intelliHR Holdings Limited (ASX: IHR), a human resources (HR) technology business from the information technology sector, on 14th May 2019, announced to the exchange that the company has demonstrated accelerated growth of both contracted customers as well as revenues received. The key drivers of this accelerated growth were the outcome of the sales pipeline growth along with the optimisation of the sales process to win new business faster.

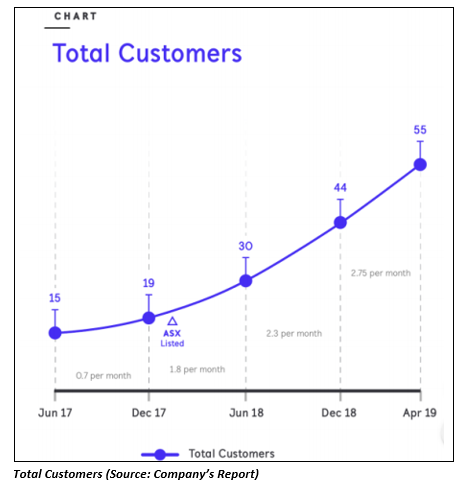

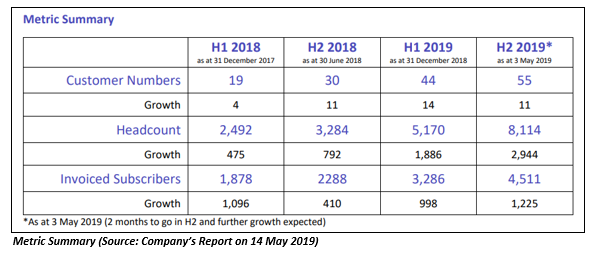

As at 3rd May 2019, 8,114 were the total contracted subscribing users of intelliHR, along with 55 customers. Over the last 18 months, the velocity with which the company won customers has increased four times. For every $1 investment in sales and marketing, the company is getting $7 return from its efficient sales performance.

The business has also optimised marketing directly to the mid-to-enterprise sized marketplace, which has resulted in a larger customer wins. Thus, the average customer size, which was 91 subscribers per customer in 2017, has reached an average of 170 subscribers per customer. This also significantly increased the value of each new customer win.

With the recent customer wins, the company expects that the average customer size will continue to grow. Based on 248 active customers, the company expects a total ARR to be in excess of $21 million.

Value addition of intelliHR to its customers:

intelliHR is an all-in-one HR software solution, which can automate a wide range of manual and/or paper-based HR work. It helps in eliminating the low-value tasks as well as administration time for HR teams, people leaders including the staff. The users are also provided with the essential compliance functionality along with the best practice tools in performance management.

The advanced HR analytics capabilities of intelliHR are market leading and a key differentiator. Also, the companyâs business model is endorsed with 111% of year-on-year revenue retention.

intelliHRâs SaaS revenue model:

Through the ongoing subscription fees and one-off professional services fees, the company generates its income. In the last four months, the company has been contracted with $500,000 in Subscriptions and a further $92,500 in Professional Services Fees, which is an indication of the strong future revenue growth potential of the business.

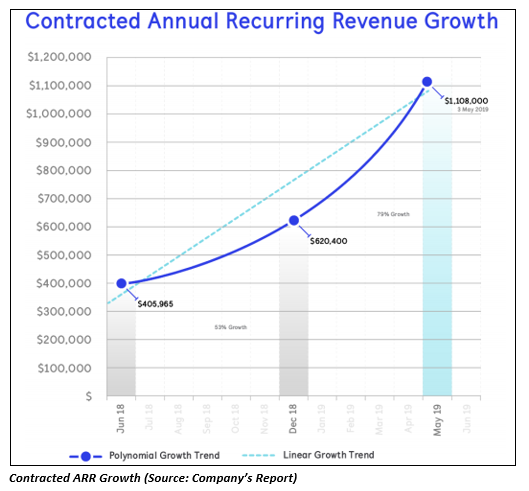

Based on the number of contracted subscribers, the shareholder value creation is measured as it gets translated directly into the ARR. In H1 FY2019, the company reported that the business successfully grew this key revenue item by 53%. In H2 FY2019, the key revenue item has grown further by 79%. It means that in just four monthsâ time, there was an addition of close to $500,000 in ARR.

On the other hand, each new customer is charged a professional services fees for implementation services, training and process redesign consulting workshops. Increase in the customer base is also a key measure of shareholder value creation as it is a revenue source.

At market close on 14th May 2019, the stock of IHR was trading at $0.105, up 22.093% as compared to its previous closing price.

Today IHR shares are trading at $0.100 on ASX (as at AEST: 12:05PM, 15 May 2019), down by 4.762%. intelliHR Holdings Limited holds a market capitalisation of $11.99 million and approximately 114.19 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.