The COVID-19 turmoil has led to a global economic crisis affecting all the sectors across economies. The World Health Organization recently advised that there is a ‘long way to go’ for the COVID-19 pandemic as global deaths cross the 210k mark.

Amid the ongoing unrest, every industry appears to be gripped by its own set of challenges. Although some are overwhelmed by the disturbance in the supply chain, many businesses are struggling significantly because of the swift change in the demand pattern.

With the implementation of nationwide lockdown across several geographies, the education sector, which thrives on classroom learning, has taken a hit as most of the educational institutions are shut during the lockdown.

To continue teaching/learning practices, institutes have resorted to an inadequate yet speedy solution to tackle the situation. Schools, universities and colleges have somewhat adopted the ‘Work From Home’ culture widely used by businesses these days. The education sector, using technology, is opting for alternate solutions such as web conferencing based face-to-face tutorials, online assessments and lectures. The institutions have made significant investments in online learning platforms, ensuring that the learning continues.

E-learning During COVID-19 Lockdown

The unprecedented disruption caused by the coronavirus outbreak has led to the temporary shut down of schools and colleges in many nations. It has also revolutionised how colleges teach and connect with students through online instruction.

Governments in every country are taking every measure possible to stop this outbreak and save millions of lives. The governments in several nations banned public gatherings, but the colleges and schools cannot afford to delay their sessions for long. And with no confirmation as to when the world will be free from the infectious disease, online schooling is the only way schools or colleges would be able to complete their syllabus in time and maintain their student bodies.

ALSO READ: How is Education Sector Placed With Online Learning Trend Amidst Virus Threat

In this article, we will acquaint you with two ASX-listed stocks from education space- JAN, 3PL

Janison Education Group Limited (ASX:JAN)

An education technology pioneer, Janison Education Group Limited offers online learning and digital assessment solutions for various educational courses. The group provides two main offerings in the education technology sector- Janison Insight and Janison Academy.

- Janison Insights is a leading platform at the global level, which is for the provision of large-scale servicing national education departments, digital exam authoring testing and marking, tertiary institutions as well as independent educational organisations.

- The second offering in the education tech industry is Janison Academy which is a leading integrated learning platform utilized by government departments along with some large enterprises to build capability in their people.

‘Janison Remote’ Resolving the Continuity Problem of Global Education

JAN group continues to deliver high stakes exams via online supervision amid the COVID-19 crisis to ensure there is no impact on the future of students. Students are taking exams from their own homes available anytime, anywhere and on-demand. The AI-based ID checks and incident tracking is providing outstanding exam integrity. The target markets for this include various universities, certification course providers, governments as well as school exam service providers.

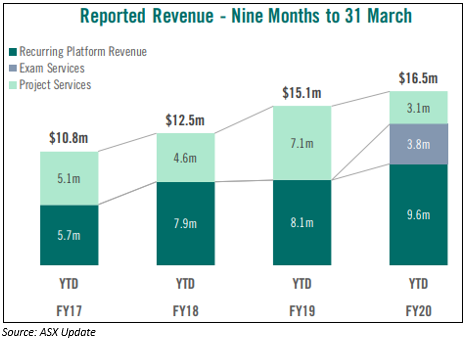

Key Financial Highlights for FY20 YTD:

The recent events experienced globally as a result of COVID-19 have forced educational institutions and professional associations to accelerate their plans to digitise course material and exam delivery.

The Company highlighted that in the long-term, it is well-positioned to benefit from this dramatic, and most likely permanent, shift in the market as demonstrated by the recent early wins to digitise course material for Centennial College, Canada.

- The group reported strong growth in Group ARR (Annualised Recurring Revenue) of nearly 26%.

- The group stated that for the nine months to 31 March 2020 it has recorded growth of almost 59% in the assessment recurring revenue.

- EBITDA reported rising to 10%, up nine percentage points for the nine months to 31 March 2020 climbed by 2% on pcp.

- Janison highlighted closing cash on hand of ~$2.9 million as on 31 March 2020.

On the operational front, the Company has commenced working with education service providers at the global level as a result of the five-year exclusive agreement it secured with the Organization for Economic Cooperation and Development (OECD) to digitise the PISA-based Test for Schools (PBTS).

Janison Completes Capital Raising of $7 Million

The Company announced the completion of the capital raising of $7 million by way of a private placement of ordinary shares to institutional and sophisticated investors, including John Baker, a global EdTech leader.

The funds will be utilized to invest in sales and marketing execution to support multiple international growth opportunities; platform development to target additional market segments and inorganic opportunities.

The Placement was made at a per-share price of at $0.25, which is equivalent to a 12% discount to the 20-day volume-weighted average price of $0.28 on the date of the Placement.

On 28 April 2020, the share price of JAN fell by 1.408% to $0.350 at AEST 02:34 PM. The market cap of the stock was reported to be $64.49 million with approximately 181.65 million outstanding shares trading on the ASX.

A leader in online education, 3P Learning Limited designs learning resources for schools as well as families, including spelling, mathematics as well as literacy. 3PL provides its suite of learning resources in over 17,000 schools and to nearly 5 million students in across the globe.

Minimal Impact of COVID-19 on 3PL’s Operations

3P Learning provides the following update on its business operations for the third quarter of FY2020 (ended 31 March 2020):

Regardless of the uncertainty surrounding COVID-19, there has not been any interruption to the operating activities of 3P Learning, including sales, marketing along with product development.

Moreover, the Company stated that its technology suite is scaling nicely along with enhanced usage and demand. The longer-term impact from COVID-19 on 3P Learning is difficult to assess at present, especially for the education and ed-tech segments. The Company has, however, witnessed an increase in demand for its products and services.

The Company anticipates generating positive operating cash flows for the full year and, subject to COVID-19 adversely impacting the timing of cash collections for future billings. Moreover, 3PL also projects cash to be higher at the end of FY20, compared to the prior corresponding period (pcp).

3P Learning expects an increase in deferred revenue for the full year compared to pcp, which is a positive sign for the financial year 2021.

On 28 April 2020, the share price of 3PL climbed by 1.987% to $0.770 at AEST 02:34 PM. The market cap of the stock was reported to be $105.31 million with approximately 139.48 million outstanding shares trading on the ASX.