The health care industry is expected to witness considerable changes in the next few years, as numerous, prominent health care firms are set to redefine themselves with digital transformation in their major functional areas through a customer-centric methodology.

It is anticipated that the health care sector will have many opportunities in upcoming years and spending in this sector expected to rise at a compound annual growth rate (CAGR) of 5% in 2019-2023. The drivers responsible for the growth of the health care sector in upcoming years are increasing prevalence of chronic diseases, aging demographics, advancements in the technology.

Health care technology- There has been a significant role of technology in many industries and the same goes for health care industry also. It is believed that technology has the power to transform the health care sector and an increased focus on investments is expected in upcoming years. Some key trends with digital technology which can drive a decent growth to the health care sector in upcoming years are-

Artificial intelligence (AI) and machine learning (ML)- The influence of artificial intelligence and machine learning in the health care industry is certainly life changing. Artificial Intelligence applications are transforming hospital care to clinical research, drug development and insurance and the working of the health sector in order to improve patient outcomes and lessen spending. The key facts that call for implementing Artificial Intelligence are-

- To address and prevent the hospital errors which is one of the leading causes of patients’ death.

- Prevention of medical errors which can lead to many complications.

Electronic health record (EHR)- An electronic health record (EHR) is a digital version of a paper chart of patient and contains the medicinal and treatment histories of patients. EHRs are a crucial part of health IT and can provide-

- EHR allows access to evidence-based tools that providers can utilize to make decisions related to a patient’s care.

- EHR comprises a record of all medication information, diagnoses, medical history, immunization dates, and laboratory test results of patients.

Health-tracking app- Health tracking applications will definitely play the role of personal health assistants. One can utilize these for providing alerts in medication, and human-like interactions will also be possible. Advanced artificial intelligence algorithms power assistants such as Google Assistant, Siri, Cortana will deliver immense value to the users when combined with healthcare apps.

In this article, we are highlighting prominent ASX listed health care stocks with their outlook in upcoming years- RHC, CSL, SHL

Ramsay Health Care Limited (ASX:RHC)

An ASX listed global health care sector player Ramsay Health Care Limited (ASX:RHC) was established in 1964 and is engaged in providing high quality services and delivering excellent care to the patients. The company is well-recognized throughout the health care industry across the globe for its quality health care operations and excellent record in hospital management and patient care.

Outlook-

Ramsay released its full year results for the duration of the year ended on 30 June 2019, providing an outlook for the upcoming years-

- For the fiscal year 2020, the company anticipates completion of approximately $170 million worth of brownfield projects.

- In the financial year 2020, the company expects stronger volume growth, augmented by its Australian brownfield investment programme and the improvement in NHS volumes in the United Kingdom.

- Ramsay also mentioned that the changes in its operating model within the business would also contribute to the profits over the forthcoming years.

Stock Performance

On 13 January 2020, the RHC stock closed the day’s trading at $74.680, down by 0.16% from its last close. The company’s market capitalisation stood at approximately $15.12 billion, with nearly 202.08 million shares outstanding. The stock has delivered a positive return of 27.19% in the last year. The P/E ratio of the stock stands at 28.240x with an annual dividend yield of 2.03%.

An ASX listed major health care player CSL Limited (ASX:CSL) is global biotechnology firm focused on influenza vaccines and rare and serious diseases. The company operates mainly in three businesses- CSL Behring, CSL Plasma and Seqirus. The research and development portfolio of CSL focuses on innovation in new and improved products, and manufacturing capability conforming to the continued development of the company.

Outlook 2020-

In its AGM and investors presentation 2019, CSL discussed its outlook for 2020, the highlights are-

- The company is anticipating a continued strong demand for its plasma and recombinant products, one-off impact on sales of arising from the transition to new distributor model in China.

- Slight margin growth from plasma product mix shift, recombinant products growth & conclusion of HELIXATE®.

- The company reaffirmed NPAT in the range of $2,050 million to $2,110 million in FY2020, up by ~7 - 10% on fiscal year 2019.

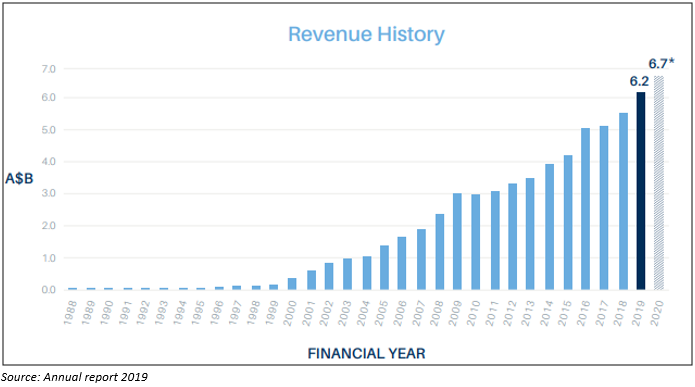

- Approximately 6 per cent of revenue growth is expected in the fiscal year 2020.

- Phase 1b study of CSL362 in healthy volunteers and SLE patients would start in the first half of 2020.

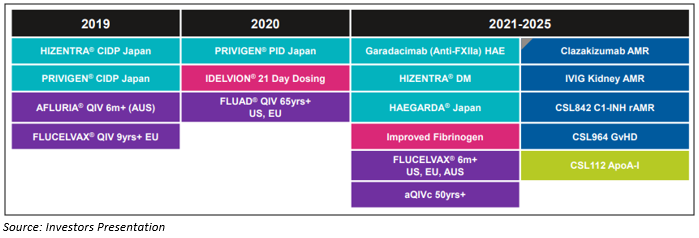

- In 2020, FLUCELVAX® QUADRIVALENT would be approved in Australia for more than nine years.

- In 2020, the company anticipates approval of FLUAD® QUADRIVALENT in the US and Europe for more than 65 years.

Significant target launch for upcoming years-

Stock Performance

On 13 January 2020, the CSL stock closed the day’s trading at $294.500, down by 1.604% from its last close. The company’s market capitalisation stood at approximately $135.84 billion, with nearly 453.87 million shares outstanding. The stock has delivered a positive return of 52.34% in the last year and 35.93% in last six months.

Sonic Healthcare Limited (ASX:SHL)

Sydney headquartered global health care sector player Sonic Healthcare Limited (ASX:SHL) provides services in radiology/diagnostic imaging, laboratory medicine/pathology and primary care medical services. The company has its operation in the United States, Belgium, Germany, Australia, the UK and more. In 2019, the company acquired one of the leading providers of anatomical pathology services in the United States-Aurora Diagnostics, with 32 practices across 19 states, with more than 1,200 staff and over 220 pathologists.

Outlook 2020-

- For the fiscal year 2020, Sonic expects an underlying EBITDA growth of 6–8%.

- The capital expenditure on property, plant and equipment is anticipated to be significantly lower in the financial year 2020.

- Due to the front-loading of interest expense a minor decrease in net profit is expected for FY2020.

Revenue for the fiscal year 2020 is based on market consequences forecast that also include FX rate assumptions-

Stock Performance

On 13 January 2020, the SHL stock closed the day’s trading at $30.330, down by 0.066% from its previous close. The company’s market capitalisation stood at approximately $14.42 billion, with nearly 475.02 million shares outstanding. The stock has delivered a positive return of 38.58 per cent in the last year and 10.08 per cent in the last six months. The P/E ratio of the stock stands at 24.780x with an annual dividend yield of 2.77%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.