Newcastle Coal Futures (thermal coal) are recovering at a rabbit pace with price reaching US$78.62 (as on 16 September 2019) from the level of US$71.30 (Dayâs low on 29 August 2019), which in turn, underpinned the growth of over 10 per cent. The ASX-listed coal miners are welcoming the recovery in coal prices amid an increase in the number of coal-powered energy generation.

New Hope Corporation Limited (ASX: NHC) presented the figures for the financial year 2019 ended 31 July 2019, and the company sounds optimistic over the future of coal in the global market.

A Glimpse Over the Coal Market

Australia is the worldâs second-largest thermal coal exporter by volumes, and the country exported 208 million tonnes of thermal coal ($26 billion) in 2018. However, the ambivalent consumption of coal in the global market could bring some stagnancy to the coal prices ahead.

The reliance of the significant coal consumer-Japan, on nuclear energy, is a potential risk for the thermal coal prices ahead. However, the higher consumption in the Asian market could offset the risk.

The global economies are adapting strict measures to shift towards the zero-emission in line with the Euro 6 standards, and the high carbon footprint of coal contains potential to cap any substantial gain in the coal prices.

Carbon Emission by Power Source (Source: DIIS)

Despite such drawbacks, many industry experts anticipate, coal to capture a large portion of the energy generation sector ahead, especially in emerging Asian economies.

Do Read: How Would the Coal Demand Dilemma Shape the Australian Coal Industry Ahead?

New Hope Corporation Limited (ASX: NHC)

New Hope Corporation sounded very optimistic over the emerging demand for coal in the Asian markets amid high investment in the coal-fired power stations.

However, NHC believes the coal market to be unstable in the near-term, albeit, the company anticipates the Asian demand for thermal coal (high-quality) to remain strong.

New Hopeâs Adaptability

The acquisition of a forty per cent additional interest in Bengalla during FY2019, along with a high production rate of 10Mtpa provides the company with a profitable and sustainable asset base.

However, despite aiming for further synergies to sail across the volatile tides of the coal market, the company is set to face tough times ahead in the absence of the approvals for the Acland Stage 3. The Queensland operations of the company will witness a record lower production in the years ahead as the Acland production is constrained to mining remnant coal from Stage 2 operations.

The Jeebropily mine is also scheduled to cease mining operations in December 2019.

FY2019 Highlights:

- The revenue of the company for FY2019 stood at $1,306 million, which underpinned the growth of 21 per cent against the revenue of the previous corresponding period (or pcp).

- The profit before tax and non-regular items stood at $384 million, up by 3 per cent as compared to pcp, and the profit post income tax and before non-regular items stood at $268 million, up by 3 per cent against pcp.

- The company produced 10.9 million tonnes of saleable coal in FY2019, up by 21 per cent against the 2018 production amid a 60 per cent increase in the production from the Bengalla (80 per cent interest).

- NHC exported 10.6 million tonnes of the total saleable production in FY2019, which underpinned a 23 per cent growth against the pcp, and supplied 0.3 million tonnes in the domestic market, up by 5 per cent against pcp.

- The company also declared a fully franked final dividend of 9 cents a share for FY2019.

The recent recovery in thermal coal prices (Newcastle coal) supported the share prices of the company, and the stock recovered lately from the level of A$2.170 (Dayâs low on 16 August 2019) and marking a new high of A$2.620.

The stock of NHC last traded at A$2.495 (as at AEST: 12:37 PM, 18 September 2019).

Whitehaven Coal Limited (ASX: WHC)

Apart from NHC, Whitehaven Coal (ASX: WHC) is also focused on the Asian markets amid high demand estimation.

The strategy of the company is to own and operate large and low-cost mines, which produces a mix of high-CV thermal coal and premium SSCC & other metallurgical coals to increase the market share in Asia.

Whitehaven is bullish over the coal demand ahead, and the company recently presented the IEA projections of coal to the investors.

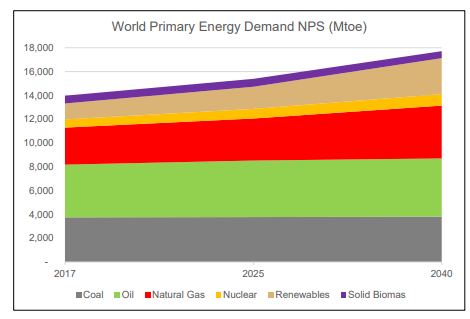

International Energy Agency (or IEA) anticipates that coal would retain the position of the largest source for electricity in 2040.

(Source: Companyâs Report) (NPS- New Policies Scenario)

The IEA NPS projects the coal demand to inch up from 5.35 billion tonnes of coal equivalent in 2017 to 5.44 billion tonnes of coal equivalent in 2040, which nearly equals to 2 per cent.

However, the IEA also project the coalâs share for the primary energy would decline from 27 per cent (2017) to 22 per cent in 2040 as LNG and renewables would gain momentum during the projection period.

Also Read: ASX-Listed Alternative Energy Stocks Under Investorsâ Lens as Oil Risk Surmounts

WHC also projects strong demand for thermal coal in India and other Asian economies with a decline in Europe and China.

- As per the company, the demand for thermal coal would grow by 23 million tonnes per annum in India, 22 million tonnes per annum in Vietnam, and by 33 million tonnes per annum in other Asian economies from 2018 to 2023.

- WHC also projects the demand for thermal coal in Europe to fall by 39 million tonnes and in China by 40 million tonnes per annum from 2018 to 2023.

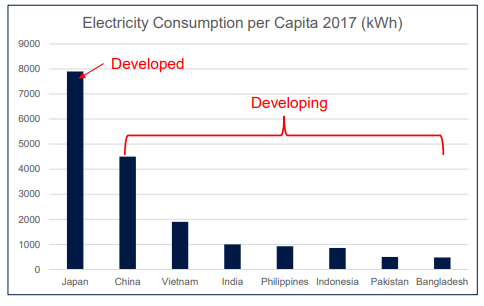

The anticipated increase in thermal coal demand from the Asian economies is mainly due to the anticipated low per capita electricity consumption along with the growing populations and rapid industrialisation, which would fan the electricity demand and growth in generation from all sources.

(Source: Companyâs Report)

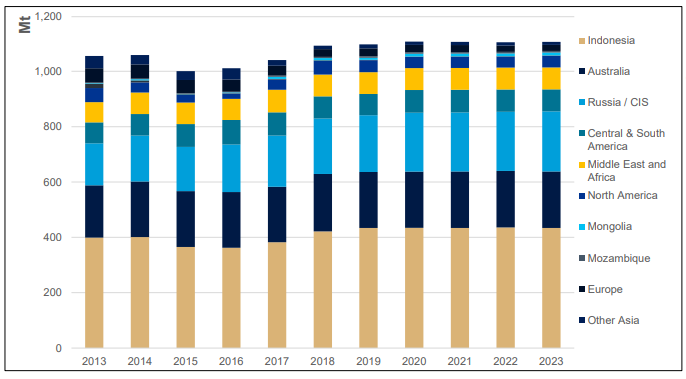

While the demand is anticipated to increase across Asia, the coal supply is projected to remain stagnant, which in turn, could support the coal prices over the long-run.

Coal Supply Projections (Source: Companyâs Report)

The demand for thermal coal is anticipated by the Australian coal miners to increase amid a projected increase in energy consumption and generation in Asia; hence, the miners are bullish on the future of coal.

However, the decline in coal usage for energy generation in Europe and China could offset the impact of the increase in demand across Asian economies, and investors should dig out for more information.

Also, investors should keep a close eye over various government policies, which could impact the demand and supply projections.

The stock of WHC last traded at A$3.355 (as at AEST: 12:37 PM, 18 September 2019).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.