Overview of the Australian Telecom Sector

The telecommunication sector comprises of the companies that enable global communication through either Internet or Phone, wires or wirelessly, airwaves or cables. The telecom sector has developed from the telegraph to the digital and wireless technology used in the present.

The Australian telecommunication market is driven by Mobile broadband and Fibre-to-the-Node (FttN) market. The mobile broadband market is growing steadily in Australia with a decline in fixed-line telephony traffic and revenue. As the fibre and fixed-wireless broadband services are becoming more widely available, the fixed-line DSL broadband is declining.

A market research firm has anticipated a steady rise in the mobile broadband market over the next five years to 2023. Also, the firm has predicted a very slow mobile subscriber growth over the next five years to 2023.

The Communications Report for 2017-18 presented by the Australian Communications and Media Authority (ACMA) showed that Australia's telecom industry generated a revenue of $44 billion in the last financial year. The report also demonstrated a growth of 15 per cent from the wireless telecommunications between 2014 and 2018.

Major Telecom Providers in Australia

The Australian telecom service market is segmented into the major providers - Optus, Vodafone and Telstra - and second-tier market providers - TPG, Macquarie Telecom and Vocus-M2.

Let us have a look at some of these telecom service providers trading on the Australian Securities Exchange:

Vocus Group Limited

A specialist fibre network services provider, Vocus Group Limited (ASX: VOC) operates Australiaâs second largest inter-capital network. The company has created a top-grade telecom infrastructure platform across New Zealand and Australia, offering a secure, resilient and reliable network connection. The company owns and manages a 21st century fibre network within Australia and New Zealand, that has the capacity to assist rapid growth in demand for bandwidth.

Operating Performance:

Recently, Vocus received a nonbinding, indicative proposal from AGL Energy Limited (ASX:AGL) for the acquisition of all the shares of Vocus via a scheme of arrangement, at a price of AUD 4.85 per share in cash. Earlier, the company received a similar proposal from EQT Infrastructure for the acquisition of all the shares of Vocus at a price of AUD 5.25 per share in cash.

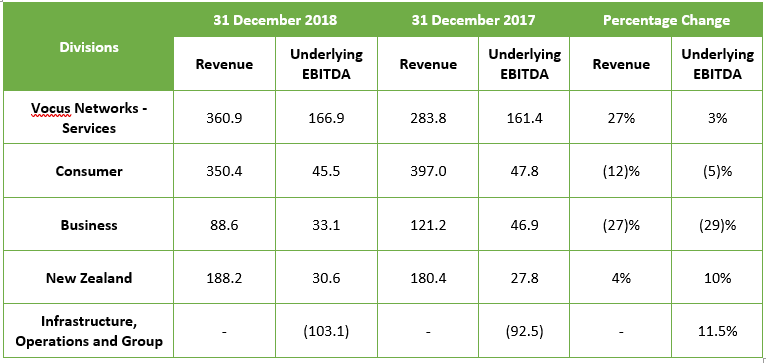

During the period ended 31 December 2018, the company renamed its operating segments as follows:

- Business (formerly Commander Australia)

- Infrastructure, Operations and Group (formerly Group Services)

- Vocus Networks - Services (formerly Enterprise, Government & Wholesale Australia)

The company informed that the ASC (Australia Singapore Cable) submarine cable between Perth, Singapore and Indonesia was successfully launched in 1HFY19. During the half-year ended 31st December 2018, capex payments of AUD 133.0 million were made in relation to the ASC. The company has estimated the final capex payments in relation to the ASC project at AUD 8.4 million that is to be made in the second half of FY19.

Financial Performance:

In H1 FY19, the companyâs Statutory Revenue improved slightly by 0.7 per cent to $974.2 million from $967.3 million in H1 FY18. However, its Underlying EBITDA fell 9.8 per cent to $170.7 million in H1FY19 compared to the prior corresponding period (pcp). The company reported a Net Profit after Tax of $16.5 million during the half-year period.

The table below incorporates the divisional performance of the company in H1 FY19 relative to H1 FY18:

Future Outlook:

The company aims to maximise profitable growth within its core Enterprise, Government & Wholesale markets in New Zealand and Australia, utilising its fibre and network assets. The companyâs goal is to double its revenue from these Australian and New Zealand markets within five years.

The company expects its Underlying EBITDA to be in the range of $350m - $370m, Capex (ex ASC) between $160m - $170m and Depreciation and Amortisation range to be $160m - $165m in FY19.

Stock Performance:

The companyâs stock is trading at AUD 4.350 (12:18 PM AEST, 14th June 2019), up 0.7 per cent relative to the last closed price. It has delivered a return of 40.07 per cent on YTD basis. The stock has generated a huge return of 1136.01 per cent since it commenced trading on the Australian Stock Exchange.

Telstra Corporation Limited

One of the leading telecommunications and technology companies headquartered in Australia, Telstra Corporation Limited (ASX: TLS) provides a wide range of services worldwide. The company has been committed to the Asia Pacific region for a long time. It has one of the largest subsea cable networks in the region, delivering access to 400,000 kilometres of cable. The networks of the company are connected to nearly 60 data centres, with the largest integrated data centre footprint in the Asia-Pacific region.

Operational Performance:

The company announced on 29th May 2019 that it expects increased restructuring costs and non-cash impairment of legacy IT assets in FY19 due to good progress on its T22 strategy. The company also anticipates a reduction of around 6000 roles by the end of the financial year.

Telstra declared 5G spectrum auction results on 10th December 2018, stating that it has secured 30- 80 MHz nationwide in the auction, investing 386 million dollars to assist its national 5G rollout.

In the half-year ending 31st December 2018, Telstra added 239,000 additional retail postpaid mobile services, while Telstra Wholesale added 125,000 mobile services (included both postpaid and prepaid services).

Financial Performance:

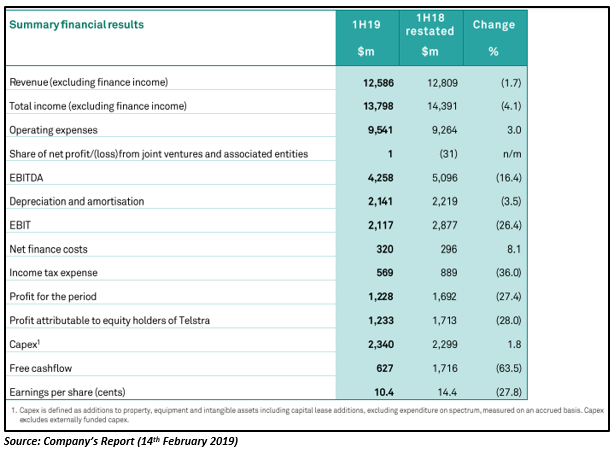

Telstra published its financial results for the half-year ending December 31, 2018 on 14th February 2019. The companyâs financial results were in accordance with its guidance with its total income, EBITDA and NPAT down by 4.1 per cent, 16.4 per cent and 27.4 per cent, respectively on a reporting basis. The results reflected the significant and progressive impact of the NBN roll-out.

The underlying fixed costs of the company declined 4.2 per cent in 1H19, with around $900 million achieved in cost reductions since FY16.

Dividend Update:

Telstra announced an ordinary fully paid dividend of AUD 0.080 on 14th February 2019. The declared dividend was related to a period of six months, carrying a payment date of 29th March 2019. The record date and the ex-date of the dividend were 27th February 2019 and 28th February 2019, respectively. It was a fully franked dividend with 30 per cent corporate tax rate for franking credit applicable on it. The dividend reinvestment plan was also applicable to the declared dividend at a DRP price of AUD 3.17610.

The current annual dividend yield stands at 3.26 per cent (as on 14th June 2019).

Stock Performance:

Telstraâs stock is trading higher on 14th June 2019 (12:23 PM AEST) at AUD 3.850, up by 0.26 per cent in comparison to the previous closing price. The stockâs 52-week high and low value stood at AUD 3.840 and AUD 2.547, respectively. Since it began trading on the Australian Securities Exchange, the stock has delivered a return of 22.3 per cent. However, it performed better in 2019, providing a YTD return of 39.95 per cent.

Speedcast International Limited

A global communications partner, Speedcast International Limited (ASX: SDA) has an extensive multi-technology terrestrial and offshore network. The company offers telecommunications managed services and IT solutions to governments and enterprises and has more satellite capacity than any other service provider.

Operating Performance

The company published its Annual Report 2018 on 18th April 2019, in which it mentioned that it has further strengthened its position as the worldâs leading remote communications services provider in 2018. The company has around 1,500 employees in more than 40 countries, serving around 3,200 customers in 140 countries.

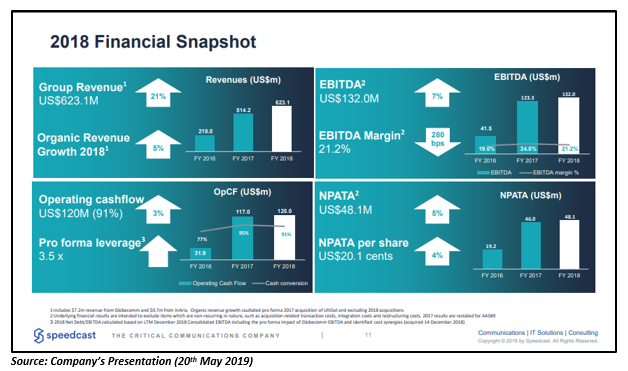

In December 2018, the company completed the acquisition of Globecomm Systems Inc. for a cash consideration of $134 million. The acquisition supported doubling Speedcastâs revenue in the Government sector and bringing both significant cost and revenue synergy opportunities. The company also signed two largest contracts in 2018, with Carnival Corporation in the U.S and NBN Co in Australia.

Financial Performance

The companyâs financial performance was weaker than expected despite several achievements in 2018. The revenue of the company improved 21 per cent in the year ending 31 December 2018 to USD623.1 million. However, the âProfit for the year after tax attributable to the owners of the Companyâ declined 69 per cent to USD1.9 million.

Stock Performance:

The companyâs stock is trading at AUD 3.655 on 14th June 2019 (12:23 PM AEST), up by 0.69 per cent. The performance of the stock has been tremendously well since it commenced trading on the ASX on 12th August 2014, generating a massive return of 88.81 per cent with a YTD return of 32%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.