Health care, being the dynamic sector, keep investors on their toes before injecting their funds. Vigilance to information is an important criterion that allows investors and market enthusiasts to capitalise money in the stocks. Variables playing a role in the decision making and strategy of investors include; the companyâs market cap, profits earned, P/E ratio, clinical trials, patents, regulatory approval. Simply put, Health Care sector holds the potential to deliver huge profit to traders in a short span of time.

Three Health Care Players, Opthea Limited (ASX: OPT), Nanosonics Limited (ASX: NAN), and Paradigm Biopharmaceuticals Limited (ASX: PAR) have shown a remarkable Year-to-Date returns in the Australian stock market, post-release of significant updates on research and development, R&D Tax incentive, successful clinical results, publications as well as financial annual performance.

Letâs take a glimpse of their recent developments.

Opthea Limited (ASX: OPT)

Clinical-stage biopharmaceutical company, Opthea Limited is an ophthalmic drug manufacturer with a mission to treat back-of-the-eye diseases.

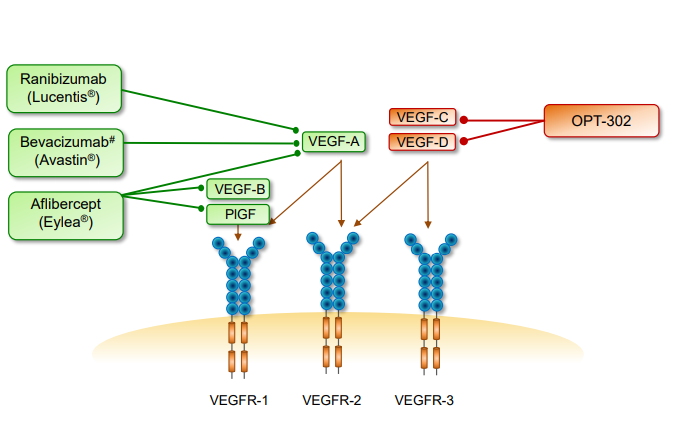

Opthea has a significant intellectual property portfolio revolving around Vascular Endothelial Growth Factors, VEGF-C, VEGF-D, and VEGFR-3; the IPR being held with Vegenics Pty Ltd, which is Optheaâs wholly owned subsidiary. The companyâs developmental program is aimed at developing a novel therapeutic product, OPT-302 for retinal eye diseases, including wet age-related macular degeneration (wet AMD) and diabetic macular edema (DME).

Mode of Action of OPT-302: Inhibition of VEGF-C and VEGF-D. (Source: Companyâs Presentation)

Receipt of $14.6 million R&D Tax Incentive

Recently, Opthea has been credited $14.6 million research and development (R&D) Tax Incentive from the Australian Taxation Office under Australian Federal Government program, upsurging the companyâs cash reserves to more than $30 million. This rebate would be exploited against the expenditure incurred in the fiscal year 2018/2019 on R&D activities, including the implementation and delivery of results from the clinical trials of OPT-302 in both wet AMD and DME, as stated by CEO & Managing Director of Opthea, Dr Megan Baldwin.

New Market Darling

The Company released encouraging results from clinical trials in the past and recorded an enormous year-to-date (YTD) return paving its way to become investorsâ favorite. On 7 August 2019, Opthea unveiled a significant positive outcome of Phase 2b Study of a potential game-changer OPT-302 in the treatment landscape of wet age-related macular degeneration (AMD) disease.

Post this release, OPT stockâs return witnessed an upward direction, with an incredible leap of 138.15% within a day, post the announcement. OPT stockâs closing price was on 6 August 2019 was $0.865, while the stock ended the market session on 7 August at a price of $2.06.

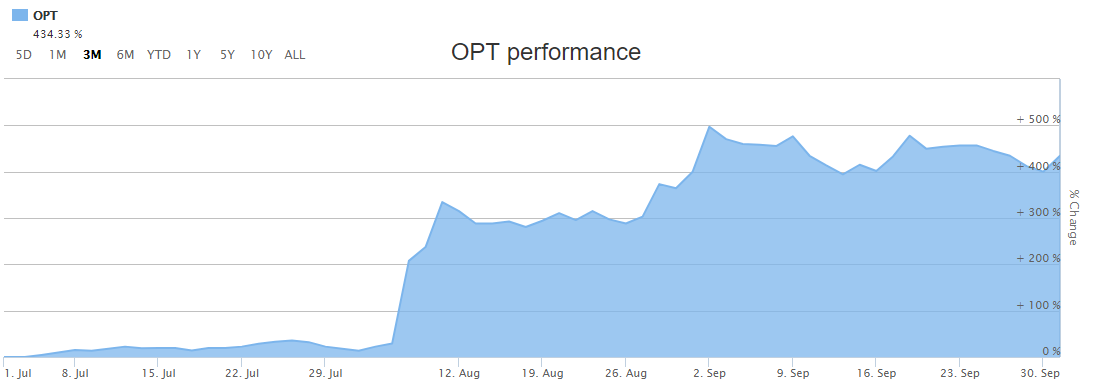

Stock Performance

OPTâs shares generated a whopping return of approximately 514.04% on a YTD basis, interestingly, 422.39% return has been generated during the last three months.

As on 3 October 2019, OPTâs shares were trading at $3.31, down by 5.429% (AEST 2:08 PM). The company has a market cap of $876.01 million and approximately 250.29 million outstanding shares. Optheaâs shares touched a 52 weeks high and low price of $4.150 and $ 0.530 respectively.

OPTâs three months return. Source: ASX

Nanosonics Limited (ASX: NAN)

ASX listed health care company, Nanosonics Limited is focused on the development and commercialisation of solutions for infection control. Its innovative technologies deliver better standards of care, ensures better safety of patients, clinics, their staff and the environment.

Setting a new standard of care in ultrasound probe disinfection practices, as well as improving its visibility worldwide, Nanoionics invented a novel, automated trophon® EPR high-level disinfection device specialised for reducing cross-contamination in patients, along with reducing the spread of Health Acquired Infections (HAIs).

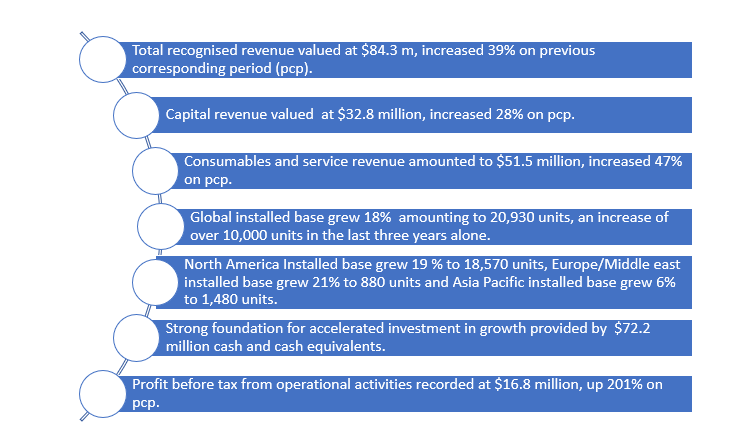

Robust FY2019 Results

Post-release of robust full-year results on 27 August 2019, Nanosonicsâ shares surged up on ASX.

Core Areas Development

- During FY2019, the company significantly invested in new product development, while completing important milestones, on the way towards the launch of next significant new product targeted for the end of FY20, provided regulatory approved.

- Nanosonics also invested in restructuring the business capacity and capability by appointing four new executives to its management team, to steer the next phase of Nanosonicsâ growth.

- Successfully launched trophon® 2 in North America, Europe and Australia, marking its presence across the globe.

- Further widening geographical footprints, the company extended the distribution agreement with GE Healthcare in Nordics, Spain and Portugal together with new contracts signed in Switzerland, Israel and Kuwait.

- Establishment of Nanosonics entity in Japan is currently underway representing developments in Japanese markets.

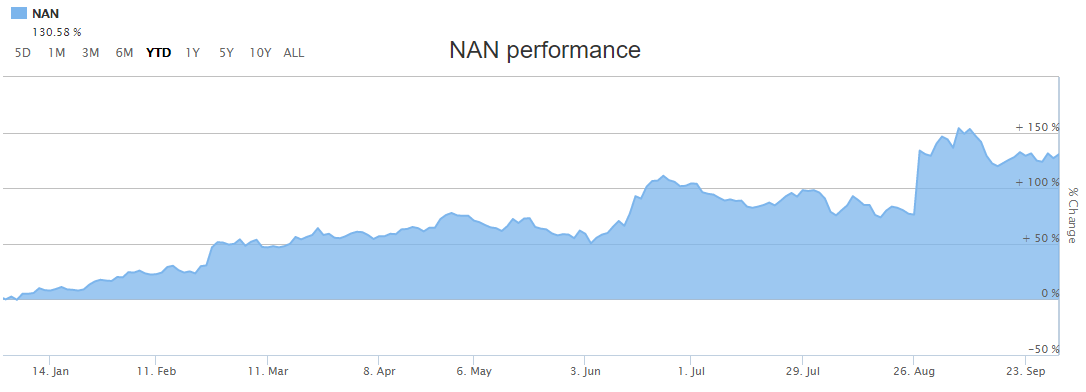

Stock Performance

NANâs shares generated significant return of 123.74 % on a YTD basis, with 39.15% return generated in the last six months. As on 3 October 2019, NANâs shares were trading at $6.135, down by 1.367 % (AEST 2:23 PM). The company has a market cap of $1.87 billion and approximately 300.31 million outstanding shares. Nanosonicâs shares touched a 52 weeks high and low price of $7.1 and $ 2.6 respectively.

NANâs YTD return, Source: ASX

Paradigm Biopharmaceuticals Ltd (ASX: PAR)

PAR is a health care company, engaged in repurposing a FDA approved drug; injectable Pentosan Polysulfate Sodium (iPPS), with a safe history of more than sixty years inflammation therapy.

In the announcement dated 30 September 2019, Paradigm revealed that data elucidating the mechanism of action (MOA) of its lead drug candidate PPS for pain reduction has been published in the international peer-reviewed scientific journal, PLoS One.

Paradigmâs Ground-breaking Discovery

Paradigmâs novel study confirms that the bone cells (osteocytes) produce high levels of pain mediator Nerve Growth Factor (NGF) in Knee Osteoarthritis (OA) patients. This innovative study also confirmed that the drug PPS; an active ingredient of Paradigmâs trademarked product Zilosul®, inhibits the production of NGF in these bone cells, thus decreasing pain in OA patients.

Key Highlights of the Discovery

- This finding provides a strong scientific basis for the MOA of PPS in reducing knee pain as reported in Paradigm's Phase 2b clinical trial that enrolled 112 patients.

- Also underpins Paradigm's study in more than 500 OA subjects who were treated under TGA special access scheme.

- Moreover, Paradigm's regulatory submissions to the US-FDA are backed by this novel MOA of PPS along with its anti-inflammatory properties and ability to modify the disease that protects the degeneration of cartilage.

- To deal with the ongoing opiate crisis, âBig Pharmaâ proactively spends billions in developing nonaddictive, safe and effective non-opiod pharmaceutical agents explicitly targeting NGF making Paradigmâs breakthrough discovery potentially a very attractive commercial partnership opportunity.

- To further strengthen Paradigms IP protections over the repurposing of PPS for treatment of pain associated with several diseases including OA, the company has filed two patents.

- Likewise, this discovery further supports Paradigmâs future regulatory submissions.

Mr. Paul Rennie, Paradigmâs Chief Executive Officer commented that âWe continue on the pathway to commercialise Zilosul® and believe this ground-breaking discovery will further attract commercial interest in Paradigmâs clinical developmentâ.

Stock Performance

PARâs shares generated a remarkable return of 197.60 % on a YTD basis, interestingly, 113.00% return has been generated during the last three months.

As on 3 October 2019, PARâs shares were trading at $2.89, down by 2.034% (AEST 2:30 PM). The company has a market cap of $569.97 million and approximately 193.06 million outstanding shares. PARâs shares touched a 52 weeks high and low price of $3.030 and $ 0.693 respectively.

PARâs YTD return, Source: ASX

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.