The healthcare sector can be unpredictable for stocks of big organisations, much less small-cap stocks. However, small healthcare companies that focus on a distinctive target market have the potential to develop much faster than large-cap companies.

Due to its diversity, the healthcare sector is an exciting industry to invest. While ASX blue chips like Cochlear Limited (ASX:COH) and CSL Limited (ASX:CSL) may be prominent in this sector, there are still a lot of unaddressed markets for other companies to target, and investors are keenly watching these players.

Small-cap healthcare and coronavirus

Small-cap shares are listed companies that have a market capitalisation in a range of $300 million to $2 billion. Small-caps can offer investors more opportunity for growth, and a significant benefit of investing in small-cap companies is to beat institutional investors.

The share market of Australia provides various excellent opportunities for investing in top healthcare sector companies. Still many stocks are not covered by experts and have a lot of scope for the investors to generate a significant return. The investors generally consider investing small-cap space, since the universe of these stocks is vast.

As this is the time when blue-chip stocks are experiencing the impact of the COVID-19 pandemic, the adverse effect on smaller stocks could be shattering. Still, there are a few small caps health sector companies that have profited from the crisis in a commercial sense and have generated good returns in the last three months, around the time the virus began to spread locally in China before spreading worldwide.

Read More: Opportunities to be Tapped in the Healthcare Sector Amid Coronavirus

In this article, we are highlighting four ASX-listed small-cap healthcare stocks that have profited from the COVID-19 Pandemic and continue doing so - UCM, ZNO, AFP, AEI

USCOM Limited’s USCOM 1A Sales Up

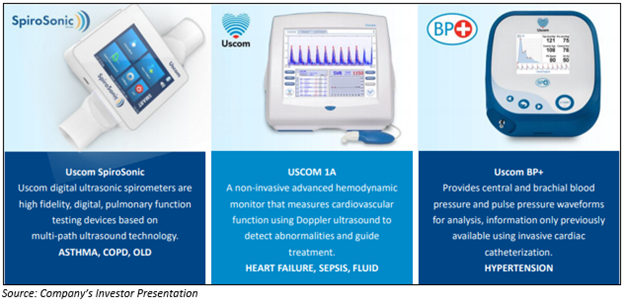

Medical technology player Uscom Limited (ASX:UCM) is into the development, designing and international marketing of non-invasive cardiovascular and pulmonary medical devices. UCM has primarily three sets of medical devices in the field of pulmonary and cardiovascular intensive care: the Uscom SpiroSonic Suite for Asthma, COPD; USCOM 1A for heart failure, sepsis; Uscom BP+ for hypertension.

On 26 March 2020, the Company updated its investor presentation on ASX, disclosing the third-quarter results and impact of COVID-19.

COVID-19 impact:

The Company is playing a significant role in combating COVID-19, its product USCOM 1A which is the only universally available Doppler Haemodynamic Monitor is used for cardiovascular support when a coronavirus infected person is in the ICU.

Moreover, USCOM 1A is recommended by the Chinese National Health and Medical Commission of the People’s Republic of China for the treatment of severe COVID-19 in children as well as in adults.

It is noteworthy to mention that the Company achieved mid-term sales for USCOM 1A as all markets recognise the demand for improved ICU services.

Quarterly Results:

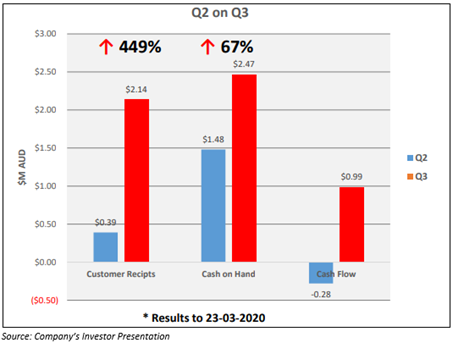

- The Company has reported approximately ~$0.35 million profit in the third quarter of FY2020.

- The positive cash flow of the Company recorded at $0.99 million.

- USCOM has cash on hand worth ~$2.47 million.

Zoono Group Limited, Al Rabban Capital Signed a Distribution Agreement

Global biotech Company Zoono Group Limited (ASX:ZNO) is principally engaged in the development and distribution of environmentally-friendly antimicrobial solutions suitable for surface sanitisers, skincare and mould remediation therapies. The hand and surface sanitisers manufactured by the Company have been proven effective against the coronavirus family.

Significant Exclusive Distribution Agreement with Al Rabban Capital:

On 25 March 2020, Zoono announced that the Company and Al Rabban Capital signed an Exclusive Distribution Agreement for the supply of Zoono products in the MENA region.

As COVID-19 continues to spread across the globe, all nations are looking for effective solutions to reduce the virus’ impact. Zoono technology, Z-71 Microbe Shield and hand sanitiser have recently been tested against the COVID-19 and have shown to be more than 99.99% effective.

As per the key terms of this agreement, Zoono will deliver its product in totes (1,000 litres each) which Al Rabban would repackage locally, and the initial order lodged by Al Rabban is for approximately NZ$2.4 million.

AFT Pharmaceuticals Limited witnesses strong demand for its products

AFP Pharmaceuticals Limited (ASX:AFP) is engaged in developing, licencing and selling pharmaceutical products in Australasia and globally, with a total of four offices and five research and development networks. The Company has product licences in more than 120 countries, and over 130 products are available in the Australasia region.

Refinancing and provides trading update:

On 23 March 2020, AFP Pharmaceuticals revealed that it had concluded an agreement with the Bank of New Zealand for refinancing its current six-year CRG loan facility maturing on 31 March 2020.

Concerning the agreement, the managing director of the Company Dr Atkinson stated that he was pleased to complete the refinancing, and this gives AFT pharma funding certainty and is anticipated to result in finance cost savings of approximately $2 million annually over the three-year term of the facility.

It is noteworthy that, the Company continues to see robust demand for its several products as noted on 10 March 2020 subsequent the coronavirus pandemic. The products that are in high demand comprise influenza and cold medicines, antibiotics and Vitamin C Liposachets®.

Moreover, the company highlighted that it is too early to be precise on the anticipated earnings outcome for the financial year 2020. However, the Company mentioned that it reiterates its guidance that it expects operating earnings to be the “mid to upper end” of the guidance range of $18.8-$21.8 million.

Aeris Environmental Ltd’s Aeris Active kills ~99.99% of the coronavirus surrogate

An ASX listed disinfectant manufacturer Aeris Environmental Ltd (ASX:AEI) is into the development as well as markets environmentally-friendly, proprietary technology that makes significant improvements in asset sustainability along with performance. The Company’s proprietary hospital-grade disinfectant having residual Aeris Active has been granted as general product for the coronavirus disinfection.

Aeris Active is effective against coronavirus in 60 seconds

Aeris Environmental disclosed that Eurofins AMS Laboratories informed the Company, that Aeris Active had achieved more than 4-log reduction (~99.99%) after just sixty second contact time against the coronavirus surrogate, murine hepatitis virus.

Aeris Active comprises a proprietary biocide system (dual active), providing broad-spectrum viricidal, fungicidal and bactericidal efficacy simultaneously with proprietary ‘residual protection’ affording, in addition to the initial kill, long-term protection (almost seven days) of at-risk surfaces.

Aeris Environmental Ltd disclosed that the Company is increasing the supply, with numerous manufacturing sites currently in production. Moreover, AEI stated that the capacity is now coming online in Chine, SE Asia and the US.

Let us now have a look at the stock performance of these four ASX listed healthcare sector players on 27 March 2020:

- Uscom Limited (ASX:UCM) - The stock of UCM closed the day’s trade at $0.235, with the market capitalisation at nearly $38.91 million and almost 149.66 million shares outstanding. The 52-week high and low price was noted at $0.530 and $0.095. The Company has generated a positive return of 126.09% on a year to date basis and 116.67% in the last three months.

- Zoono Group Limited (ASX:ZNO) - ZNO stock closed the day’s trade at $1.585, up by 7.095%. The market capitalisation was nearly $241.7 million, and the Company had almost 163.31 million shares outstanding. The 52-week high and low price was noted at $2.440 and $0.063, respectively. The Company has generated a positive return of 116.06% on a YTD basis and 125.95% in the previous three months.

- AFT Pharmaceuticals Limited (ASX:AFP) - AFP stock closed the day’s trade at $3.600, with the market capitalisation at nearly $364.91 million and almost 97.31 million shares outstanding. The 52-week high price was noted at $3.750. The Company has generated a positive return of 20.97% on a YTD basis and 20.97% in the last three months.

- Aeris Environmental Ltd (ASX:AEI) - The stock of AEI closed the day’s trade at $0.440, down by 6.383%, with the market capitalisation at nearly $100.51 million and almost 213.85 million shares outstanding. The 52-week high and low price was noted at $0.745 and $0.125, respectively. The Company has generated a positive return of 64.91% on a YTD basis and 56.67% in the last three months.

_09_03_2024_01_03_36_873870.jpg)