The pharmaceutical market in Australia is defined as a knowledge-intensive, technology-driven industry that is well poised to contribute to the overall economic activity and particularly enhance social wellbeing. The S&P/ASX 200 Health Care Index is up 1.29% (+449.7 points) to the current value of 35,211.2 (as ta AEST 02:44 PM).

Letâs look at the following two healthcare companies that are actively advancing the use of their respective drug candidates through clinical trials and expedited regulatory pathways.

Orthocell Limited

Regenerative medicine company, Orthocell Limited (ASX:OCC) is based in Murdoch, Australia. The company has developed novel, first in class, most advanced portfolio of products and cell therapies to repair soft tissue injuries and support mobility for patients. The commercialised products include -

- Autologous Tenocyte Implantation Ortho-ATI® cell therapy licensed by Therapeutic Goods Administration (TGA).

- CelGro® platform technology, is a collagen medical device that augments repair of tissue and heals several surgical, orthopaedic and reconstructive applications. European regulatory approval (CE Mark) received for marketing and sale within the European Union. Preparations underway for first approvals in the USA.

- Autologous Chondrocyte Implantation, Ortho-ACI®, which helps in regenerating damaged cartilage tissue and tendon. Pre-IND meetings with the US (FDA) completed while clinical studies underway for approval.

Source: Companyâs Investor Update

Source: Companyâs Investor Update

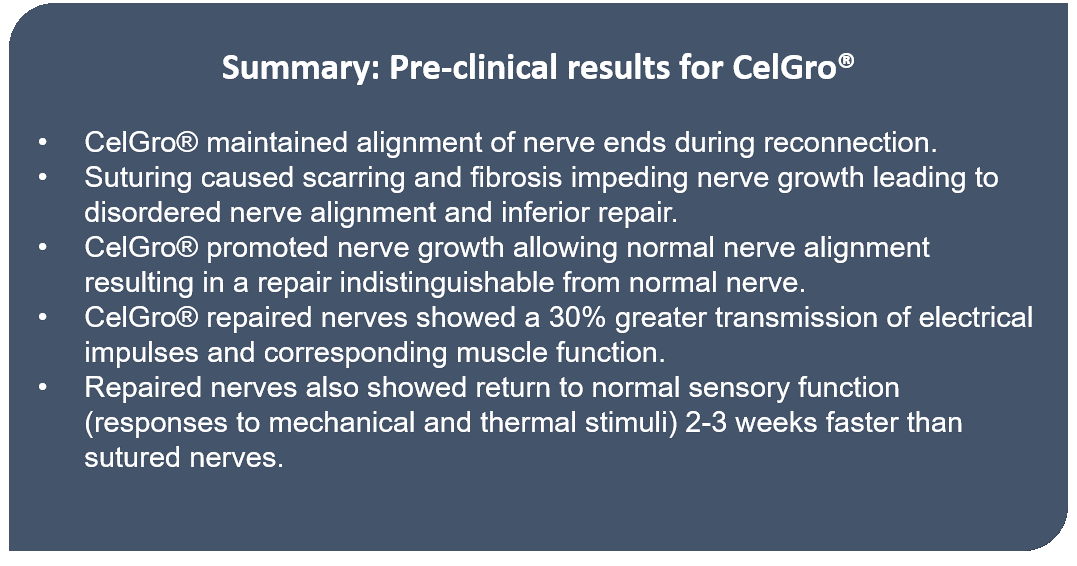

Pre-clinical results for CelGro®- On 25 July 2019, Orthocell announced positive pre-clinical results for the use of CelGro® in enhancing repair of severed peripheral nerves. The new results evidently demonstrate how CelGro® restores nerves to their normal or pre-injured structure, which is not possible to be examined as part of the current human nerve regeneration trial.

The pre-clinical study was conducted with 30 rats across three study groups (Control; Direct suture method and CelGro® repair method). Motor and sensory outcomes were measured at multiple time points. The result summary for the trial is as follows-

The pre-clinical study follows the recently completed CelGro® Human Nerve Regeneration Trial wherein four patients successfully completed participation and experienced 83% improvement in muscle power of affected limbs after surgery with CelGro® and had subsequently returned to work, sport and other regular activities.

Currently, further patient data is being gathered by the company, and Orthocell will provide a related clinical update in 3Q CY2019.

CelGro® Single-Stage Dental Implant Study- On 19 June 2019, Orthocell reported that all the patients had positively finished the CelGro® single-stage dental implant study (Marketing Study) intended to assess predictability and effectiveness in fast-tracking treatment time.

The 10 patients treated in the Marketing Study had previously suffered, in some cases for many years, from damaged, missing or diseased teeth. However, after surgery with CelGro®, the impact on patientsâ lives was significantly positive.

The dental bone regeneration addressable market for CelGro® is estimated to be worth more than USD 900 million per annum, and the platform demonstrated a breakthrough in bone and soft tissue reconstruction and is an integral component in the rapidly advancing dental implant market.

Stock Performance- Orthocell has a market cap of circa AUD 69.09 million with approximately 153.53 million outstanding shares. On 25 July 2019, the OCC stock was trading at AUD 0.495, climbing up 10% by AUD 0.045 with 4.35 million shares traded (as at AEST 12:42 PM).

In addition, the OCC stock has delivered positive and high returns of 260% in the last three months, 246.15% in the last six months and 190.32% YTD.

Race Oncology Ltd

Race Oncology Limited (ASX: RAC), established in 2011 and based in Melbourne, Australia, operates as a speciality pharmaceutical company with its primary drug asset being Bisantrene, a small molecule cancer chemotherapy drug that had been developed for the treatment of acute myeloid leukaemia.

Bisantrene trial treatment in Israel - On 25 July 2019, Race Oncology announced (as advised by Sheba) that the first patient had completed their seven-day course of treatment with key cancer drug Bisantrene, without any major complications in the trial at the Sheba Medical Center in Israel. This marked a major milestone for the company since the drug disappeared more than 25 years ago.

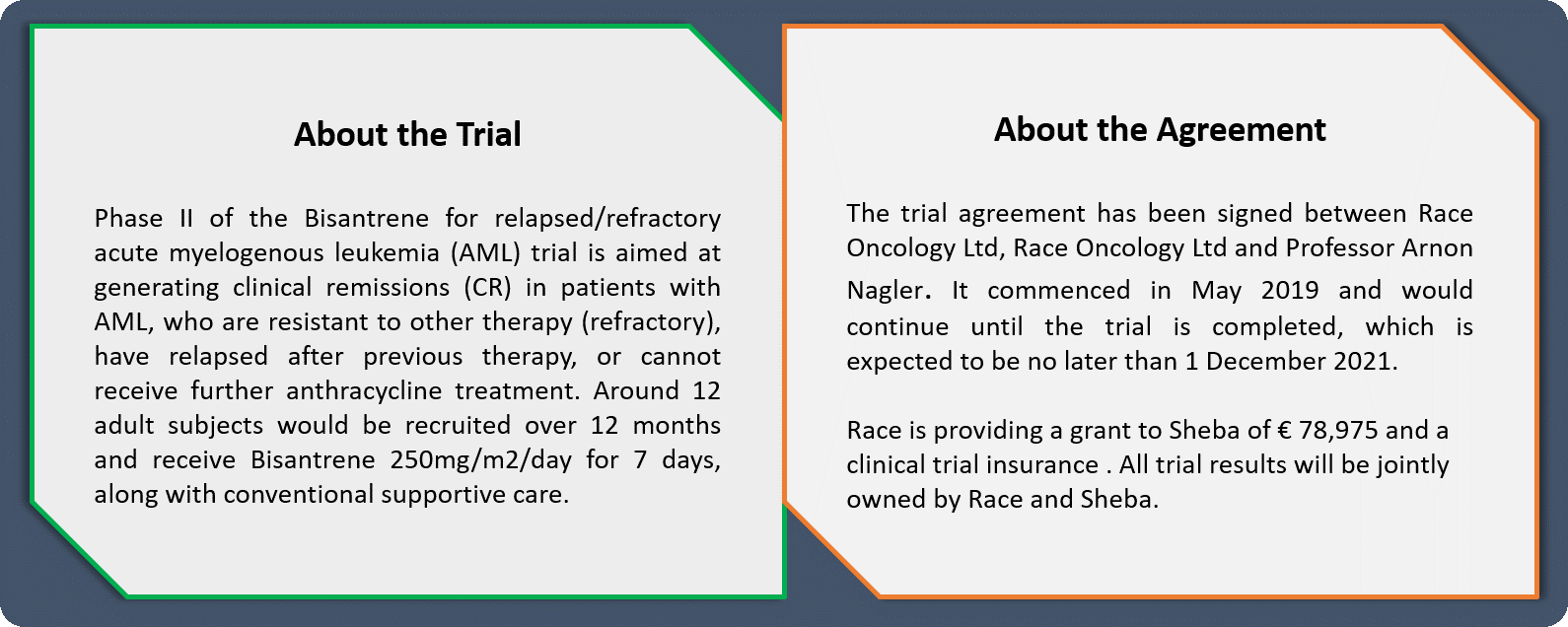

The trial agreement with Sheba was announced on 14 May 2019 (see figure below for details) and had been approved by the Israeli Ministry of Health and the hospitalâs Research Ethics Committee. The Sheba Medical Center trial is being led by Professor Arnon Nagler as the principal investigator, who is also a highly-regarded international leader in the leukaemia field.

Source: Companyâ announcement dated 14 May 2019

Source: Companyâ announcement dated 14 May 2019

Bisantrene underwent over 40 clinical studies during the 1980s and 1990s before the drug was abandoned following a series of pharmaceutical mergers. Race Oncology is currently seeking to gain US FDA approval for Bisantrene for AML under the accelerated 505(b)(2) regulatory pathway and filed its Investigational New Drug (IND) application for the same.

In addition, Bisantrene is the subject of two recently granted US patents and has been awarded US Orphan Drug designation and a Rare Paediatric Disease designation.

March 2019 Quarter Report â According to Race Oncologyâs report for the quarter ended 31 March 2019, the company recorded around AUD 505k of cash outflows from operating activities such as research and development (AUD 213K), business development and marketing (AUD 119K), manufacturing and distribution (AUD 267K) and other staff and administration expenses. The net cash and cash equivalents amounted to ~ AUD 1.58 million at the quarter-end. The expected cash outflow for June quarter was reported at AUD 0.551 million.

Stock Performance - The company has a market capitalisation of ~ AUD 3.93 million with around 87.24 million shares outstanding. On 25 July 2019, the RAC stock was trading at AUD 0.057, edging up 26.667% by AUD 0.0012 (AEST: 3:50 PM), with approximately 1.476 million shares traded against an average annual volume of 167,147.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.