Midst diverse sectors, the Australian Biotech sector represents a profitable market with great prospects for considerable returns to investors, fetching their attention to investing in shares despite the fluctuating and uncertain global trend. In Australia, the Biotechnology and Medical industry has seen tremendous fast-track growth not only in terms of size but also reputation gained over the past few years. Moreover, the life expectancy of humans has increased; hence people seek out the best health care opportunities to unravel medical problems. Furthermore, ample funding grants by the government bodies and institutions is also a key factor in attracting stakeholdersâ interest from around the world. These facts place the Australian Biotech/Health Care system amid the best in the world.

Australian Biotech Stocks namely Orthocell Limited (ASX:OCC), and Impressions Health Care Limited (ASX: IHL) have shown significant Year-to-date returns in the Australian stock market and released their recent updates recently, in relation to research and development, successful clinical results, commercialization strategy as well as operational and financial annual performance. Letâs take a look into the details of each of these Australian biotech stocks.

Orthocell Limited (ASX:OCC)

Orthocell is a small- cap, regenerative medicine company with a focus on development and commercialization of its two prime products â CelGrow®, for repairing soft tissues and OrthoATI® for treatment of resistant tendon injuries. It is also involved in another product Ortho-ACI®.

Stock Performance

OCCâs shares are trading at $0.390, down by 1.26% (1:59 PM AEST, 6 September 2019) with the market cap of $60.95 million and nearly 154.31 million outstanding shares. The company generated a positive return of 154.84% on YTD basis.

Successful CelGro® Tendon Regeneration Trial

OCC unveiled positive results from CelGro® tendon regeneration clinical trial. The outcome of the study confirmed that the patients, suffering from damaged rotator cuff tendon as a result of any sport or road accidents, or work-related problems leading to chronic pain and affecting mobility, successfully restored normal functioning of the shoulder, upon CelGro® tendon regeneration treatment surgery.

CelGro® surgery was found was safe and tolerable as per interim clinical results announced earlier. The CelGro® was also found to be able to guide tendon healing with 100% mobility without any pain reported in patients.

Two years post-CelGro® tendon regeneration surgery, a successful tendon repair was observed in all the patients. CelGro® was also found to strengthen rotator cuff tendon repair in the shoulder. No revision surgery for a re-tear of the rotator cuff tendon is required. This is a significant finding as according to data reported at the American Academy of Orthopaedic Surgeons Annual Meeting in 2015, in 57% of cases a revision surgery for re-tears has been reported.

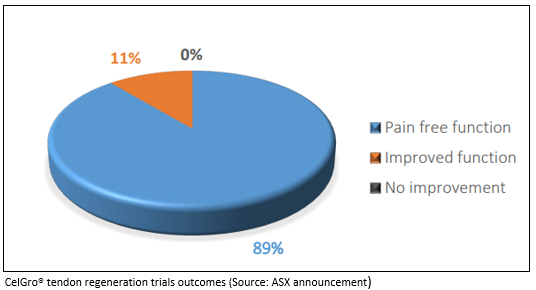

Important observations from clinical study:

- Ten patients were registered for the clinical study.

- Performance of CelGro® collagen membrane was evaluated when used to enhance surgical repair of rotator cuff tendinopathy and tear.

- CelGro® was reported to guide tendon healing

- 89% of patients went back with pain free function.

- No side-effects reported after the CelGro®

- Substantial improvement in performing daily activities was observed in patients.

The company has framed a clear marketing strategy for CelGro® tendon regeneration suggestion into key markets. With nearly 500,000 rotator cuff surgeries performed annually in the US, the estimated annual worth of CelGro®âs potential market, specifically in rotator cuff tendon, worldwide is US$1 billion.

Impression Healthcare Limited (ASX: IHL)

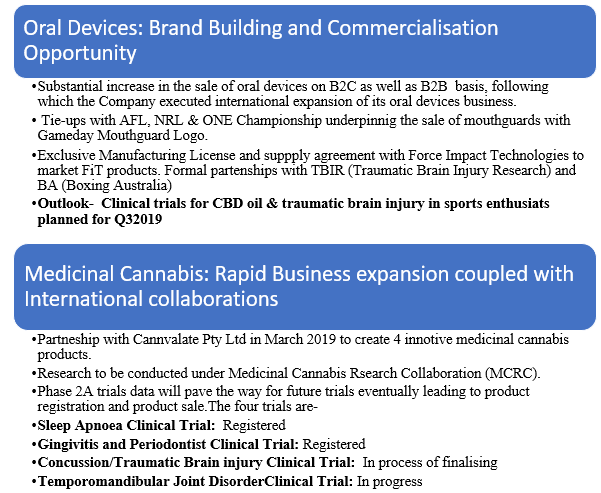

Australia based company with its head office located in Melbourne, IHL deals in manufacturing and commercialisation of best-in-class, and cost-effective oral devices.The company is undertaking four clinical trials investigating the use of uniquely formulated medicinal cannabis products for the treatment of Temporomandibular Joint Disorder, Obstructive Sleep Apnoea, Periodontitis (Gum Disease) and Traumatic Brain Injury/Concussion.

Stock Performance

IHLâs shares are trading at $0.081, up by 2.532% (2:18 PM AEST, 6 September 2019) with the market cap of $50.01 million and nearly 633.06 million outstanding shares. The company generated a positive return of 393.75% on YTD basis.

Recent Business Update

Impressions Health Care recently announced the appointment two renowned medical specialaists, Associate Professor Michael Stubbs, and Dr David Cunnigton to its Medical Advisory Board, managed by Dr Sud Agarwal, CMO of Impression. The company also reported first wholesale Order of IncannexTM CBD Oils from Linnea SA.

Annual Results

On 4 September 2019, Impression Health Care released the Annual Report for the fiscal year ended 30 June 2019. FY2019 has been an astounding year for IHL, with activities on providing unique solutions in Health care & Medicinal Cannabis.

Business activities and outlook: Major highlights are given below:

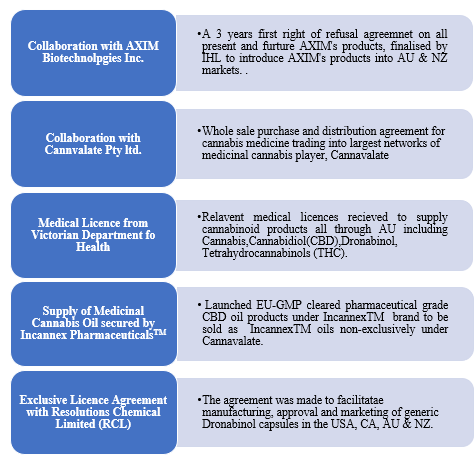

Licences /Agreements / Collaborations:

The Licenses and agreements secured by the company over the past year is briefed below.

Key Financial Highlights:

In FY2019, the Company recognized a revenue of $1,176,466, compared to $1,012,233 for FY2018, showing an increase of 16.4%. The Net Loss after Tax (on ordinary activities) was $2,718,399 in FY2019 in comparison to $2,947,991 for FY2018, an improvement of 7.8%. No dividends were paid in both 2019 and 2018. Net tangible assets per security remained constant at $-0.001 for the fiscal year 2018 as well as 2019.

Overall, Impressions Healthcare Limited observed a robust business during the past year with the aim of long-term value creation for shareholders, commercialization & development of Intellectual Property assets.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.