The worldâs largest IT and remote communications services provider, Speedcast International Ltd (ASX: SDA) has been listed on the Australian Securities Exchange since 2014. It has a multi-access tech and orbit network and a multi-band network of more than eighty satellites along with a connecting global terrestrial network.

The Company receives extensive local support from more than forty countries and is uniquely positioned as a strategic partner, tailoring communications, IT and digital solutions to meet consumer demand (catering to more than 3,200 customers in over 140 countries in varied sectors) and facilitate business transformation. Few managed information services (MIS) provided by SDA include- data and voice applications, crew welfare, IoT solutions, cybersecurity, network systems integration services and content solutions.

Interesting on 20 December 2019, the SDA shares were in action, and traded last up by 4.93 per cent from its last close, at a price of $0.745 . As on the date, the market cap of the Company is $170.22 million, and it was trading with approximately 239.74 million outstanding shares. The annual dividend yield is 10.14 per cent.

In this article, let us screen through a few recent events with this giant communication services provider, which might have propelled investors to build a positive investing sentiment towards it, as witnessed from the ASX statistics provided above-

Recent Management Amendments

SDA witnessed a number of management and Board changes in the past few months. These might prove to be instrumental in the way business in conducted and enhance the approach mechanism of the Company. New people, new ideas and new methods in a competitive marketplace are always a boon for any Company.

Following are the changes made to the management in the recent times:

- Post the resignation of Mr. Clive Cuthell as Chief Financial Officer and joint Company Secretary, SDA welcomed Mr. Peter Myers as Chief Financial Officer (commencing 4 November 2019) and Company Secretary (effective 22 November 2019). He will act as joint Company Secretary alongside Mr. Dominic Gyngell and would bring along an extensive mid and large cap ASX-listed company experience with substantial commercial along with finance competencies, especially in intricate businesses.

- Jennifer Grigel was chosen as the Chief Operating Officer, beginning early 2020, to build on the significant operations progress achieved to date. She will succeed Sebastien Lehnherr and take charge of the role.

- Sebastien Lehnherr will be going back to the Companyâs largest Energy customer, Schlumberger, as the global Chief Information Officer, post a phase of transition.

- In September, the Company onboarded Peter Shaper and Joe Spytek as independent non-executive directors after a global search to underpin SDAâs Board renewal process. Both have an extensive experience in satellite telecommunications industry and have a successful history of building business successes.

As part of the Board renewal process, SDAâs Directors are likely to bring a performance-based equity incentive package to shareholders in the days to come.

Pleased with the efficient new additions to SDAâs exceptional platform, Ms. Grigel believes that the Company has instigated substantial transformation to certify that the operations team drives its platform much more effectively and consequently benefit customers. There lie enormous opportunities to even better serve them while progressing with automation and innovation.

The new team will be instrumental in the following-

- delivering on the potential for growth that exists;

- grow and develop a team that is already well respected in the global satellite communications industry;

- leverage the Companyâs global platform, unique market position and substantial opportunities;

- develop the Finance group into an industry leading team that supports and guides the organisation to better meet customersâ expectations, improve business performance and enhance outcomes for all stakeholders.

1H 2019 Results

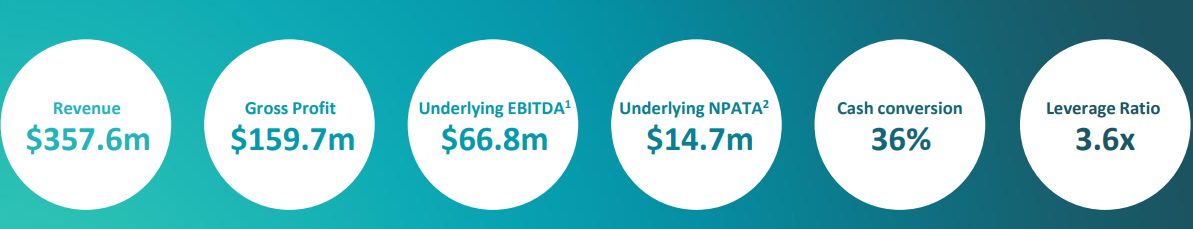

Evident from its preliminary financial results for the period ending 30 June 2019 (1H 2019), the Company faced a very challenging six month, with lower than expected financial performance and slower organic growth. The key highlights of the companyâs financial performance are mentioned below:

- Statutory NPAT loss was $175.5 million.

- Net debt increased to $625 million at 30 June 2019.

- On the bright side though, Group revenue was up by 17.3% to $357.6 million.

- EBITDA was up by 3% to $62.2 million (excluding $4.6 million impact of AASB 16).

SDAâs 1H 2019 Results (Source: Companyâs Report)

The industry and operating challenges along with Globecommâs underperformance in the first half led to the subdued results. However, SDA responded to market challenges by undertaking an extensive analysis of the business to place an operating plan to address underlying issues.

This resulted in a better start to the second half of 2019, where the product and service offering is noticeably gaining traction amongst consumers. With more than 20 new and extended contracts in its kitty, the Company has a solid pipeline to drive growth in the days to come.

Strategic initiatives, operational and system enhancements, process integration and the right structure in place are catalysts of generating organic revenue and earnings growth, while reducing costs.

A Better 2H 2019 for SDA- What to Expect?

Below are the companyâs expectations over the medium term:

- Deliver healthy growth in Maritime- commercial shipping as well as in cruise.

- Surge in defence spending by the Government.

- Revenue synergies from Globecomm integration - anticipated next year and beyond.

- Underlying EBITDA likely to be ~$21 million.

- Energyâs return to growth expected to lift underlying EBITDA margin.

- Market share gains and scale expected in the medium term.

- The FY19 EBITDA to lie between $150 million â $160 million.

- Cost savings of up to $10 million expected in the second half of FY19 (equating to $20 million of annualised savings).

- Capex of $50 million and a leverage ratio of less than 4x at the end of 2019 is expected by the firm.

- No dividends likely to be declared in the second half of the year (none was declared for 1H 2019 as well).

With a power-packed team in place and well placed strategies to tap existing and growing opportunities in the communications space, it will be interesting to witness the critical communications company, Speedcast, unfold its business stance in the days to come. We encourage you to stay tuned to Kalkine Media for any developments in the Company, to aid your investing decision.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.