Close to the first weekend of October and on the day that the Chinese markets were closed, the Australian index S&P/ASX 200 slumped by almost 150 points, ~2.2 per cent to close Thursday, 3 October 2019âs session at 6493.

The result has been a consequence of the ongoing fear of recession hovering over the global markets, and the expectations of further interest rate cuts, a move by the Central bank to stabalise the weakening of the Australian economy. On 1 October 2019, the Reserve Bank of Australia (RBA) reduced the cash rate cut by 25 bps, which now stands at 0.75 per cent, a fresh record low, with anticipations of a further monetary easing. It should be noted that this move was made domestically while globally, the trade-war and US economic data remain in focus.

The slash by the central bank was done for the third time in four months, after consecutive rate cuts in June and July. Few experts believe that the rate cut momentum is a result of the disappointing car and retail sales data, while traders expect at least four rate reductions by the end of 2019.

Banks Suffer in the Dynamic Market

On the risk of a prolonged economic downturn, the financial sector stocks, majorly banks, were hit heavily after Thursdayâs trade as they seem to be struggling to cover for the damage amid the low interest rates scenario, with customers inciting sharp political criticism. A few experts expect that the subdued level of credit growth would make it difficult for lenders to grow earnings, while bad debts pace.

The ASX Stance During the Trade Session

The trade session on Friday 4 October 2019 began with the Aussie shares rising slightly, as investors expected a stronger recovery for the local market. Australian stocks edged higher going into the afternoon session and around noon, the ASX 200 index had risen by 0.1 per cent to 6,502 points. This was a relief post a two day slump of the market, wherein losses wiped approximately $80 billion off the share market. Moreover, the Australian dollar was up by 0.5 per cent to 67.5 US cents, as a result of the lift in European and US equity markets, trade surplus and the increase in the some of the base metal prices.

The ASX Stance at Market Close

After the closures of the trade session on 4 October 2019, the investor sentiment towards the Australian stocks was witnessed building slightly positively, with the S&P/ ASX 200 index at 6517.1, up by 24.1 basis points or 0.4 per cent.

The consumer discretionary and staples, energy, health care, industrials, IT, materials, metals & mining, communication and real estate closed in green, whereas the financial sector and banks continued to suffer, in red.

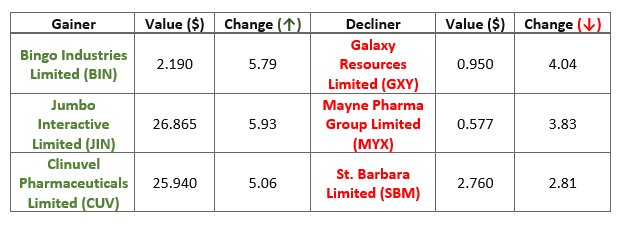

Gainers and Decliners for the day

The below table depicts the top 3 gainers and decliners for the day:

The Expert Opinion

The protracted trade war does not cease to go out of discussion while discussing Australian shares, as the Australian economy is heavily impacted by the events in the US. Industry experts believe that President Trump could be more inclined to churn a trade deal with China well ahead of the 2020 US presidential election, as the globe understands that the ongoing dispute is negatively impacting not just the US economy, but beyond.

Discussing the retail segment, as consumer spending accounts for more than half of Australia's economic activity, experts look forward to the recent Australian retail sales figures to be released by Australian Bureau of Statistics (discussed ahead in the article).

A set of experts believe that exhausted consumers and a downturn in the construction space of the Australia, which has been a triggering concern this year with the property plummet gaining traction, is together holding back momentum from monetary easing and a lower Australian dollar.

However, given the dynamic nature of businesses, it is safe to say that even though investors do seem skeptical about selling and buying the right equities, they should hold on to their nerves and expect growth in the economy, as Australia has always dealt with economic turmoil optimistically.

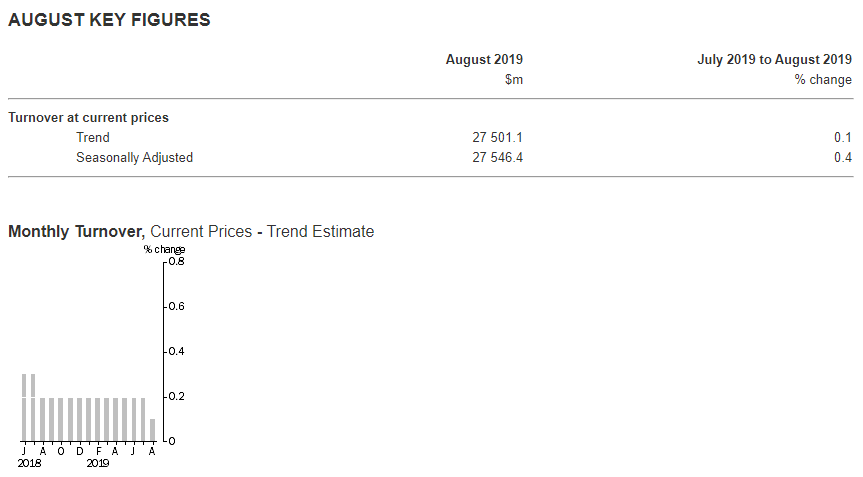

A look at Retail Trade, Australia for August 2019

On 4 September 2019, ABS released the trend of Australiaâs Retail Trade for August 2019, depicting that the trend estimate was up by 0.1 person in August 2019 after a rise of 0.2 per cent in both June and July 2019. The seasonally adjusted estimate was up by 0.4 per cent in August 2019 post a relatively unchanged result (0.1 per cent) in July 2019, and a rise of 0.3 per cent in June 2019.

(Source: ABS)

In trend terms, Australian turnover was up by 2.3 per cent in August 2019 compared to the prior corresponding period. Food retailing, clothing, footwear, household goods retailing, and personal accessory retailing were amongst the rising industries. The industries which fell in trend terms included Cafes, restaurants and takeaway services and Department stores.

Discussing the territories, Victoria, WA, Queensland, Tasmania and the ACT rose in trend terms.

Deciphering this release, market experts seem rather disappointed, given the scale of the policy stimulus boost to disposable incomes, and August still not witnessing a meaningful lift in spending. The slight boost of the retail sector fell short of market expectations. However, on the bright side, few experts consider this to be the silver lining after volatile sales conditions.

Besides delivering share market updates, we are committed to provide a deep insight towards micro and macro factors affecting the trade sessions in Australia, and we encourage you to stay tuned for the latest events.

To understand the Australian Share Market Evolution In the Century, we encourage you to READ HERE.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.