The companies come into existence after abiding the laws prescribed in a particular jurisdiction. Mainly, these laws are known as Companies Act or Corporation Act etc. However, it is not the only law that companies have to follow; there are other laws also such as security laws, labour laws, competition laws etc. At times, new laws are formed to tackle particular hindrances faced by the people of a country or companies or any individual by the non-existence of such laws. Similarly, if the problem persists in the existing law, changes are made to the existing laws called Amendments.

It becomes important to understand a bit about law before we discuss listing and procedures; as these laws have to be complied by companies while applying for listing, and the post-listing of the stock in any exchanges.

Listed or Not:

It is very simple to check whether any company is listed or not. Also, there are many ways to check whether the company is listed or not. Some of the ways to do so are mentioned below:

- Mostly, the companies have websites these days, and the listed companies mainly host a section known as âInvestorâ or âInvestor Relationsâ within the respective websites. The different sections provide material developments, communications and regulatory fillings etc.

- Now, the focus can on looking out for exchange names mentioned in those particular sections or the announcements made by the companies. At times, the companies also provide real stock price at the website.

- Exchange websites can be utilised to check whether the company exists in the exchange.

- Investors can search on web search engines as âABC ticker codeâ â ABC being the company name, and the ticker is a symbol designated by the exchanges to any security. Subsequently, if you have the ticker, the price of the security can be checked on a real-time basis on the web search engines.

Listing Process

Listing means the admission of the securities of any company, government, entity, derivatives etc. to the stock exchange. A stock exchange facilitates the market for such securities; therefore, the securities are listed on an exchange. Similarly, de-listing of the security means offloading of currently traded securities in consideration of price or maybe shares; this depends upon the de-listing route adopted by the company.

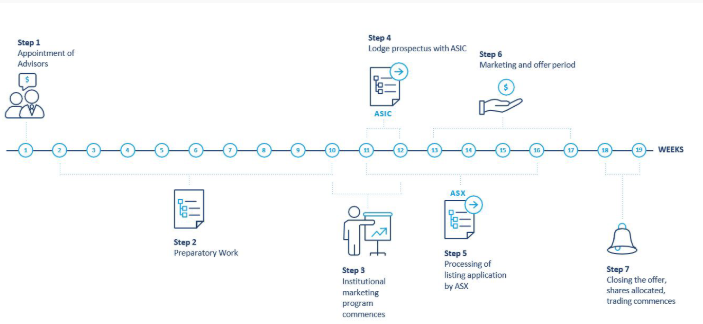

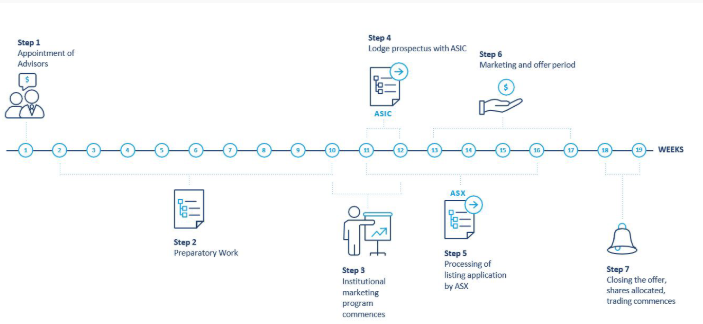

Indicative Schedule of the Listing Process: Source: ASX

Process

Appointment of Advisors â In this stage, the company appoints investment banks to consider the proposal and asses the company, which includes due diligence, prospectus drafting, discussions with the exchange, incorporating a new public company, preparation of listing application etc.

Negotiation & Marketing â Now in this step, the entity engages with underwriters to negotiate the issue price, floor and cap price, etc. The company also engages in marketing of the prospectus to attract higher investor participation, and the application is lodged with an exchange.

ASIC â The company would now, during this step, have to lodge the application with the Australian Securities & Investment Commission (ASIC).

Offer Period â Moving ahead, the company provides date of opening and closing of the offer period, and the investors subscribe for the number of shares etc. Meanwhile, the company continues to market itself for a maximum investor participation.

Closing â Finally, after the offer period is closed, and the securities are allocated to the investors; subsequently, the securities are admitted to the exchange for trading.

Listing on ASX

There are a lot of conditions that are necessitated prior to the listing on ASX. In addition, companies should comply through profit or asset tests. Below, we discuss some significant conditions related to the ASX Listing of the entity; it is worth noting that the below conditions do not reflect all the conditions to be met:

- Any entity intending to list at the exchange must fall under the three categories described by the exchange, namely - ASX Listing, ASX Debt Listing or ASX Foreign Exempt Listing.

- A prospectus or PDS must be issued and lodged by the entity with ASIC.

- If the entity is a foreign based organisation, it should be registered under the Corporations Act.

- If the entity is a trust â it needs to register as a managed investment scheme unless exempted by ASIC; if the entity is exempted from registered managed investment scheme, the responsible entity should be bided under Corporation Act; buy-back of units in the trust is prohibited.

- The entity cannot be listed with less than 20% of the free float at the time of admission.

- The entity must satisfy the conditions listed under profit test or assets test, and the entity must appoint a person to communicate with the exchange on rule matters related to the listing.

- The organisation would be required to satisfy the exchange that the directors at the time of listing are of good fame and character.

Profit Test

- The entity must satisfy the condition of going concern, and the rule is satisfied if the company is a successor of going concern.

- The organisation should be in the same business as it was in the past three financial years, at the time of listing on the exchange.

- The entity made an aggregate profit of A$1 million in the preceding three financial years from continuing operations.

- The consolidated profit from the entityâs continuing operations must be of A$0.5 million in the preceding 12 months to a date no more than 2 months prior to the application date.

- The entity should provide a statement from directors confirming that the business would continue to be profitable up to the date of application.

- The company/entity must provide below mentioned documents, and in each case audit report is mandatory that should not be a modified opinion, emphasis of matter or matters that the exchange considers unacceptable include â

- Audited accounts for the preceding three financial years; if the company had its full-year end in the previous 90 days, it should submit statements for 3 financial years preceding the latest full-year results; however, it should also submit the latest reviewed or audited half-year result.

- If the company applies for listing more than 6 months or 75 days post the full-year close; then, it should provide audited or reviewed accounts for the latest available half-year or longer period.

- Unless or otherwise stated, the company must provide a review of the financial statement by a registered company auditor or an independent accountant.

Assets Test

For this test, we have discussed some significant conditions:

If the organisation is an investment entity:

- The entity must have net intangible assets of at least $15 million after considering the costs of raising fund.

- It should be pooled development funds with net tangible assets of not less than $2 million after deducting the cost of fund raising.

If the organisation is a non-investment entity:

- At the time of admission, the entity must have net tangible assets of no less than $4 million after considering the cost of raising capital.

- It should also have a market capitalisation of no less than $15 million.

- Either, the entityâs total intangible assets after raising the funds should be in cash for a proportion of less than half of total intangible assets or in the readily convertible form; or the entity should have half or more of the total intangible assets after raising funds in cash/readily convertible, and the entity is bided by the business to keep half of its assets in cash/readily convertible. Further, the business objectives should state the expenditure program, and if these objectives are not in PDS, then these should be supplemented to ASX.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.