With reference to managing a company, there are several stakeholders like chief officers, directors, managers and most importantly the shareholders who guide the company to accomplish its goals and objectives.

Management is the backbone of the company and acts as the captain of the ship, setting principles of planning, organising, directing and controlling the actions of the members to achieve the organisational goals. Therefore, management jobs require the control over the action and performance of the company while leading the people working in the company.

It is the basic assumption that management works in the best interest of the company, but they are humans too. Conflicts arise when the managers put their interest before the company goals. Also, some analysts believe that revenue of the company is reflective of its management; however, it is not valid if the company is performing well, the management is of the superior quality! It may be the business model, higher demand for product in the market.

Some ASX listed companies recently witnessed a change in their management. Let us see what derived these changes and how the companies are performing.

Carsales.com Limited (ASX: CAR)

Carsales.com Limited (ASX: CAR) is an online classifieds business in Australia, engaged in catering to more people with the sales or purchase of automobiles including cars, motorcycles, trucks, caravans and boats than any other classified group of websites in the country. As on 21 January 2020, the market capitalisation of the company stood at $4.39 billion.

Appointment of New Chief Financial Officer: Carsales.com Limited recently appointed William Elliott as Chief Financial Officer (CFO). Mr Elliott worked with CAR for 4 years at several senior finance positions and has a total of 14 years of finance experience.

During early December 2019, the company announced various organisational structure changes to recognise the increasingly global mindset of the business, where Ajay Bhatia took the role of Managing Director – Australia. As a part of structural change, Simon Ryan stepped down from the position of Managing Director – Commercial.

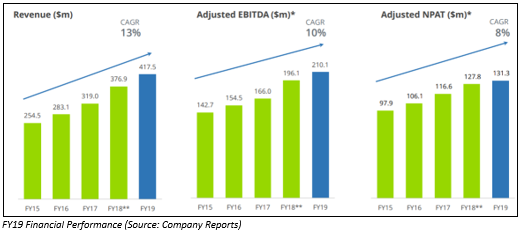

FY19 Group Revenue Up 11%: The company reported robust revenue performance in core Dealer and private advertising segments during FY19. Group revenue grew by 11% to $417.5 million and witnessed a CAGR (Compounded Annual Growth Rate) of 13%. This was mainly due to core Australian classifieds businesses which continued to perform well.

During the year, adjusted EBITDA went up by 7% to $210 million with the slight contraction in EBITDA margin to 50.3%. The decent financial performance of the company enabled the board to declare a dividend of 25.0c per share, reflecting an increase of 5% on the previous corresponding period.

What to Expect from CAR Going Forward: The company expects recovery in Australian automotive market conditions, owing to lower interest rates, improved lending environment, recovering property sector and recent tax changes. Carsales.com also expects to register decent progress with respect to the domestic adjacent businesses of Redbook and tyresales.

Stock Performance: The stock of CAR was trading at $18.050, up by 0.782%, on 21 January 2020 (AEDT 03:48 PM). As per ASX, the stock of CAR gave a return of 6.67% on a YTD basis, 19% in the last 3 months and 3.29% in the past 30 days. This resulted the stock to trade very close to its 52-weeks’ high level of $18.150. In terms of valuation, the stock was trading at a P/E multiple of 51.17x and earning a dividend yield of 2.54%.

Metcash Limited (ASX: MTS)

Metcash Limited (ASX: MTS) is a wholesaler to independent retailers in the food, grocery, liquor, hardware and automotive industries.

MTS Announces New CEO of Hardware Pillar: On 17 January 2020, the company announced the appointment of Annette Welsh as new CEO of the Hardware pillar, effective 1 May 2020. Ms Welsh, who is with the company since 2010, has more than 30 years of experience in the retail, wholesale and logistics sectors at a global level.

Under her current role as Hardware’s General Manager of Merchandising, she has built strong relationships with retailers and suppliers. Ms Welsh is expected to aid in continuing the growth momentum of the company’s hardware business, backed by her extensive experience and deep understanding of the business.

This organisational change comes after Mark Laidlaw decided to retire as the CEO of the Hardware pillar, effective from the end of April, after his role in the company for 10 years.

H1FY20 – 6th Consecutive Year of Earnings Growth for Liquor: The company recently announced its half-year results for the period ended 31 October 2019, unveiling that total food pillar sales increased by 1.2% and liquor delivered its sixth consecutive year of earnings growth.

For the half year, group underlying EBIT declined by $8.4 million to $149.7 million and underlying profit after tax of the company stood at $95.7 million.

Stock Performance: The stock of MTS was trading at $2.640, down by 0.377%, on 21 January 2020 (AEDT 03:48 PM) and is very close to its 52-weeks’ low level of $2.410. As per ASX, the stock gave a positive return of 1.96% on a YTD basis but a negative return of 10.03% in the past 30 days. The market capitalisation of the company stood at $2.41 billion.

Contact Energy Limited (ASX: CEN)

Contact Energy Limited (ASX: CEN) is involved in the generation and retailing of electricity. The company got officially listed on Australian Stock Exchange in 2015. The company through a release dated 17th January 2020 announced that Mike Fuge would succeed Dennis Barnes as Chief Executive Officer of the company, effective 28 February 2020.

New Loan Facility

- In another update, it was mentioned that Westpac NZ and CEN entered a $50 million, 4-year sustainability-linked loan facility. In addition, this facility happens to be the first such loan, which have been issued by Westpac NZ as well as also one of the first of its kind in New Zealand.

- The company would be receiving a discounted interest rate on the facility in the event of meeting ambitious targets, which are linked to its environmental, social and governance rating, by the independent ratings agency RobecoSAM.

- As per the key personnel of the company, this loan facility aligns with the desire of the company to continuously improve in areas, which matter to stakeholders, including environmental as well as emissions metrics

The company would be releasing its financial results for the six months ended 31 December 2019 on 10 February 2020.

Stock Performance: On 21 January 2020 (AEDT 03:49 PM), the stock of CEN was trading at $7.230 per share with a decline of 2.692%. The stock delivered returns of -6.42% and -2.49% in the span of three months and six months, respectively, while in terms of valuation, the stock was trading at a P/E multiple of 16.130 and earning a dividend yield of 4.7%.