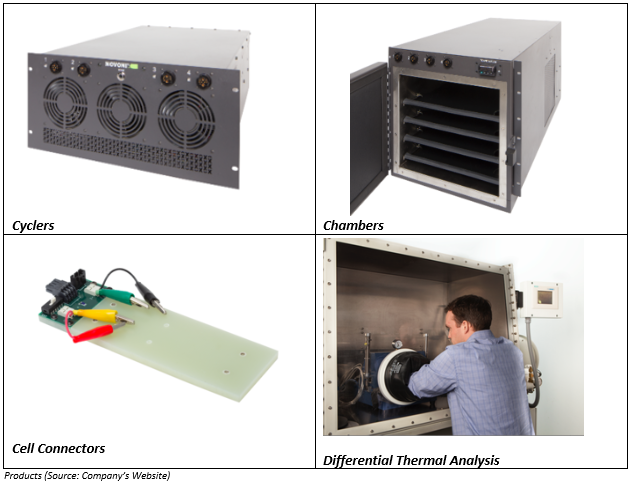

About the company: NOVONIX Limited (ASX:NVX) was carved out of Dr. Jeff Dahnâs lab at Dalhousie University. The company focuses on the development of equipment with an emphasis on the use of HPC for lifetime assessment of Li batteries. The company holds expertise in materials as well as cell testing, and at the same time, it also provides various battery testing equipment along with accessories.

Recent Update/s: On 3 July 2019, the company announced that is expanding the production capabilities of its lithium-ion battery anode material in Chattanooga, Tennessee, USA by signing a long-term lease on new premises.

Recently, NVX had hosted technical as well as BD conferences with global battery-makers and provided its anode materials specimens for assessment. In this process, it was confirmed that the market for the anode material product is growing strongly that PUREgraphite (a subsidiary company of NOVONIX Limited) has focused upon

Thus, PUREgraphite LLC has signed a lease on 3,700 m2 of area. Here, NOVONIX would be the guarantor of the lease commitments. The lease is for the period of five years with two options to renew each for five years.

Apart from that, PUREgraphite can also lease further space in the 11,150 m2 building for accommodating the future expansion necessities of the group.

At present, PUREgraphite is shifting its current facility, equipment and personnel from Duncan Street, Chattanooga facility to Corporate Place, Chattanooga.

Stock Performance: Since NVX got listed on ASX, the shares have given a return of 105.36%. NVX is trading at A$0.615 up by 6.957% as compared to its previous closing price. NVX holds a market capitalization of A$73.68 million and approximately 128.14 million outstanding shares. (as at AEST: 1:30 PM, 05 July 2019)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.