The increasing use of medical cannabis products has prompted many countries to soften the regulations regarding the manufacturing and consumption of cannabis products. Last year, Canada became the second and the largest country in the world to regulate cannabis products for adult use.

The Hemp Farm Act of 2018 signed by US, effectively de-scheduling hemp and cannabidiol (CBD) as schedule 1 narcotics and regulating the hemp industry on a federal basis.

Due to the support from Governments of different countries combined with the increasing popularity of cannabis product, many companies are entering into cannabis space. Letâs take a look at few Cannabis stocks already trading on ASX.

Creso Pharma Limited (ASX:CPH)

Creso Pharma Limited (ASX: CPH) is involved in developing and selling the highest quality, GMP, standardized CBD Nutraceuticals for humans and animals in partnership with top tier credible commercial partners.

Recently, the company signed a long-term commercial agreement with Pharma Dynamics for distribution of the cannaQIX® products range in South Africa.

Image of cannaQIX 10® (Source: Company Reports)

The company recently received PharmaCielo Ltd.âs very first commercial CBD export from Colombia. PharmaCielo, a global company privately held and headquartered in Canada, is currently planning to acquire Creso Pharma via a share and option scheme.

At market close on 23 August 2019, CPHâs stock traded at $0.415 with a market capitalisation of circa $61.38 million.

Elixinol Global Limited (ASX:EXL)

A global leader in the cannabis industry, Elixinol Global Limited (ASX: EXL) recently announced that its wholly-owned subsidiary, Elixinol LLC has entered into a manufacturing and supply agreement with Pet Releaf, in line with Elixinolâs growth strategy of increasing distribution of its branded products through partnerships with trusted and highly regarded brands.

Under this agreement, Pet Releaf is going to buy a minimum US$18.0 million worth of products from Elixinol LLC and it will pay a deposit of US$1.8 million by way of three equal payments during the term of the Agreement.

The companyâs Dutch based wholly owned subsidiary, Elixinol B.V recently joined hand with UK based PharmaCare to create a co?branded CBD capsule range. These capsules will be sold via Holland & Barrett, UKâs leading health and wellness retailer.

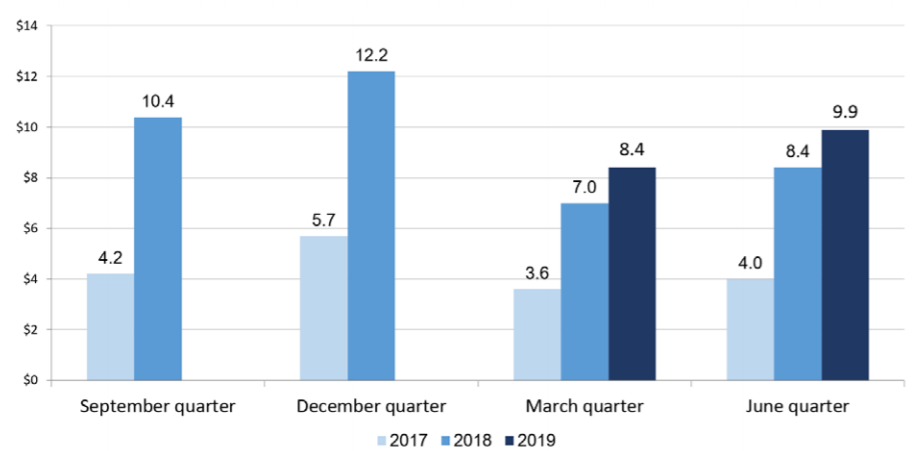

In the June quarter, the company earned a revenue of around $9.9 million.

Quarterly Revenue growth Graph (Source: Company Reports)

At market close on 23 August 2019, EXLâs stock traded at $2.440 with a market capitalisation of circa $354.39 million.

Medlab Clinical Limited (ASX:MDC)

Medlab Clinical Limited (ASX: MDC) is involved in creating new medicines which are derived from bacterial metabolites and bioavailable cannabinoids. These medicines helps in managing pain associated with cancer, HIV/AIDS and any other chronic disease.

In August 2019, the company completed the NanaBidialTM Phase 1 trial. Medlab Clinical Limited is one of few companies who possess proof via clinical studies that the Medlab patented pharmaceutical grade cannabis formulations are actually absorbed and can prove how the product is utilised, metabolised and eliminated from the body over time.

Significant achievements in the past few months include:

- Heads of Agreement (HOA) executed with American Nutritional Corp Inc (ANC) to rapidly expand Medlabâs nutraceutical business in the USA;

- Human ethics approval for a second Nanabis⢠Trial;

- Execution of Heads of Agreement for NanaBis⢠with Thai listed pharmaceutical company, Mega Lifesciences Public Company Limited for the distribution of Medlabâs cannabis-based medicine, NanaBis⢠in parts of South America.

At market close on 23 August 2019, MDCâs stock traded at $0.480 with a market capitalisation of circa $102.3 million.

Ecofibre Limited (ASX:EOF)

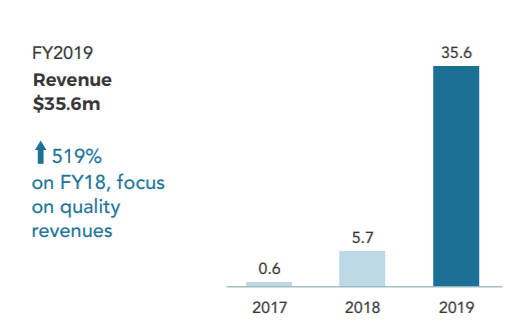

Provider of hemp products in the United States and Australia, Ecofibre Limited (ASX: EOF) earned a revenue of $35.6 million in FY19, up 519% on FY18.

FY19 Revenue Growth (Source: Company Reports)

For FY19, the company reported a NPAT of $6 million, up 170% on last year. FY19 profits was an outcome of significant, ongoing investment over the last three years to commercialise Ecofibre's capabilities. Currently, the companyâs largest and most profitable business is Ananda Health.

As per the companyâs Chairman Barry Lambert, the rules around âMedicinal Cannabisâ in Australia are such that the company donât believe that it could build a viable business in Australia. According to him this is because of the uncommercial rules around growing and processing the plant along with the lack of demand caused by the regulations which make it unaffordable to almost all Australians.

At market close on 22 August 2019, EOFâs stock traded at $2.750 with a market capitalisation of circa $850.7 million.

Althea Group Holdings Limited (ASX:AGH)

Althea Group Holdings Limited (ASX: AGH) is primarily involved in the sales and distribution of medicinal cannabis products along with the development of a manufacturing and cultivation facility.

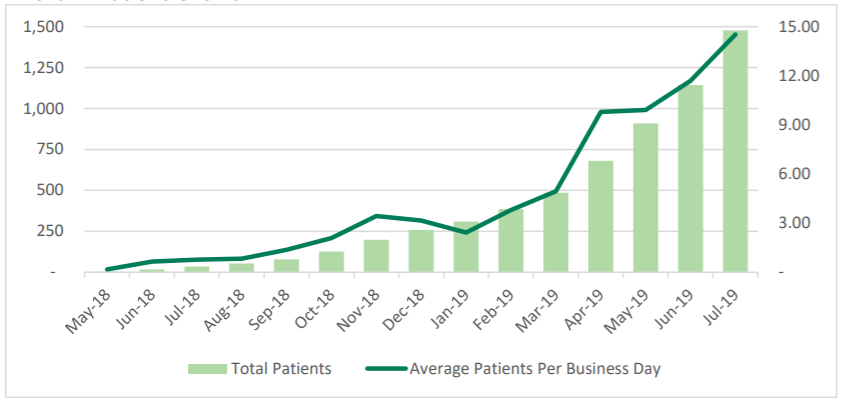

In the months of July 2019, the company welcomed 334 new patients, representing the largest number of new patients to be prescribed Althea products in a single month to date (refer below figure).

Patient Growth Chart (Source: Company Reports)

The company recently entered into an agreement with Tetra Health Pty Ltd (âTetraâ), a Sydney based medicinal-cannabis company, to support continued growth through its secondary clinic channels.

The companyâs short-term goals include reaching the 5,000 patient milestone, adding new products to Altheaâs portfolio, and completing the construction of the proposed production facility.

At market close on 23 August 2019, AGHâs stock traded at $0.785 with a market capitalisation of circa $181.82 million.

Cann Group Limited (ASX:CAN)

Cann Group Limited (ASX: CAN) Developer of medicinal cannabis products, Cann Group Limited (ASX:CAN) recently announced that it has got approvals for manufacturing licences for its current Northern and Southern medicinal cannabis setups in Melbourne.

With these approvals, Cann Group now holds all cultivation and manufacture licenses required under the Narcotics Drugs Act.

For the half year ended 31 December 2018, the company incurred an operating loss after tax of $4,898,171.

Significant achievements during the half year period include:

- Supplied the first Australian patients with Aurora Cannabis Inc (Aurora) cannabis oil through the Therapeutic Good Administrationâs (TGA) Special Access Scheme;

- Cann and IDT Australia Limited (ASX: IDT) executed a manufacturing agreement under which IDT will provide manufacturing support in relation to medicinal cannabis-based product formulations intended for supply to patients in Australia and oversea;

- Cann also secured a contract with the Victorian Department of Health and Human Services (DHHS), through its Office of Medicinal Cannabis (OMC), for the supply of cannabis plant extract (resin).

At market close on 23 August 2019, CANâs stock traded at $1.75 with a market capitalisation of circa $257.37 million.

AusCann Group Holdings Limited (ASX:AC8)

Leading cannabinoids-based pharmaceutical company AusCann Group Holdings Limited (ASX:AC8) is strongly progressing with the development of its hard-shell cannabinoid medicines which address the need for stability and precise dosing in the treatment of patients with cannabinoid-based medicines.

June Quarter Highlights:

- Completed a production scale-up of the capsules in a Good Manufacturing Practice (GMP) environment;

- Received its first commercial export shipment of active pharmaceutical ingredient medical cannabis concentrate from MediPharm Labs.

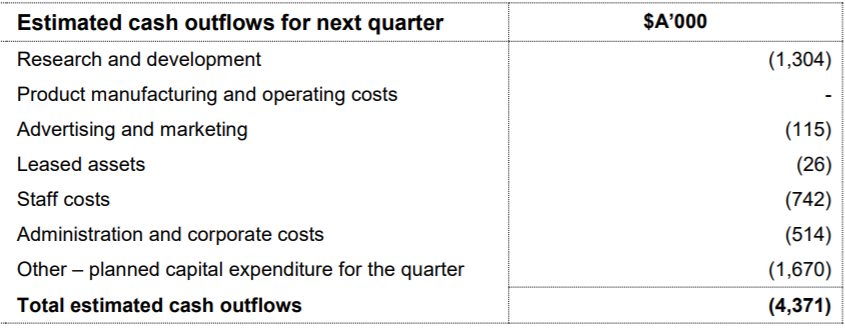

The net cash used for operating activities during the June quarter was around $359k. The net cash used for investing activities was around $112k while, the net cash used for financing activities was $1,557k. At the end of June quarter, the company had cash and cash equivalent of $35,286k. The company expects to incur a net cash outflow of around $4.37 million in September quarter.

Estimated Cash Outflows for September quarter (Source: Company Reports)

At market close on 23 August 2019, AC8âs stock traded at $0.375 with a market capitalisation of circa $120.48 million.

MGC Pharmaceuticals Ltd (ASX:MXC)

European based âSeed to Pharmacyâ bio-pharma company, MGC Pharmaceuticals Ltd (ASX: MXC) recently secured commitments to raise $4.75 million via a share placement to sophisticated and professional investors at an issue price of $0.04 per share. The funds raised from this placement will be used for:

- Initial construction works on its Malta GMP Pharma facility.

- Production and sales of pharmaceutical grade cannabinoid derived medicines.

- Costs towards undertaking the dual listing on the London Stock Exchange (LSE).

The company recently achieved 100 patients milestone in Australia. Recently, it has also signed a long-term lease with Malta Industrial Parks to construct a large-scale Pharma Production Facility, making it the first cannabis industry companies to sign a long-term lease agreement with the government.

At market close on 23 August 2019, MXCâs stock traded at $0.045 with a market capitalisation of circa $59.46 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.