Innovation has become an essential component for any organisation, regardless of the industry, to standout in the highly competitive market. Across the global, companies are taking great advantage of cloud platforms and new emerging IT trends to make their offerings, including products, and services even better. Companies need to adopt new and emerging IT technology platforms to cater to constantly changing consumer needs in order to grow their market share and increase revenue. IT platforms enable companies to get their work done more effectively and efficiently.

The benchmark Index S&P/ASX 200 closed at 6,506.8 on 29 August 2019, up 0.1%, while S&P/ASX 200 Information Technology Sector settled at 1,370.3, down 0.84%. In this article, three companies operating in the IT sector have been discussed that have recently released their results for the financial year FY19, in addition to some important information.

LiveTiles Limited

LiveTiles Limited (ASX:LVT) is an information technology company that allows users to create their own intelligent workplace experiences. The company sells its software in Australia and overseas. LiveTiles is a US-based company with a registered office in South Bank, Australia.

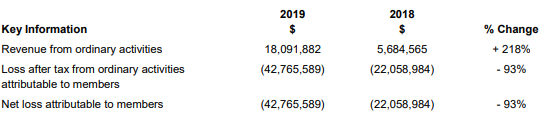

Key Highlights of LVT FY19 Performance: LVT updated the market on 27th August 2019 regarding its performance during the year ended 30 June 2019 via an ASX announcement. The company reported

- Total revenue & other income increased by 249% to $22.485 million

- Revenue from ordinary activities grew by 218% to $18.091 million

- Loss after tax dipped by 93% to $42.765 million

- Group cash balance as of 30th June 2019 is $14.880 million

FY19 Highlights (Source: Companyâs Report)

Strategic Partnership with GO1.com: In another market update on 23th August 2019, LVT announced to have entered a partnership with GO1.com. Few Highlights of the partnership are as follows:

- The partnership is aimed at launching the LiveTiles Learning Platform.

- The two companies would jointly pursue the commercial opportunities.

- LiveTiles would combine its intelligent platform (workplace technology) with the GOI online platform to provide targeted learning solutions.

- The alliance would help them to provide outstanding learning and development offerings.

- It would expand the opportunity for both the parties to create commercial opportunities through cross selling and joint sales initiatives.

- The strategic collaboration would help the companies to grow their customer base and bring innovation to the market quicker.

Stock Performance: LVT closed the dayâs trading at $0.377 on 29 August 2019, down 4.557% from its previous closing price, with ~660.67 million outstanding shares and a market cap of $260.96 million. The 52-week low and high range of the stock is $0.275-$0.670. In the last three months and six months, the stock has delivered -18.56% and 14.49%, respectively.

Weebit Nano Ltd

Data memory technology business, Weebit Nano Ltd (ASX: WBT) is scheduled to hold its annual general shareholder meeting on 26 September 2019. On 29th August 2019, WBT issued 5,828,467 fully paid ordinary shares in the company on the same terms as the existing shares at a price of $0.39 per ordinary share. The shares were issued to sophisticated investors under a private placement unveiled to the market on 27 August 2019. Proceeds would be directed towards funding the continued development of the companyâ technology as well as for general working capital purposes.

Capital Raising: On 27 August 2019, the company had announced to have received sophisticated investorsâ commitments for nearly 6,410,256 new ordinary shares to secure $2.5 million. Additionally, WBT had unveiled plans to raise an additional amount of $2.5 million via a non-renounceable entitlement offer. The company would offer existing eligible shareholders at the record date of 3 September 2019 with the opportunity to subscribe for 1 share for every 9.5 shares under the offer.

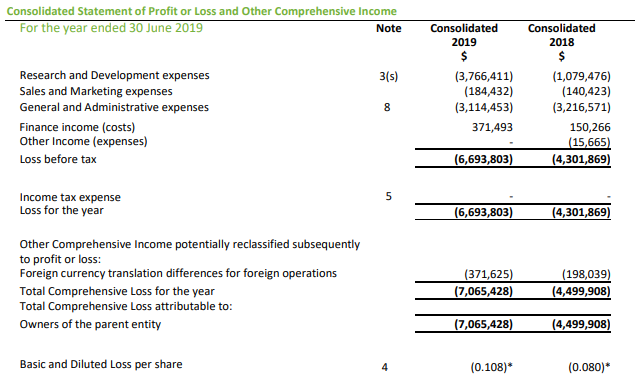

Key Highlights of Operating & Financial Performance in FY19

- Lost after tax increased to $6.693 million from $2.39 million posted in the previous corresponding year, majority reflecting R&D activities and administration costs.

- Net cash outflow from operating activities was $5.745 million.

- The company had $1.670 million cash in hand at the end of FY2019.

- The company has registered 3 patents related to its technology.

Source: Companyâs Report

Stock Performance: WBT closed the dayâs trading at $0.420 on 29 August 2019, up 7.692% from its previous closing price, with ~ 63.65 million outstanding shares and a market cap of $24.82million. The 52-week low and high range of the stock is $0.350-$1.550. In the last three months and six months, the stock has delivered negative returns of 30.97% and 24.27%, respectively.

FinTech Chain Limited

FinTech Chain Limited (ASX: FTC) is a financial technology service provider, catering to more than 400 banks and 4 million merchants (indirectly) through T-LinxTM, an integrated payment acquiring infrastructure solution. The company owns more than 100 invention patents and IP rights.

Deals for T-LinxTM: On 27th August 2019, FTC signed a contract with the Shenzhen branch of state-owned China Construction Bank (CCB). The contract boosts the reach of the patented T-LinxTM payment services of the company. Few highlights of the contract are as follow:

- The contract with China Construction Bank is aimed at enhancing the breadth and quality of services offered by CCB to its merchant customers in Shenzhen.

- FTC would also provide marketing services to CCB Shenzhen, in addition to POS machine value-added services.

- Other value-added technical services include Merchantâs MIS R&D and integration test and integrated solution of membership points.

- In exchange, FTC would get 70% of acquiring service fee net income and handling fee of various payment businesses including WeChat Pay and Alipay.

Additionally, on 13th August 2019, FTC had signed an agreement with the Huanan Rural Credit Union. Under which, it would

- Incorporate T-LinxTM in the banking payment solutions of the union for accelerating and facilitating the billing checkout process.

- FTC would receive a recurring revenue stream of three basis point for any T-LinxTM initiated payment transactions in Heilongjiang. This would follow the T-Linx TM expansion and commercialisation in Shaanxi, Hunan, Xinjiang and Shanxi provinces inChina.

Key Highlights of FY19 Performance : The company recently presented its 2019 annual report, unveiling

- Revenue of 19 million in FY2019, representing an increase of four-fold, backed by continued gain in the market penetration of the T-LinxTM platform in China.

- Gross profit during the period stood at RMB28.64 million, compared with a loss of RMB2.05 million in the same period a year ago.

- Cash inflow from operating activities reached RMB703,882, while net cash used in investing activities was RMB2.05 million and net cash from financing activities was RMB2.03 million.

- Cash and cash equivalents at the end of the year stood at RMB2.29 million.

Stock Performance: FTC closed the dayâs trading at $0.120 on 29 August 2019, down 4% from its previous closing price, with ~ 650.77 million outstanding shares and a market cap of $81.35 million. The 52-week low and high range of the stock is $0.035-$0.240. In the last three months and six months, the stock has delivered returns of -21.88% and 257.14%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.