Tesla is breaking the internet with the stock of the company registering record highs amidst the record performance of its EV segment. The Tesla Model 3 is performing really well across the global front, and the sales are further anticipated for Model 3 and other models by industry experts to grow with higher penetration of EV worldwide.

Also Read: Tesla Shares Making Records; Elon Musk Is a Very Happy Man!

Electric mobility is growing rapidly with EV sales showing twofold growth in 2018 and further gaining momentum in 2019 on a monthly basis.

While the EV sales and industry is growing rapidly, it is time for Tesla and other major auto carmakers to secure the supply of critical battery metals. While lithium is abundant in the market to meet the growing demand from the EV sector, other critical metals for EV such as cobalt, copper, nickel are witnessing a bottleneck in the wake of certain market events.

Copper, which is an important integrated part in battery cathode, is currently surging over the supply woes and high demand from China.

To Know More, Do Read: Copper Surpasses December High; Strong Demand from China and Supply Constraints Propel Prices

While there are supply constraints for copper, there are many resource-rich countries with high mine production to fill out for the shortage very soon, keeping battery makers calm over the copper supply woes, and the demand is also forecasted to aligning with supply over the years ahead.

To Know More, Do Read: ICSG Slashes Supply and Demand Outlook for Copper; BHP’s Escondida Disruption Propels ASX Copper Stocks

It is cobalt, which is particularly concerning the battery and EV manufacturers over its dense supply from the Democratic Republic of Congo, which controls ~65 per cent of global cobalt supply.

While the ethical issues of securing cobalt from DRC is high, the absence of a low-cost alternative to replace cobalt in batteries is now traumatising battery makers.

In the wake of successful sales, Tesla is now securing long-term contracts for cobalt, and as per many media houses, the Elon Musk-led EV giant is in talks with Glencore Plc to secure a long-term contract in order to secure much needed cobalt at its Shanghai-based Gigafactory.

Cobalt prices took a hit in early 2018 over the supply woes and ethical issues in DRC, the largest cobalt supplier, which in turn, prompted many EV carmakers such as Tesla to switch to more copper and nickel-based batteries; however, the replacement limitation at the current moment is again supporting cobalt with global players such as Tesla, BMW AG, Volkswagen, securing long-term contract to keep the supply squeeze in check ahead.

Benefit Coming Ahead for Australia Miners?

Glencore is one of the world’s largest supplier of Cobalt, which it produces mainly as a by-product of copper mining in DRC and nickel and copper mining in Australia. While operations of cobalt players in DRC might face some issues due to the incorporation of cobalt under the label of “Strategic Metal” by the DRC government to increase Royalty, the operations in Australia are relatively at ease due to friendly environment in Australia around cobalt mining.

Australia is the third-largest supplier of cobalt, and the metal is currently in the list of critical minerals along with some rare-earth metals.

Australia’s cobalt is anticipated by many industry experts to be high in demand ahead, as battery manufacturers and EV carmakers increasingly seeking secure and ethical supply sources. Australia holds an estimated one-sixth of the world’s known cobalt reserves with significant opportunities to dig from existing mines.

The Department of Industry, Innovation and Science estimates the 2019 cobalt production to stand at 5,500 tonnes and refined cobalt production of 3,200 tonnes. There are many cobalt projects in the pipeline amid a projected recovery in nickel and copper prices ahead.

Also Read: Indonesia Export Ban to Create a Nickel Boom while Mincor and Independence Develop Assets?

Miners and Project Under Lens

Australian Mines Limited (ASX:AUZ) operated Sconi project with an annual capacity of 1.8 thousand tonnes in Queensland is under the lens along with Clean TeQ’s Pty Ltd operated Sunrise project in New South Wales with an annual capacity of 3.2k tonnes.

- Till now, the Sconi project has delivered a bankable feasibility study with a revised mine life of over 30 years, pre-tax internal rate of return (or IRR) of 20 per cent and post-tax IRR of 15 per cent.

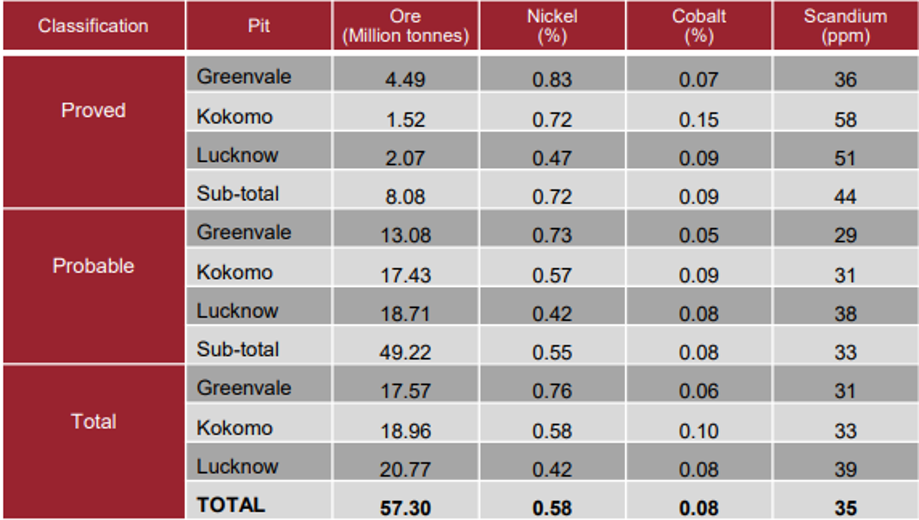

- The project has a Prescribed Project status provided by the Government of Queensland along with an updated mineral resource

Sconi Ore Reserves (Source: Company’s Report)

- The current estimated pre-tax net present value of the prospect if at $1.47 billion @8 per cent discount rate with a 5.8 year payback period.

Key Takeaways

- Tesla is breaking the internet with the stock of the company registering record highs amidst the record performance of its EV segment.

- Electric mobility is growing rapidly with EV sales showing twofold growth in 2018 to now surging in 2019 on a monthly basis.

- While the EV sales and industry is growing rapidly, it is time for Tesla and other major auto carmakers to secure the supply of critical battery metals such as copper, nickel, and cobalt.

- It is cobalt, which is particularly concerning the battery and EV manufacturers over its dense supply from the Democratic Republic of Congo, which controls ~65 per cent of global cobalt supply.

- In the wake of successful sales, Tesla is now securing long-term contracts for cobalt, and as per many media houses, the Elon Musk-led EV giant is in talks with Glencore Plc to secure a long-term contract in order to provide needed cobalt at its Shanghai-based Gigafactory.

- While operations of cobalt players in DRC might face some issues due to the incorporation of cobalt under the label of “Strategic Metal” by the DRC government to increase Royalty, the operations in Australia are relatively at ease due to friendly environment in Australia around cobalt mining.

- Australia’s cobalt is anticipated by many industry experts to be high in demand ahead, as battery manufacturers and EV carmakers increasingly seeking secure and ethical supply sources.

- Australian Mines Limited (ASX:AUZ) operated Sconi project with an annual capacity of 1.8 thousand tonnes in Queensland is under the lens along with Clean TeQ’s Pty Ltd operated Sunrise project in New South Wales with an annual capacity of 3.2k tonnes.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.