Diversification, in general, is a strategy of managing risks by allocating investments in various asset classes within a portfolio. The varied assets could be shares, bonds, debentures, commodities, real estate, etc. Thus, it helps in reducing the instability of the portfolio over a period of time.

In diversification, the investor chooses various stocks from different industries and sectors. The benefit of diversification is that in case even one of the stocks does not perform well, the remaining stocks make sure that the portfolio remains secured.

Some of the types of diversification:

- Diversification based on industry

- Diversification based on geography

- Diversification based on strategy

- Individual company diversification

- Asset class diversification

In this piece of article, we will discuss three stocks from three different sectors, along with their recent updates and stock performance.

Turners Automotive Group Limited

About the Company

Turners Automotive Group Limited (ASX: TRA), earlier known as Turners Limited, was formed through the 2014 merger of Turners Auctions, largest vehicle and machinery retailer in New Zealand, and Dorchester Pacific, which is a leading consumer finance and insurance business. The company at present operates as an integrated financial services group, with major focus on the automotive sector.

Recent Update/s:

On 2 July 2019, Turners Automotive Group Limited released an ASX announcement, under which it highlighted that as part of its newly developed growth strategy, which was launched in March 2019, the company is making an investment of A$1 million in Collaborate Corporation Limited (ASX: CL8), an Australian tech-focused car-sharing and vehicle subscription business. With this investment, the company will get hold of a 12.13% stake in Collaborate. The company will also appoint a director to the Collaborate board.

The core business of Collaborate is around the fast-growing car sharing market, with DriveMyCar, the leading peer-to-peer car rental business in the country, and complemented by Carly, which is the first truly flexible car subscription offering in Australia.

By investing and working with Collaborate, the company would be able to focus on its core business of expanding its share in the New Zealand automotive retail market as well as get exposure to the exciting opportunity in the larger and fast developing Australian market.

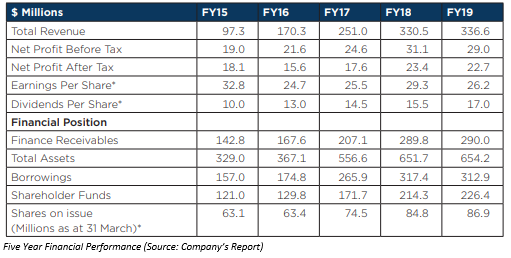

Turners Automotive also released its annual report to shareholders on 28 June 2019, under which it reported a 2% year-on-year growth in revenue to $336.6m in FY19 ended 31 March 2019, compared with $330.5m in FY18. Net profit before tax for the period stood at $33.6m, excluding the $4.6m adjustment for the Buy Right Cars brand write-of.

Stock Performance:

The shares of TRA last traded on 5 April 2019 with the closing price of A$2.100. TRA holds a market capitalization of A$182.46 million and approximately 86.89 million outstanding shares.

Mineral Resources Limited

About the Company:

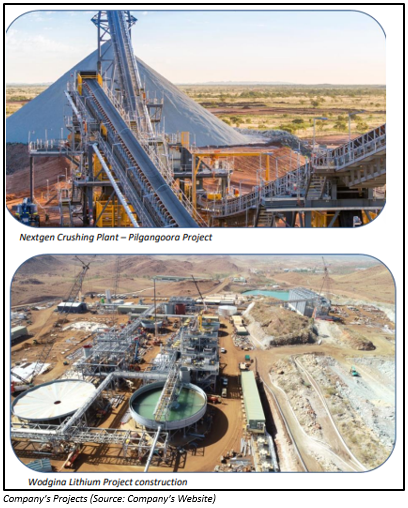

Mineral Resources Limited (ASX: MIN) is a leading mining services provider based out of Perth. The company majorly focuses on iron ore as well as hard-rock lithium sectors in Western Australia. The company was listed on the Australian Securities Exchange in 2006.

Recent update/s:

Recently on 5 June 2019, the company announced the resignation of Non-Executive Director Mr. Tim Robert from the board of the company with effect from the same date.

Mr. Robert resigned from the post due to the demands of his other business interests as well as his residence in New Zealand.

However, Mr. Robert would remain a supportive shareholder of Mineral Resources and has no plans to dispose of his shareholding in the company.

Mr. Roberts served the organization for 2.5 years as a director, and contributed towards the growth and development of the companyâs business.

Stock Performance:

In the previous one month, the shares of MIN have given a return of 10.05%. The stock was trading at A$15.630 (AEST: 1:59 pm, 3 July 2019), down 0.192%. MIN holds a market capitalization of A$2.95 billion and has approximately 188.1 million outstanding shares.

Mercury NZ Limited

About the Company:

Mercury NZ Limited (ASX: MCY), along with its subsidiary companies, is in the business of producing, trading as well as selling electricity in New Zealand. The company operates through energy markets and other segments.

MCY was founded in the year 1998 and is headquartered in Auckland.

Recent Update/s:

According to a company announcement on 3 July 2019, MCY board appointed Prue Flacks to succeed Joan Withers as Chair. Joan Withers is set to step down from her position at the annual shareholder meeting scheduled on 27 September 2019.

On 19 June 2019, Mercury NZ Limited announced that it is exercising its right to fully redeem its NZ$300 million of subordinated capital bonds ("MCY010 Bonds"). The redemption will be in line with the trust deed for the MCY010 Bonds on 11 July 2019, which is the first reset date.

The holders of the MCY010 Bonds will be entitled to receive the principal amount of NZ$1.00 of each MCY010 Bond held along with the accrued and unpaid interest up to the 1st reset date.

Further, Mercury NZ is undertaking a new offer of subordinated capital bonds. Those who are the holders of the MCY010 Bonds and have received an allocation from their financial adviser can elect to get access to few or all of the proceeds from their MCY010 Bonds applied to the settlement of that allocation.

The company, on 19 June 2019, made another announcement, reporting that after the bookbuild for its offer of capital bonds, NZ$300 million of capital bonds have been assigned to retail and institutional investors in New Zealand. The interest rate for the capital bonds to the first reset date would be 3.6% per annum. These capital bonds would be issued on 11 July 2019 and are anticipated to get quoted on the NZX Debt Market.

Stock Performance:

In the previous one year, the shares of MCY have given a return of 38.24%. MCY stock is trading at A$4.330 (AEST: 2:21 pm, 3 July 2019), up by 2.364%. MCY holds a market capitalization of A$5.76 billion with approximately 1.36 billion outstanding shares. Its P/E stands at 29.98x, while dividend yield is 3.37%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.