Technology can be understood as the invention, which helps the people to ease their lives and raise their standards of living. Over a span of time, it has helped the economy to witness the growth in terms of macroeconomic parameters such as GDP, Income of particular sector, employment generation, etc. Technology has elevated its footprints from old school methods to new developed products.

Coming to the Australian economy, fintech has experienced more attention than any other sector over the period. Technology also includes Artificial Intelligence, which looks like the future of modern technology. Apart from fintech, technology in communication space, technology in Medical sector could prove to be growth catalysts for the economy.

MedTech includes those companies, which are involved in the business of supplying and developing medical products, healthcare software development companies as well as mobile application development companies. Let’s have a look at three medical technology companies:

Sonic Healthcare Limited

Sonic Healthcare Limited (ASX: SHL) comes under leading medical diagnostics companies of World. The company provides radiology and laboratory services to the medical fraternity.

Revenue and Earnings Growth

The company has recently notified the market participants with the operational and financial performance for the first half of financial year 2020:

- SHL posted revenue amounting to A$3.3 billion, reflecting growth of 15%. The achieved revenue growth comprises 5% organic revenue growth (in constant currencies). This was particularly strong in its Australian, UK and Swiss laboratory businesses, as well as in its Imaging division.

- The company reported net profit amounting to A$254 million with the growth of 14%.

- For the half year ended 31 December 2019, the company declared an interim dividend amounting to 34 cents per share, reflecting the growth of 3.0%. The said interim dividend would be paid by the company on 25th March 2020 with the record date of 11th March 2020.

Well Set for Future Growth

- On the outlook front, SHL is well positioned for future growth, with strong brands and market positions, its binding culture of Medical Leadership, as well as a balance sheet which provides significant financial flexibility.

- The company continues to aim at synergistic acquisitions, joint ventures, and contract opportunities, mainly in the US and European laboratory markets.

- SHL is in a robust, stable position, along with embedded culture of Medical Leadership, respected brands and quality services.

- The company expects investment grade credit metrics to provide flexibility for future growth and anticipates continuous improvement in services and efficiencies, which is a key element of its corporate culture.

The stock of SHL closed the day’s trading at $31.050 per share on 21st February 2020, indicating a fall of 0.767% against its previous closing price. The company has a market capitalization of $14.86 billion as on 21st February 2020. The total outstanding shares of the company stood at 475.05 million, and its 52-week low and high are $23.380 and $32.070, respectively. The stock of the company has generated a return of 4.89% and 9.41% in the time period of three months and six months, respectively.

Ansell Limited

Ansell Limited (ASX: ANN) provides superior health and safety protection solutions, which improves human well-being. The company possesses a leading position in the personal protective equipment and medical gloves market.

Half Year Performance of ANN

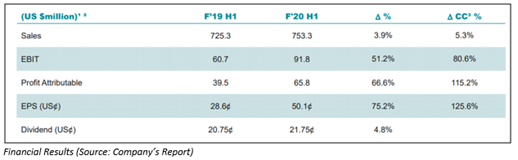

The company managed to deliver robust sales, earnings growth as well as strong cash generation in 1H FY20 despite geopolitical tensions, which continued to affect global economies, sectors and business sentiments.

- Ansell reported sales amounting to $753.3 million with the growth of 3.9% and rise of 5.3% on constant currency basis. ANN posted EBIT amounting to $91.8 million with a rise of 4.8% on YoY basis.

- These results reflect resilience of its diverse business operations as well as disciplined execution of its strategy.

- Healthcare business of ANN has continued to witness its positive momentum by delivering 3.4% organic sales growth along with improved profitability.

- The integration of the Ringers business with the company is proceeding well with 13.5% comparable organic sales growth. During the period, the company has expanded the reach of this best-in-class portfolio of impact protection gloves into its global markets and customers in EMEA and APAC.

- The company declared an interim dividend of 21.75 US cents per share, which was 4.8% jump as compared to the previous year. This reflects confidence in the company to continue to generate strong cash flows, while maintaining decent funding capacity for growth initiatives.

- The record date for the said dividend is 25th February 2020 and it will be paid by the company on 12th March 2020.

Impact of Coronavirus

- When it comes to future aspects, the company anticipates positive as well as negative impacts on its business from the coronavirus crisis. However, the company is actively providing support to the authorities of China to provide a decent amount of personal protective equipment (PPE) which has raised the demand for these products.

- The adverse effects of the crisis can be seen in external plant shutdowns in the manufacturing sector, which has led to decrease the manufacturing production, lower stock levels as well as potential supply chain disruption which might also have some negative implications for its customers.

- Moreover, the company expects earnings per share for FY20 in the range of 112¢ to 122¢ as compared to adjusted full year EPS of 111.5¢ of FY19 on the back of a robust pipeline of orders and ongoing strategic initiatives.

The stock of ANN closed the day’s trading at $31.510 per share on 21st February 2020, indicating a fall of 0.943% against its previous closing price. The company has a market capitalization of $4.14 billion as on 21st February 2020. The total outstanding shares of the company stood at 130.21 million, and its 52-week low and high are $24.100 and $33.430, respectively. The stock of the company has generated a total return of 9.39% and 17.51% in the time period of three months and six months, respectively.

Cochlear Limited

Cochlear Limited (ASX:COH) is a health care sector company, which is engaged in the sale and manufacturing of Cochlear implant systems.

Growth in Sales Revenue

- During 1H FY20, the company experienced the business to deliver a rise of 9% in sales revenue, which amounted to $777.6 million. The underlying net profit of the company stood at $132.7 million, which was in line with 1HY FY19, along with operating profit growth offset by foreign currency contract losses. Cochlear implant revenue witnessed the growth of 14% with units growing at the rated of 13%.

- A number of small investments in companies with novel technologies has been made in innovation fund of the company, which might help the company to improve or leverage the its core technology, over the longer term.

- During the period, the company continued with the investment in product development and market growth initiatives for generating long-term market growth. The company possess strong balance sheet with enough cash flow generation for fund investing activities, capital expenditure as well as growing dividends to shareholders whilst maintaining conservative gearing levels.

During the month of November 2019, the company has received FDA approval for Osia 2 System. It added that Osia 2 System provided expansion to its Acoustics portfolio into the next generation of bone conduction hearing solutions. Moreover, on 14th February 2020, FDA has approved Cochlear™ Nucleus® Profile™ Plus with Slim 20 Electrode (CI624).

On the outlook front, the company is anticipating underlying net profit in the range of $270 million-290 million, reflecting a rise of 2%-9% on underlying net profit for FY19. This guidance has been adjusted downwards from $290 million-300 million previously.

The stock of COH closed the day’s trading at $231.600 per share on 21st February 2020, indicating a fall of 4.436% against its previous closing price. The company has a market capitalization of $14.02 billion as on 21st February 2020. The total outstanding shares of the company stood at 57.83 million, and its 52-week low and high are $164.000 and $254.400, respectively. The stock of the company has generated a total return of 9.17% and 10.56% in the time period of three months and six months, respectively.