Resource sector marks its place in the very heart of the Australian economy, and the sector contributes significantly to the overall development of the continent. While such a dependency of the economy is evident, resource stocks are not disappointing the market and contributing decently in the surge of S&P/ASX 200 Index.

To know more about the performance of resource index, Do Read: Amidst Multiyear Index Highs, Resource Stocks-PRU, AWC, and S32 Announce Quarterly Report

The quarterly bells are now ringing on ASX, with many resource companies reporting their December 2019 quarter highlights, which marked the year-end for few.

Post reporting the quarterly performance for few resource players like Rio Tinto Limited (ASX: RIO), Resolute Mining Limited (ASX: RSG), Perseus Mining Limited (ASX: PRU), Alumina Limited (ASX: AWC), South32 Limited (ASX: S32), and many more, let us now turn our attention toward companies which recently reported their December 2019 quarterly highlights and other important updates.

For Performance of Rio and RSG, Read: S&P/ASX 200 At Record High- Top Gunner Rio and Gold Explorer RSG to Maintain Momentum?

On the Radar Ahead- Lynas Corporation Limited (ASX: LYC), Mount Gibson Iron Limited (ASX: MGX), and Sandfire Resources Limited (ASX: SFR).

Lynas Corporation Limited (ASX: LYC)

- Production

The December 2019 quarter ready-for-sale production of rare earth oxides stood at 4651 tonnes, which remained ~14.56 per cent below against the previous quarter. The ready-for-sale production volume for Neodymium and Praseodymium (or NdPr) stood at 1242 tonnes (oxides), which remained ~17.47 per cent down against the previous quarter.

LYC did not bag the regulatory approval for an uplift in the production at Malaysia, which could justify the fall in the production. However, the company took advantage of a reduced production rate upgrade a number of the circuit to improve the quality of rare earth metals.

- Sales

During Q2FY20 (December 2019 quarter), LYC managed to sell 3507 tonnes of rare earth oxides, down by ~16.22 per cent against its previous quarter. The sales revenue declined by ~13.42 per cent during the quarter (Q-o-Q) to stand at $85.8 million.

The decline in sales and revenue was mainly the result of a decline in production capacity rather than demand, as the demand for rare earth metals remained strong and is still strong.

- The Growth Plan

Post receiving the lead agency status from the WA government, LYC now plans to expand across the United States- a country which is looking to secure the rare earth metals supply over China’s dominance in the segment.

Also Read: Lynas Brings Delight to Shareholders; Kalgoorlie Plant Bags Lead Agency Status

So far, LYC has submitted a compliment tender with the U.S. Defence Department and has advanced plans related to the separation plant development in Texas in collaboration with Blue Line Corporation.

LYC last traded at $2.360 on ASX on 24 December 2020, up by 0.85 per cent against its previous close.

Mount Gibson Iron Limited (ASX: MGX)

- Operation and Sales

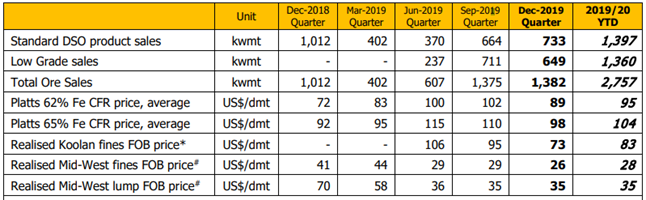

MGX sold 733k wet metric tonnes of standard Direct Shipping Ore (or DSO), up by ~10.39 per cent against its previous quarter. While the low-grade sales dropped by ~8.72 per cent during the December 2019 quarter to stand at 649k wet metric tonnes, the total ore sales surged by 0.50 per cent against previous quarter to stand at 1,382k wet metric tonnes.

The iron ore remained in a bull run till September 2019 quarter, and retracted, which in turn, reduced the average realised price for the December 2019 quarter.

The average realised price for Platts 62% Fe CFR stood at USD 89 per wet metric tonne, down by ~12.74 per cent against previous quarter; while the average price for Platts 65% Fe CFR stood at USD 98 per wet metric tonne, down by ~10.90 per cent against the previous quarter.

Source: Company’s Report

- Cost and Liquidity

MGX generated a revenue of $106 million on a FOB (Free-on -Board) basis for the quarter, which took the half-yearly revenue on FOB basis to $224 million. The operating cash flow generated by the company for December 2019 quarter stood at $14 million, which took the half-yearly operating cashflow of $39 million.

As on 31 December 2019, the company retained cash and liquid investments of $398 million.

The unit production cost, which remained $69 per wet metric tonne (on FOB) basis during the quarter remained under the guidance along with the half-yearly unit production cost of $72 per wet metric tonne.

MGX increased the sales guidance for 2019/20 by ~30 per cent, which now stands at 4.8 to 5.3 million wet metric tonnes while keeping the all-in cash cost unchanged in the range of $70 to $75 per wet metric tonne on FOB basis.

MGX last traded at $0.945 on 24 December 2020, down by 3.57 per cent against its previous close on ASX.

Sandfire Resources Limited (ASX: SFR)

The company recently undertook an expanded exploration at its Tshukudu Exploration Project in Botswana, which comprises of ~11,700km 2 of licensed tenement surrounding T3 Copper-Silver prospect of the company.

The licensed tenement hosts a rare belt-scale exploration opportunity with major emerging sediment- hosted copper belt (200km). The T3 project holds the potential to emerge as a new production hub, which in turn, provides an impetus to the company to expand the exploration activity around the tenement.

SFR started exploration activities over the prospect and associated tenement in November 2019 post the acquisition of MOD Resources Limited (ASX:MOD) and identified a number of high priority targets within 25km of the T3 prospect.

The drilling at A4 Dome, which is one of the many identified priority targets, has retuned significant intercepts. The drill results from the first five- hole at the A4 Dome is as below:

- The drill hole identified as MO-A4-022D intersected 38m @ 1.1 per cent copper and 9g/t of silver from 44m down-hole, which further includes; 13m @ 1.8 per cent copper and 6g/t of gold from 44m down-hole.

- The drill hole identified as MO-A4-023D 32m @ 1.3 per cent copper and 21g/t of silver from 56m down-hole, which further includes; 13.4m @ 1.9 per cent copper and 37g/t of silver from 72m down-hole.

- The drill hole identified as MO-A4-024D 7.3m @ 2.6 per cent copper and 46g/t of silver from 43m down-hole, which further includes; 6.7m @ 1.8 per cent copper and 5g/t of silver from 69m down-hole.

- The drill hole identified as MO-A4-026D 9m @ 1.3 per cent copper and 4g/t of silver from 67m down-hole, which further includes; 5m @ 3.3 per cent copper and 76g/t of silver from 84m down-hole; and, 11.2m @ 1.9 per cent of copper and 28g/t of silver from 139 m down-hole; and, 13.7m @ 1 per cent of copper and 22g/t of silver from 91.3 m down-hole

- The drill hole identified as MO-A4-027D 3.8m @ 1.6 per cent of copper and 3g/t of silver from 83.8m down-hole, which further includes; 11m @ 1 per cent copper and 22g/t of silver from 93m down-hole; and, 5m @ 1 per cent copper and 22g/t of silver from 115m down-hole.

As a result of such significant intersection, the company assess that A4 Dome mineralisation is similar to substantial T3 deposits.

SFR last traded at $5.940, down by 0.17 per cent on 24 December 2020 against its previous close on the exchange.