The outbreak of coronavirus possesses a potential threat to the future of businesses around the globe. Businesses across are conserving cash amidst the uncertainty and boards across businesses are going to the extent of deferring or withdrawal of dividends. Even, APRA (Australian Prudential Regulation Authority) has set guidelines for Australian banks and insurers to consider deferring of dividend distribution decisions or reducing the pay-outs.

Dividend holds an important priority for those who position their portfolio for passive income. Amid the prevailing environment, certain companies have managed to declare a dividend accounting to their decent balance sheet position.

In this backdrop, let us have a look at two dividend paying companies: AMC, BKW; their dividend pattern supported with strong financials.

Amcor Plc (ASX: AMC)

Materials company, Amcor is into production and development of responsible packaging of products. These products include beverage, food, medical, personal- and home- care products, among others. AMC provides a wide range of rigid packaging, flexible packaging, closures, speciality cartons and services.

The Company delivered strong results with positive expectation for FY 2020 outlook, in its nine months results for the period ending 31 March 2020. Strong results account to a wide range of geographic presence of AMC and its sales being completely weighted to the end markets of essential consumer staples.

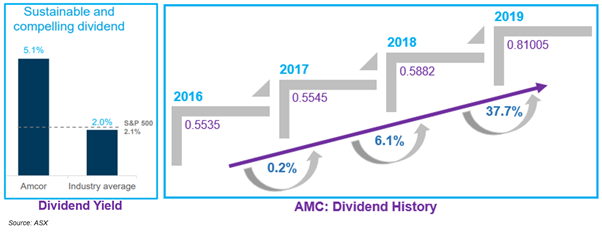

For the third quarter FY 2020, the Company declared an interim dividend of 11.5 cents per share. The ex-dividend date and the record date will be 27 May 2020 and 28 May 2020, respectively. Followed by the date of payment which is scheduled to be 17 June 2020. Currently, AMC has an annual dividend yield of 4.73 per cent (as on 20 May 2020).

The Company also mentioned that it had repurchased 3.2 per cent or 51.5 million of outstanding shares for a total cost of $478 million, during the nine months period. Further, Amcor expects to complete $500 million of buy-back program by the end of FY 2020.

The snippet of the performance in nine months period is as follows.

- AMC gained pre-tax synergy benefits of $55 million (year to date) from integration of Bemis.

- In constant currency terms, adjusted EBIT increased by 6.9 per cent on previous corresponding year, to $1,059 million.

- Earnings per share was 26.9 cents per share and net income was $433 million.

- Adjusted EPS was 44.7 cents per share, an increase of 13.7 per cent on pcp basis (in constant currency terms).

- Adjusted free cash flow (before dividends) was $367 million, an increase of $217 million from last corresponding period. This increase mainly indicates better working capital performance and higher earnings.

- At 31 March 2020, net debt was $5,984 million, an increase from $5,502 million at 30 June 2019. This was mainly because of the dividend payments and seasonality of cash flow generation.

Outlook: Amcor has enhanced its outlook for certain items in the updated guidance for FY 2020 ending 30 June 2020. Key highlights as follows (all items in constant currency terms).

- Adjusted EPS growth increased to 11-12 per cent from 7-10 per cent. It is likely to fall in the range of 64.6 - 65.2 cents per share.

- Net interest costs in constant currency terms decreased from $210 - $230 million to $190 - $200 million.

Stock performance: The stock of AMC closed the day’s trading session at $14.450 per share on 20 May 2020, a dip of 1.23 per cent against its previous closing price. The market capitalisation of Amcor Plc stood at $23 billion, with ~ 1.57 billion outstanding shares.

Brickworks Limited (ASX: BKW)

Materials company, Brickworks Limited manufactures and distributes building materials for commercial and residential markets. The Company was founded in 1934 and got listed on ASX in 1962. BKW’s building products range includes Cement; Clay Bricks and Pavers; Masonry and Stone; Precast; Roofing; and Specialised Building systems.

The Company has four divisions as follows.

- Building Products Australia includes Austral Bricks, Austral Precast, Austral Masonry and Bristile Roofing.

- Building Products North America includes a brick producer, Glen-Gery in the United States.

- Property includes a 50:50 JV Industrial Property Trust with Goodman.

- Investments, which include 39.4 per cent holding in Washington H. Soul Pattinson & Company (WHSP).

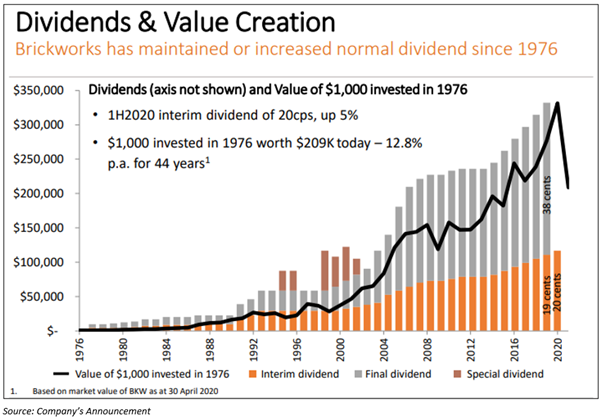

On dividend front, the Company has a strong track record of delivering consistent dividends for over 40 years. Brickworks mentioned that out of the only 8 companies, it is one such company which has increased or maintained its dividends every year since 1976.

Most recently, Brickworks distributed a fully franked interim dividend of 20 cents per share, as compared to 19 cents on prior corresponding year, an increase of 5 per cent. The record and payment dates were 14 April 2020 and 5 May 2020, respectively. Currently, Brickworks has an annual dividend yield of 4.4 per cent (as on 20 May 2020).

Lindsay Partridge, BKW’s Managing Director, mentioned that the investors are interested in the Company’s long-term investment decisions. He stated that dividends of BKW are not covered by cash flows, but by investments.

WHSP also has a long history of consistently growing dividends like Brickworks. In FY 2019, cash dividends of $56 million were received by BKW. The Company stated that it expects to benefit from a steady increase in dividends and earnings of WHSP.

The snippet of the Company’s performance in its half year report for the period ended 31 January 2020 is as follows.

- Total revenue increased from $442 million to $449 million.

- Underlying NPAT from continuing operations stood at $100 million and statutory NPAT including significant items was $58 million.

- Following the US acquisitions, the gearing increased to 21 per cent.

Performance by different divisions of the company:

- Building Products North America: EBITDA and EBIT figures were $13 million and $6 million, respectively.

- Building Products Australia: EBITDA stood at $39 million and EBIT at $10 million.

- Property: Net trust assets increased $77 million and EBIT stood at $89 million.

- Investments: EBIT declined by 36 per cent on pcp basis, to $39 million.

Stock performance: On 20 May 2020, BKW stock settled the day’s trading session at $13.50 per share, up 2 per cent as compared to its previous closing price. The market capitalisation of the Company stood at $1.98 billion, with ~149.94 million outstanding shares.