The soft, silvery-white alkali metal, considered to be the lightest metal and the lightest solid element, lithium is highly reactive and flammable. The magic metal has been in news off late due to its soared demand in the tech-savvy electric vehicles, where the lithium-ion batteries dominate, amid all other uses.

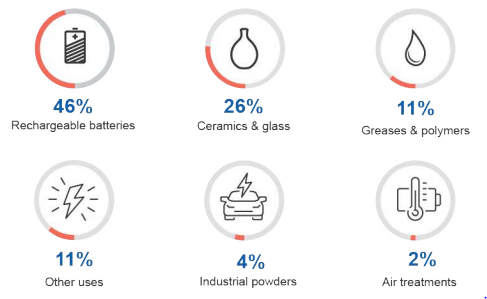

Global uses of Lithium (Source: DIIS)

Lithium Outlook

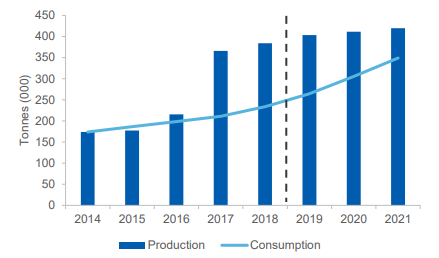

In the Australian context, market experts believe that even with sturdy expectations and soared demand from the booming EV industry, prices of lithium have been on a downfall for over a year, persistently. After $16,139 a tonne in 2018 to around $14,080 a tonne in 2019, the prices are likely to fall further in FY20 before they follow an upward growth trajectory in 202. The Aussie production would increase from an estimated 272,266 tonnes in 2018â19 to approximately 335,000 tonnes by 2020â21. The export revenue would go up in 2018â19 to around 335,000 tonnes by 2020â21, according to the Department of Industry, Innovation and Science (DIIS).

Lithium Production and Use (Source: DIIS)

Given this backdrop, let us look at four lithium stocks, listed and trading on ASX and understand their stock conduct:

Lithium Australia NL

Company Profile: An ethical and sustainable player, Lithium Australia NL (ASX:LIT) aims to 'close the loop' on the energy-metal cycle. The company has developed projects, alliances and innovative extraction processes to convert all lithium silicates to lithium chemicals. LIT plans to produce advanced components for the LIB industry and commence recycling of spent batteries and e-waste.

Stock Performance: After the close of business on ASX on 30 August 2019, the LIT stock quoted A$0.047. With a market cap of A$25.11 million, the stock has approximately 534.27 million outstanding shares, and its YTD return has been a negative 49.55 per cent.

LieNA® technology Update: On 22 August 2019, the company pleasingly notified that its LieNA® technology had transitioned from a scoping study to preliminary feasibility study assessment, which had commenced. The technology was derived post extensive research and development and was undertaken in collaboration with the ANSTO. The technology avoids conventional high-temperature treatment of spodumene concentrates and is not constrained by particle feed size. It uses an alkaline source at the required pressure and temperature to convert the mineral spodumene to a lithium-bearing sodalite phase, which is eventually recovered and selectively leached to produce a lithium-bearing solution, which further creates a high-purity, refined tri-lithium phosphate product.

The company has received enquiries for the potential supply of both LP and LFP from China and the provisional patent and Patent Cooperation Treaty applications have been lodged for LieNA® as a part of LITâs IP protection strategies.

Lake Resources N.L

Company Profile: An explorer of lithium with its focus on prime lithium basins and lithium pegmatites in Argentina, Lake Resources N.L (ASX: LKE) is the 100 per cent holder of one of the largest lithium tenement packages of the country of approximately 165,000 Ha. Few of its projects include Olaroz/Cauchari, Catamarca, Paso and Kachi.

Stock Performance: The LKE stock last traded on 28 August 2019 at A$0.056. With a market cap of A$26.78 million, the stock traded with approximately 478.24 million outstanding shares, and its YTD return has been a negative 39.13 per cent.

Change of Directorâs Interest Notice: On 27 August 2019, the company notified about the Change of two of its Directorâs Interest. Mr Steve Promnitz acquired 2,447,661 listed options and holds 15,381,293 Ordinary Shares, 2,447,661 Listed Options with an expiry date of 15 June 2021, 5,000,000 Unlisted Options with an expiry date of 31 December 2020 and 625,508 Unlisted Options with an expiry date of 21 October 2019.

Mr Stuart Crow acquired 544,870 listed options and holds 4,358,964 Ordinary Shares, 544,870 Listed Options with an expiry date of 15 June 2021, 3,000,000 Unlisted Options, with an expiry date of 31 December 2020 and 156,250 Unlisted options, with an expiry date of 21 October 2019.

Cauchari Lithium Brine Project Update: On 23 August 2019, LKE pleasingly notified that there had been a significant discovery which has similar results of 580mg/L lithium average grade in Indicated resource and is under construction for production next year at the Project. in final results, the higher grades averaged 493 mg/L lithium over a wide interval of 343m.

Cauchari Lithium Brine Project Update (Source: LKE Report)

Latitude Consolidated Limited

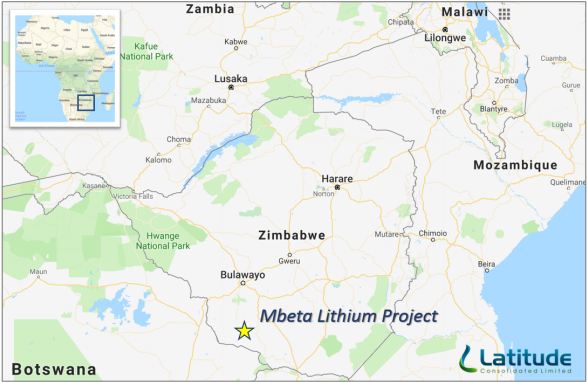

Company Profile: A Perth?based and public resources development company, Latitude Consolidated Limited (ASX: LCD) has its eye towards Lithium Projects in Zimbabwe, while the company is the holder of a portfolio of prospective gold tenements in Western Australia. It was listed on the ASX in 1999 under the Materials group.

Stock Performance: After the close of business on the ASX on 30 August 2019, the LKE stock quoted A$0.016, and traded flat with a market cap of A$4.4 million, along with approximately 275.18 million outstanding shares. The YTD return of the stock has been a negative 11.11 per cent and it has a negative EPS of A$0.010.

Quarterly Activities Report: On 30 July 2019, the company released its Quarterly Activities Report for the period ended 30 June 2019. The biggest highlight of the report was the successful acquisition of Mbeta Lithium Project, which was finalised on 25 July 2019. The Project comprises of approximately 18km² of mineral claims and is deemed as a great prospect for lithium and linked elements. Besides this, LCD notified that the Gecko North tenement E15/1587 exploration was underway, and it holds potential for both structurally?hosted gold mineralisation and paleochannel?hosted gold accumulation.

Mbeta Project Location Map (Source: LCDâs Report)

In the context of acquisition, the company has been analysing quite a few potential investment opportunities across Zambia, Zimbabwe other regions.

Quarterly Cash-Flow Statement: LCDâs Cash-Flow statement for the period ended 30 June 2019 is depicted below:

| Particulars | Amount (A$â000) |

| Net cash used in operating activities | 197 |

| Net cash used in investing activities | 27 |

| Cash and cash equivalents at end of period | 3,292 |

| Estimated cash outflows for next quarter | 235 |

Lepidico Ltd

Company Profile: Owner of projects, alliances and JV across Australia, Portugal and Canada, Lepidico Ltd (ASX:LPD), the companyâs stocks trade on the ASX and German stock exchanges. LPD owns the clean-tech L-Max®process technology and aims to become a vertically integrated business, from mine to production of battery grade lithium chemical.

Stock Performance: After the close of business on the ASX on 30 August 2019, the LPD stock quoted A$0.021, and traded flat with a market cap of A$92.37 million, along with approximately 4.4 billion outstanding shares. The YTD return of the stock has been 48.46 per cent and it has a negative EPS of A$0.001.

L-Max® Pilot Plant trail Update: On 19 August 2019, LPD pleasingly notified about the significant results from the L-Max® Pilot Plant trail, Campaign 1, which lasted for ten days. Assay results confirm L-Max® viability with average lithium extraction of 94 per cent to lithium sulphate. Insoluble lithium losses linked to impurity removal stages averaged 3 per cent and below 2 per cent for extended periods. High purity potassium sulphate worth 96 per cent K2SO4 was produced, which was deemed equivalent to 52.2 per cent K2O.

Research and development test work was due to commence in August 2019 to produce a range of caesium and rubidium products, for market assessment during the December 2019 quarter.

Issue of Shares: On 31 July 2019, LPD notified that it had issued 13,786,605 new fully paid ordinary shares to Bacchus Capital Advisors at an issue price of $0.026 per share. The issue was as per the terms of its engagement as Corporate Advisor in relation to the Desert Lion Energy Inc business combination.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.