Lithium being a critical element of electric vehicles has witnessed a substantial uplift in its demand over the recent years. Lithium-ion battery powered electric vehicles have constantly been witnessing a rise in the sales all over the world. Many Lithium stocks like LIT are under the Investorsâ radar.

Let us now look at the recent performances and updates on the ASX-listed lithium stocks.

Lithium Australia NL

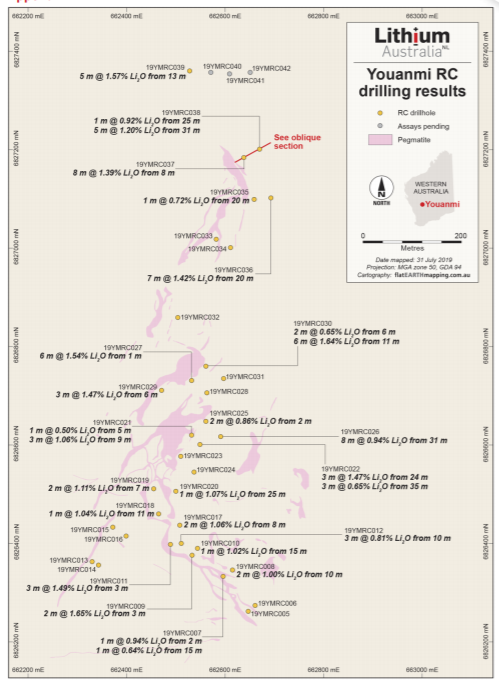

Perth-based lithium exploration and production company, Lithium Australia NL (ASX: LIT) unveiled the results of its maiden RC drilling programme within the Youanmi project area on 5 August 2019. The RC drilling programme was designed to test down-dip extensions of outcropping lithium-bearing pegmatites and till now, the programme has completed 54 RC holes for 2,455 m on the 3 km x 200 m lithium target.

The maiden drilling has returned solid results, with assay results showing significant lithium intersections:

- 8 m @ 1.39% Li2O from 8 m (19YMRC037)

- 7 m @ 1.42% Li2O from 20 m (19YMRC036)

- 6 m @ 1.54% Li2O from 1 m (19YMRC027)

- 6 m @ 1.64% Li2O from 11 m â includes 1 m @ 3.07% Li2O (19YMRC030)

- 5 m @ 1.57% Li2O from 13 m (19YMRC039)

- 5 m @ 1.20% Li2O from 31 m (19YMRC038)

Collar plan showing assay results from RC drilling at Youanmi (Source: Companyâs Report)

The mineralisation is reported over good widths of high grade and the drill data is suggesting that the pegmatites have widths of up to 9 m and dip at shallow angles (up to 40°) towards the east. It is to be noted that the mineralisation is shallow and remains open down dip and along strike, an encouraging piece of news for the company from an exploration perspective.

As per the companyâs Managing Director Adrian Griffin, the great outcomes from first-pass drilling programme justified the companyâs exploration model. It is expected that further assay results will come out by the end of this month from the remaining holes.

June Quarter Activities: On 31 July 2019, LIT announced the quarterly activities report for the period ended 30 June 2019, wherein it mentioned that during the 2019 June quarter, the company continued the production of cathode materials at its wholly owned VSPC pilot plant. International battery manufacturers, including the DLG Battery company, is currently evaluating various samples of cathode powder produced in the plant.

During the quarter, the company also progressed its pre-feasibility study (PFS) over the Sadisdorf lithium project. Via PFS, the company intends to investigate the viability of producing cathode materials for lithium-ion batteries from that location.

From the cash flows perspective, during the June 2019 quarter, the company spent A$479k of cash on exploration and evaluation activities, AA$224k on development activities, A$670k on staff costs and A$50k on administration and corporate costs. The total net cash used in operating activities during the June quarter was around A$1,090k. Further, the net cash used in investing activities was around A$433k. During the quarter, the company spent A$5 million of cash on repayment of borrowings. The companyâs total Cash and cash equivalents at the close of the quarter was decreased to A$2.7 million from A$9.13 million in the previous quarter. The Total estimated cash outflows for the September quarter is around A$1.75 million.

On 6 August 2019, LITâs shares were trading at A$0.050, down by 1.961 percent (at AEST 1:02 PM). In the past six months, LITâs stock has given a return of -41.53%. The company has a market capitalization of A$27.19 million, with 533.06 million shares outstanding.

Lepidico Ltd (ASX:LPD)

International lithium explorer and developer, Lepidico Ltd (ASX: LPD) in its quarterly activities report for the period ended 30 June 2019, mentioned that it has a zero-harm track record since health, safety and environmental incident reporting began in September 2016. The company recently transformed into a vertically integrated lithium development company from mine to chemical conversion plant with work already commenced to integrate the Karibib Lithium Project into the Phase 1 Plant Feasibility Study.

Drilling at the Karibib Lithium Project, 15 July 2019

The company recently commenced the L-Max® Pilot Plant and started a Campaign 1 in early July. The Interpretation of data collected from the Pilot Plant is expected to come out in August, with findings subsequently incorporated into the Phase 1 Plant design.

During the June quarter, the company successfully completed a Renounceable Entitlements Offer and raised $10.8 million (before costs) and issued 372,908,354 new shares and 186,454,177 new options.

The funds received from the offer will be used in the integration of the Desert Lion business as well as for the development and engineering work of LOH-Maxâ¢. The funds will also be used for the product development and qualification work.

On Cash flows front, during the June quarter, the company spent A$127k of cash on exploration and evaluation activities, A$957k on development activities, A$275k on staff costs and A$414k on administration and corporate costs. The total net cash used in operating activities during the June quarter was around A$1,759k. The net cash received from financing activities during the quarter was around A$10,480k. The total cash and cash equivalents at the end of June quarter stood at A$13.66 million. The total estimated cash outflows for the September quarter is around A$7.33 million.

On 6 August 2019, LPDâs shares were trading flat at A$0.022 (at AEST 1:19 PM). In the past six months, LPDâs stock has provided a return of 39.18%. The company has a market capitalization of A$96.77 million, with 4.04 billion shares outstanding.

Argosy Minerals Limited (ASX:AGY)

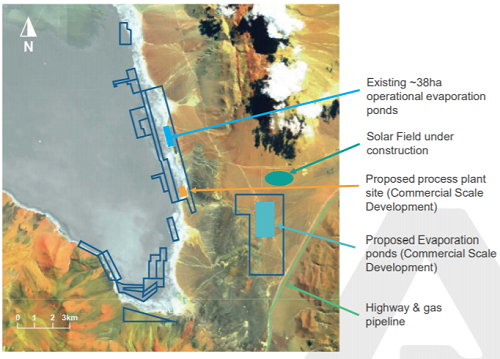

Lithium explorer, Argosy Minerals Limited (ASX: AGY) has been making solid progress towards the commercial development of its Rincon Lithium Project (77.5% interest) which lies within Salta Province, and is ideally located to nearby infrastructure as depicted in the figure below.

Rincon Project: Location and Infrastructure (Source: Companyâs Report)

The company recently, on 5 July 2019, notified that it has commenced lithium carbonate production operations from its industrial-scale pilot plant using its proprietary and exclusive successful chemical process to produce 99.5% lithium carbonate product, and following which it joined the exclusive list of international lithium carbonate producers.

Also, on 30 July 2019, the company releases its quarterly results, wherein it mentioned that during the June quarter, the company was working towards the ~2,000tpa modular commercial lithium carbonate processing plant operation as the next step in the scale-up development of the Project.

From cash flows perspective, during the period the company spent A$95k of cash on exploration and evaluation activities, A$133k on staff costs and A$420k on administration and corporate costs. The total net cash used in operating activities during the June quarter was around A$620k. The net cash received from financing activities during the quarter was around A$8,276k.

Further, the total Cash and cash equivalents at end of June quarter stood at A$7,625 million (excluding $40,000 funds held in Puna bank accounts). The Total estimated cash outflows for the September quarter is around A$920k.

On 6 August 2019, AGYâs shares were trading down by 4.545%, at a price of A$0.105 (at AEST 1:33 PM). In the past six months, AGYâs stock has given a negative return of 18.27%. The company has a market capitalisation of A$111.6 million, with 1.01 billion shares outstanding.

Piedmont Lithium Ltd (ASX:PLL)

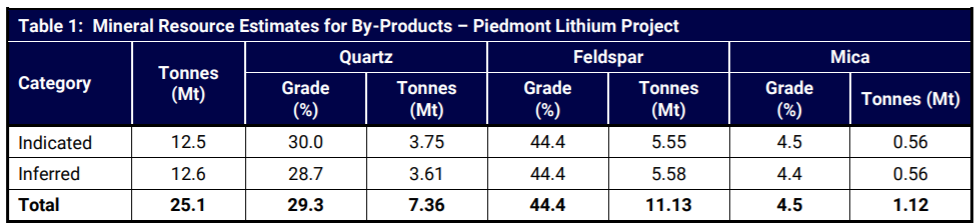

Emerging lithium entity, Piedmont Lithium Ltd (ASX: PLL) on 1August 2019, provided the updated Mineral Resource estimates for mineral by-products quartz, feldspar and mica from spodumene bearing pegmatites on the Companyâs wholly-owned Core property.

Mineral Resource Estimates for By-Products â Piedmont Lithium Project (Source: Companyâs Report)

Mineral Resource Estimates for By-Products â Piedmont Lithium Project (Source: Companyâs Report)

In the Quarterly report ended 30 June 2019, published on 30 July 2019, PLL declared that with an initial Mineral Resource estimate for the Companyâs Central property of 2.8 Mt at a grade of 1.34% Li2O, the total Mineral Resources for the Piedmont Lithium Project has now increased to 27.9 million tonnes at a grade of 1.11% Li2O, representing an increase of 72% from the previous estimate.

On the financial front, for the period ending 30 June 2019, the company mentioned that the net cash used in operating activities stood at US$2,328. The nest cash used in investing activities was recorded at US$343. At the end of the June quarter, the company had cash and cash equivalent of US$4.432 million.

On the stock performance front, the stock of the company was trading flat at A$0.135 (at AEST 1:49 PM). In the past six months, the shares of PLL has given a return of 37.76%. The company has a market capitalisation of A$110.08 million, with 815.38 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.