Lyft and Facebook were under the limelight for a couple of months.

Lyft, along with the Uber, came in picture after the passing of Assembly Bill 5 (AB5 bill) in California. As per this law, many gig workers would transform into the employees of the companies. The law requires that the companies hire workers as an employee instead of an independent contractor with some exceptions. This law came as a blessing to these contractual workers as it would be for the first time that thousands of California workers would be given the basic labour rights. Majority of the senators voted in favour of this bill which was approved by the state assembly.

Companies like Uber, Lyft and DoorDash state that the law is not applicable to them. In case the company is forced to reclassify these workers as employees of the company, then the cost of the company is expected to increase by ~ 20%.

On the other hand, Facebook was under discussion because of its recent decision which allowed the politicians to post any claims irrespective of whether the claim is true or false. The decision was also not supported by the employees of FB as well.

Candidates appearing for the US 2020 presidential election, lawmakers and civil right groups also attacked Facebook for a couple of weeks.

A letter was also provided by Katie Harbath, the head of global elections policy of Facebook to Biden campaign stating that Facebookâs approach is grounded in its fundamental belief in freedom of expression.

On the other hand, Facebook has been from a long time working to eradicate any coordinated inauthentic behaviour on its site. To meet this objective, the company deleted four distinct networks of accounts, Groups and Pages from Facebook as well as Instagram. The pages were from Iran and Russia, which aimed at other countries around the world. The people associated with these pages tried to mislead others about their identity and operations.

Nathaniel Gleicher who works as the Head of Cybersecurity Policy of Facebook clarified through one of the announcements that the company is working strongly to look for and stop these activities as the company does not require its services to affect the audience under false pretensions.

Now, the focus of the investors is slightly away from this news and has shifted towards the recent quarterly announcement of these companies. Both the companies, Lyft and Facebook, have declared their Q3 2019 results. Letâs have a look at them.

Lyft, Inc. (Nasdaq:LYFT)

Nasdaq listed, San Francisco-based ridesharing company, Lyft, Inc on 30 October 2019 released its 3Q 2019 results for the quarter ended 30 September 2019.

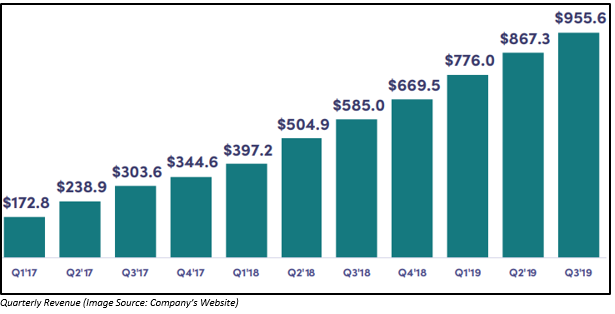

The company delivered a strong performance during the quarter with a 63% growth in the revenue to US$956 million. Record revenue during the quarter was the outcome of solid growth in the active riders along with revenue per active rider. The company continued to improve its engagement via product innovation and execution.

Q3 2019 Financial Highlights:

- Net loss increased from US$249.2 million in Q3 2018 to US$463.5 million in Q3 2019. Net loss for the period includes US$246.1 million of stock-based compensation and related payroll tax expenses which was the outcome of RSU expense recognition along with US$86.6 million related to changes to the liabilities for insurance required by regulatory agencies attributable to historical periods.

- Adjusted net loss for the period was US$121.6 million, which was US$245.3 million in the same quarter in the previous year.

- Total contribution was US$263.2 million in the third quarter of 2018 increased to US$479.2 million during Q3 2019.

- Adjusted EBITDA improved from (US$263.2) million in Q3 2018 to (US$128.1) million in Q3 2019.

Outlook:

For Q4 2019:

- Revenue is expected to be in the range of US$975 million to US$985 million.

- Revenue growth in Q4 2019 is anticipated to lie in between 46% and 47% year-over-year.

- Adjusted EBITDA loss is expected to in between US$160 million and US$170 million.

For FY2019

- Revenue is expected to be in the range of US$3.57 billion to US$3.58 billion.

- Annual revenue growth rate would be around 66%.

- Adjusted EBITDA loss is expected to lie in between US$708 million and US$718 million.

Share Information:

The shares of LYFT closed on 1 November 2019 at US$ $42.98, up 3.72% from its previous close.

Facebook, Inc (Nasdaq:FB)

Facebook, Inc on 30 October 2019 posted its Q3 2019 outcomes for the Q3 ended 30 September 2019. FBâs CEO and Founder Mark Zuckerberg stated that Q3 2019 was a good quarter as the business, as well as community, continue to grow. He also confirmed that the company is focused on making growth towards major social issues and establishing new experiences which enhances the life of people around the world. Letâs look at the Q3 operational and financial highlights.

- Daily active users during the quarter on an average grew by 9% to 1.62 billion year-over-year.

- Monthly active users as of 30 September 2019 increased by 8% to 2.45 billion as compared to the previous corresponding period.

- Mobile advertising contributed 94% of the total advertising revenue generated during the quarter.

- Capital expenditures which comprise of principal payments on finance leases, were US$3.68 billion for Q3 2019.

- The position of cash and cash equivalent along with the marketable securities as of 30 September 2019 were US$52.27 billion.

- Headcount as on 30 September 2019 was 43,030, representing a growth of 28% year-over-year.

- On an average, approximately 2.2 billion individuals use Messenger, Instagram, Facebook, WhatsApp, regularly.

Share Information:

The shares of FB closed on 1 November 2019 at US$ $193.62, up 1.03% from its previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.