Australian equity market turned jittery with US bond yields sliding down leading to inverted yield curve and simmering US China trade tension. S&P/ASX 200 witnessed worst single day dip in last 18 months, with $60 billion being wiped off. The reporting season has also signalled mixed performance of ASX listed companies. The benchmark index ended the week lower on 16 August at 6405.5, down 2.6 points.

Let us look at the key updates of 5 popular ASX stocks:

iSignthis Ltd (ASX: ISX)

iSignthis Ltd is engaged in enabling its financial sector and AML regulated clients better comply with the ever-increasing regulatory requirements for payments and identity verification, banking on its payment processing and transactional banking capability as well as emoney deposit taking. Via its Paydentity⢠and ISXPay® solutions, the company offers end-to-end on-boarding service for merchants.

iSignthis is among one of the most discussed stocks for its humongous return on stock exchange. The stock has returned as big as 417.95% return in the past six months.

The company recently inked a licencing agreement for Australian Principal Membership with the Asia-Pacific-Singapore based regional subsidiary of Visa Inc (NYSE:V). The company generates revenue on the basis of percentage fees charged to its contracted merchants as the Merchant Discount Rate (MDR) on the amount of sale processed by ISX on behalf of the merchant.

This extension of principal member relationship with Visa has strengthened the company profile of iSignthis, which already is a Principal Member of ChinaUnionPay, Mastercard, Diners and Discover in Australia, with similar level of memberships in the European Economic Area (EEA).

In 2017, the overall value of the card processing market in Australia was worth $748 billion across all card schemes, with the majority of the value being driven by retail point of sale as card present transactions.

ISX stock price last traded at A$0.96, down 4.95 percent, on 16 August 2019. As at 30 June 2019, cash reserves of the company stood at $9,989,000.

Strike Energy Limited (ASX: STX)

Strike Energy is a leading oil and gas explorer with two key onshore assets - the Perth Basin in Western Australia and the Cooper Basin in South Australia. On 16 August, the company released general meeting results.

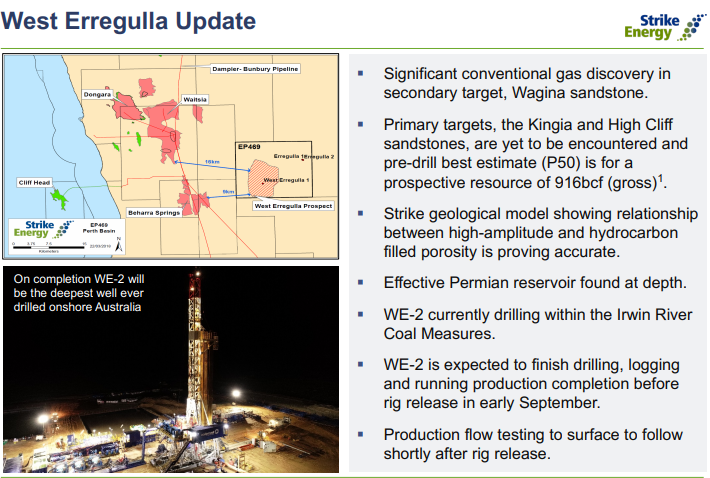

Source: STXâs market update

On 14 August 2019, Strike Energy Limited shared an update on the Wagina sandstone conventional gas discovery at West Erregulla-2.

The update follows the further interpretation of the wireline logs at Wagina that was conducted by the company, incorporating proven regional cut-offs in the petrophysical analysis as used in the case of Beharra Springsâ fields. This further interpretation resulted in an upgrade of net reservoir to minimum 10.2 metres in the Wagina sandstone.

Strike Energy informed that since the discovery announcement on the 1 August 2019, additional gas bearing Wagina sands have been encountered in the production hole section that seems to have the potential of adding a further 5 metres to the gross gas column, taking it to total 79 meters.

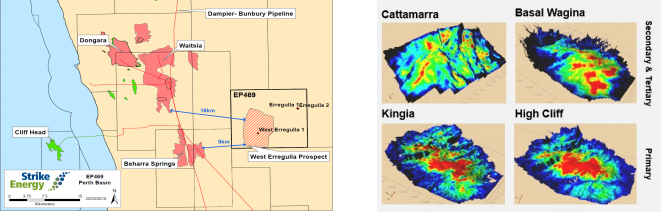

West Erregulla-2 Location and Amplitude Visualisations of stacked targets (Source: Company Announcement)

STX stock price last traded at $0.145, up 16%, compared to its last close on 16 August 2019. Over the past 12 months, the stock has surged up 3.85% including a positive price change of attractive 47.06% in the past three months.

Australian Mines Limited (ASX: AUZ)

Metals and Mining sector company engaged in the production and supply of battery-grade cobalt and nickel chemicals to the electric vehicle sector, Australian mines Limited recently announced that the final assay results from the Flemington resource expansion drilling returned additional high-grade cobalt and scandium intersections.

The significant intersection includes:

- Drill Hole FMA19_323: 15 m @ 2,054ppm (0.20%) Co from 3 m depth

- Drill Hole FMA19_331: 13 metres @ 1,186ppm (0.11%) Co from 4 m depth

- Drill Hole FMA19_332: 14 metres @ 1,202ppm (0.12%) Co from 11 m depth

These results confirmed that impressive continuity of high-grade cobalt and scandium deposit zones extends westward for over 1,200 m and is contiguous with the existing Flemington Mineral Resource.

Australian Mines intends to undertake over 12,000 metres of drilling across the Flemington Project, representing the largest exploration and resource definition program in the region, as informed by the company.

The company is in the process of initiating an additional large-scale extensional drilling campaign in October this year. It anticipates Flemingtonâs MRE by early next year.

AUZâs stock last traded at $0.024, up by 4.348 percent from the prior close on 16 August 2019. Over the past 12 months, the stock has declined by 65.67% despite a positive price change of 21.05% in the past three months.

Jatenergy Limited (ASX: JAT)

Australia-Asia trade specialist, Jatenergy Limited announced that the company has agreed to takeover 70% interest in Melbourne-based dairy product manufacturer, Australian Natural Milk Association Pty Ltd (ANMA). ANMA is approved by Certification and Accreditation Administration of the People's Republic of China (CNCA) and State Administration of Markets Regulations (SAMR) to export infant formula to China.

As per an ASX update on 15 August, Jatenergy has commenced production of its brand, Neurio Goat Infant formula at the ANMA facility.

ANMAâs manufacturing facility in Derrimut, Victoria (Source: Company Announcement)

The acquisition comes at a purchase consideration of $12 million in cash and $2 million in Jatenergy shares, which has been agreed to be staged through the six tranches from the date of agreement to 30 June 2020. JAT has planned to fund this acquisition transaction through cash reserves, debt funding and projected operational and financing cash flows.

This takeover allows Jatenergy to export dairy and infant formula products to China. The report read that this acquisition would capture the manufacturerâs margin for JAT and will also ensures that all of JATâs products can be produced under its control. This in turn would strengthen the companyâs control over pricing and quality alongside having opportunities for the development of more in-house products.

JAT stock price last closed at A$0.061, up by 1.667%, on 16 August 2019. Over the past 12 months, the stock has declined 15.49% despite a positive performance change of 1.69% in the past three months.

Weebit Nano Ltd (ASX: WBT)

An Israel-based semiconductor company, Weebit Nano recently inked a Letter-of-Intent (âLOIâ) with a Chinese company XTX Technology to co-operate in investigating ways in which XTX can use Weebitâs technology in its products.

XTX Technology is a Chinese provider of flash memory chips both inside China and around the world. It provides a variety of different Flash-based Non-Volatile Memory (NVM) solutions to about 2,000 customers, including some of the leading semiconductor companies worldwide. XTX believes that Weebitâs SiOx ReRAM technology presents the strong set of latest technologies that need to be incorporated into its products.

Further, Weebit is already engaging with potential customers in Korea and is in advanced discussions with a Tier-2 company, where Weebit is adapting its technology to meet their unique memory module requirements. Korea is the worldâs largest memory chip manufacturer that account for ~57% of the global supply and remains the key target region of Weebit for its Silicon Oxide (SiOx) ReRAM technology.

WBT stock price edged up 2.381% compared to the last trade to close at A$0.430 on 16 August 2019. Over the past 12 months, the stock has declined by 63.48% including a negative price change of 31.71% in the past three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.