Small cap stocks are referred to as the shares of smaller companies. These are usually considered as good investments due to their low valuations. These generally have a market Cap in the range of $300 million - $2 billion. These companies have chances of higher growth and have the potential for investors to earn the money faster.

Small cap companies are usually the riskiest in the economic downturn and are most likely to fail in the recession period. They have the advantage over large cap and mid cap companies during the expansion phase. The stock price will rise along with the companyâs growth.

Let us now have a look on few small Cap stocks!

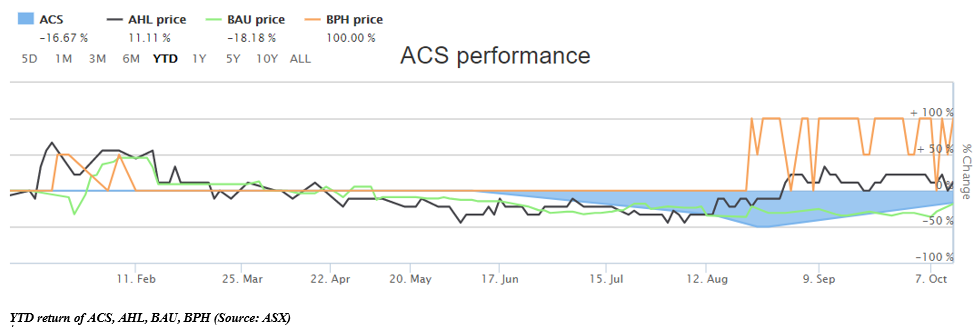

Accent Resources NL (ASX: ACS)

Accent Resources NL (ASX:ACS) is engaged in the business of exploration and valuation of mineral deposits. The company focusses on exploring iron ore, base metal and precious metal deposits.

FY19 Financial Performance (as at 30 June 2019)

- During the year ended 30 June 2019, the Company was in a net liability position of A$3,420,703 which went up from A$57,823 in FY18.

- Revenue for the company went down from A$13,932 in FY18 to A$12,762 in FY19. In the half-year ended 31 December 2018, significant losses continued with Company announcing a loss of A$32.3 million.

Subsequent to FY19, the Company signed an agreement with Rich Mark Development Group Pty Ltd for a A$2.0 million unsecured loan, subject to interest at 6% pa which accrues six monthly and is payable along with the principle at maturity on 30 June 2021.

Outlook:

The Company regards Magnetite Range Project as a core asset and will continue to seek ways of progressing development with the iron ore price scenario becoming more favourable in the future. The Company remains committed to the projects and will continue to seek ways of progressing development in the coming years.

Stock Performance: The stock is currently trading at A$0.005 (AEST-1:25 PM) on 14 October 2019, with the market cap of A$905k.

AHAlife Holdings Limited (ASX:AHL)

AHAlife Holdings Limited (ASX:AHL) is a consumer discretionary company which is engaged in sale of premium lifestyle and design products through multiple e-commerce platforms.

FY19 Financial Performance (as at 30 June 2019)

- To support its strategy and growth plans, the Company completed a successful capital raise of US$1.6 million in June and July 2019, providing AHAlife with forward flexibility to expand the business.

- The loss for the consolidated entity after providing for income tax amounted to US$2,643,241 as compared to the prior year loss of US$2,691,460.

- An increase in Trade Receivables and Inventory was observed during the year from US$25,581 and US$60,532 to US$194,210 and US$ 68,186 respectively.

Business Achievements:

Upon completion of the Design Milk acquisition, AHAlife designed and launched two test websites, Design Milk every day and Design Milk Travels, reflecting two of Design Milkâs Instagram feeds of the same names that account for 3.2 million of Design Milkâs growing audience of 7.5 million followers.

Outlook:

The Company is planning to grow their Design Milk website through additional product category opportunities and diversify revenue streams through paid advertising, e-commerce, physical retail, trade/b2b and events. In FY20, the company is all set to explore co-branded product opportunities with key partners and is planning to reposition and relaunch Ahalife and Kaufmann Mercantile websites.

Stock Performance: The stock is currently trading at A$0.011 (AEST 2:20 PM) on 14 October 2019, up by 10% from the prior day, which is very close to its 52 week-high of A$0.016. The market cap of the stock is A$10.1 million, and the performance of the stock went up by 42.86% in the past 3 months.

Bauxite Resources Limited (ASX:BAU)

Bauxite Resources Limited (ASX:BAU) is a mining Company which continues to develop its silica sand projects, exploring and maintaining the valuable bauxite assets.

FY19 Financial Performance (as at 30 June 2019)

- The Group has recorded a loss for the period after income tax of A$1,301,942 as compared to the loss of $1,450,706 in FY18.

- During the year, Employment Benefits expenses increased to A$287,391 from A$247,300 in 2018.

- The revenue of the group declined to A$113,921 from A$280,462 in 2018. This was mainly because of lower cash balance and decline in interest rates over the course of the past two financial years.

- The average rate earned on investments during the year was 2.57%, compared to an average rate of 2.42% in 2018 and the Groupâs cash balances reduced by A$812,210 over the course of the year.

Stock Performance: BAU is currently trading at A$0.045 (AEST 3:30 PM) on 14 October 2019, with the market cap of A$9.65 million.

BPH Energy Limited (ASX:BPH)

BPH Energy Limited (ASX: BPH) is a diversified player with key investments in biotechnology, resources and medical cannabis.

BPH Medicinal Cannabis Market Update:

The Company provided an update on developments for its Medicinal Cannabis investment Patagonia Genetics (PG Aust), which purchased first 1,300ltrs of Wonderland Agronutrients products to send samples to major licensed producers and grow shops internationally.

The Company earlier announced that it had completed the investment in Patagonia Genetics Pty Ltd with an option to acquire a total shareholding of 49% in PG Aust. BPH had acquired the 10% interest in PG Aust with the consideration amount of $50k in cash into PG Aust and the issue of 1.5 billion BPH shares.

BPH Biotechnology Market Update:

BPH Investee Cortical recently updated that its South Korean exclusive distributor of the flagship offering BARM has successfully obtained Korean KGMP certification.

BPH Resource Investment Market Update:

BPH Investee Advent Energy recently disclosed that NT Department of Primary Industry and Resources for has granted a renewal of Retention Licence 1 (RL1) in the Northern Territory for a period of 5 years till July 2023.

Stock Performance: The stock is currently trading at A$0.001 (AEST 3:18 PM) on 14 October 2019. The stock has gone up by 100% in the past 6 months. In terms of Valuation, the stock is trading at a P/E multiple of 10x with the market cap of A$5.98 million.

Ennox Group Limited (ASX: EXO)

Diversified financial services player, Ennox Group Limited (ASX:EXO) is in the business of corporate advisory including capital raising, M&A, IPOs and investment management activities including quoted investments, private equity or pre-IPO securities.

Financial and Operational Results (as at 30 June 2019)

- The Board of Ennox Group Ltd reported a Loss Before Interest, Tax, Amortisation and Depreciation of $581,224 and a loss after tax of $533,623 for the year ended 30 June 2019. This result was mainly driven by loss arising from re-valuations of the Groupâs investments of $302,905 during the year.

- Revenue was down to $12,669 compared to prior year of $32,480 due to lower advisory income and income from investments.

- Net assets of the Group went up to $4,225,170 as at 30 June 2019 as compared to $1,220,257 at 30 June 2018.

Stock Performance: The stock of the company is currently trading at A$0.002 (AEST3:32 PM) on 14 October 2019 with a market cap of $5.31 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.