The Australian Securities Exchange on 16 August 2019 showcased the S&P/ASX 200 index to be trading at 6405.8 or 0.1 basis points (at AEST 1:33 PM). This depicts that stocks performed well and kept investors intrigued about what would be in store, in the days to come.

Let us have a look at the three stocks, listed and trading on ASX, and maintained a fair upward momentum post close of business for the day:

Ansell Limited

Company Profile: A player catering to the industrial, healthcare and life science domains, Ansell Limited (ASX: ANN) delivers advanced protection solutions, induced with innovative products and advanced technology. The company conduct sales activities in over 100 countries and produces more than ten billion gloves per annum. The company was listed on the ASX in 1985 and has its registered office at Victoria Street.

FY19 Results: On 12 August 2019, the company released its FY19 results for the period ended 30 June 2019, stating that the Global markets in 2019 were frequently volatile, uneven and unpredictable. However, ANN was successful in maintaining organic growth amid these challenges and completing the core elements of its ambitious Transformation Program, due to which the company has fewer plants which were producing more output and utilising better technology. The final phase of the Transformation Program was underway. Till date, the company had invested $95 million of cash on the Program and expects savings of $35 million in FY20.

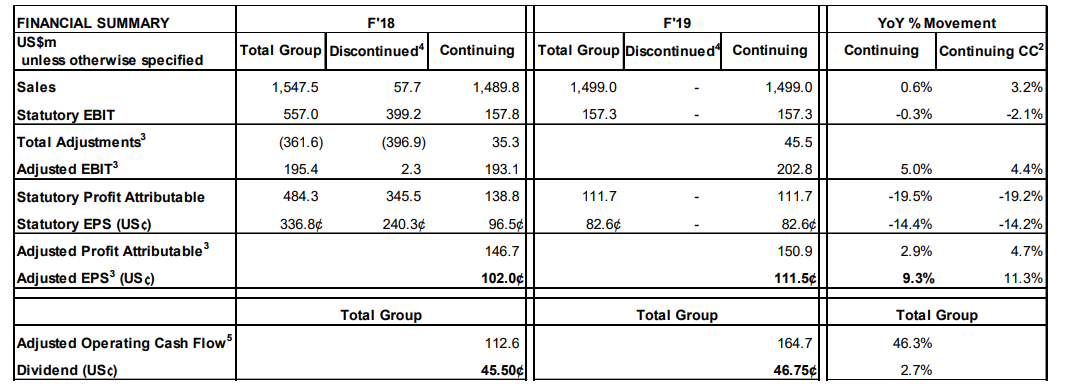

On the financial end and on an adjusted results Continuing Operations basis, the sales were up by 1%, EBIT for Continuing Operations was up by 5% and the EPS was up by 9% with the Profit Attributable up by 3%. Beyond this, the company had adopted a four- strategy base to enhance its operations and functionalities- innovation, emerging market development, leveraging the current industry-leading and trusted brands and concentrating in expansion of partnerships and distributors.

Neck-to-neck in a tech-savvy world, ANN made significant progress in digital marketing and leveraged artificial intelligence, robotics and automation in the year, as 20% of the companyâs total sales were sourced via digital channels. ANN also launched a new global website in the year.

ANNâs FY19 Results Highlights (Source: ANNâs Report)

Stock Performance and Returns: On 16 August 2019, the ANNâs stock was at A$26.37, trading down by 2.765%. The market capitalisation of the company is A$3.59 billion and has ~132.35 million outstanding shares. With an annual dividend yield of 2.48 percent, the stock has generated returns of 7.86% and 12.72% in the last three and six months, respectively. The YTD return of the stock is 26.85%.

Domino's Pizza Enterprises Limited

Company Profile: The Australian-owned master franchise holder for Dominoâs in ANZ, France, Belgium, Japan, Germany, the Netherlands, Denmark and Luxembourg, Domino's Pizza Enterprises Limited (ASX: DMP) is a world leader in the food-techno space and thrives to connect people with faster food of fresh quality. The company provides both offline and online services. It was listed on the ASX in 2005 under the consumer discretionary group and has its headquarters in Queensland.

New Substantial Holder: On 2 August 2019, Mitsubishi UFJ Financial Group, Inc. became the companyâs substantial holder with 6,448,221 ordinary securities representing a voting power of 7.53%.

Legal Action Update: On 25 June 2019, the company intimated that it had been made aware of a virtual press article relating to a matter of pay and conditions of drivers and in-store workers who were employed by DMPâs franchisees, and if the pay and conditions should adhere to the industrial agreements (which have always been applied to the companyâs franchisees) and not the Fast Food Industry Award 2010. DMP stated that it would review, action and defend any formal proceeding, which was later served with an unsealed class action proceeding filed by Phi Finney McDonald in the Federal Court of Australia.

On 28 June 2019, DMP notified that it had not been formally served with the class action court documents. It also confirmed that the company had not misled its franchisee employers as to their employee payment obligations, and rejected the allegations made in the documents, while it awaits a formal Court service and awaits to defend its case.

Stock Performance and Returns: On 16 August 2019, the DMPâs stock was at A$39.84, trading down by 0.3%. The market capitalisation of the company is A$3.42 billion with ~85.63 million outstanding shares. With an annual dividend yield of 2.81 percent, as on 13 August 2019, the stock has generated negative returns of 1.91% and 16.49% in the last three and six months, respectively. The YTD return of the stock was negative 2.80%.

Aristocrat Leisure Limited

Company Profile: A global gaming powerhouse with its roots engraved in creativity and technology, Aristocrat Leisure Limited (ASX:ALL) is a designer, developer, manufacturer and marketer of electronic gaming machines, casino management systems, and digital social games. The company is licensed in around 300 gaming jurisdictions and is operation in over 90 countries. ALL was listed on the ASX in 1996 and has its registered office in New South Wales.

Legal Proceedings: On 4 July 2019, the company notified the media that it would commence legal proceedings against Ainsworth Game Technology Limited (ASX: AGI) regarding infringement by the latter of the companyâs IP rights and breach of the Australian Consumer law.

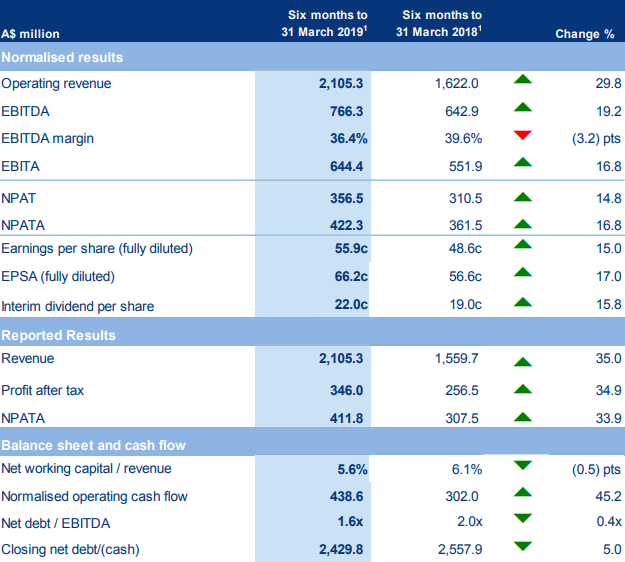

Investor Presentation and 1H19 Results: On 23 May 2019, the company announced that it had generated a Normalised NPATA of $422.3 million, up by 17% on pcp in Six months to 31 March 2019. This was primarily driven by strong growth across North America and Digital along with the ANZ performance. The Normalised revenue was up by 30% on pcp to $2.1 billion. The company declared fully franked Interim dividend per share of 22 cps, which was up by 16% on pcp. ALL was successful in the clearance of $100 million debt and maintained stable credit ratings.

Group Results Summary (Source: ALLâs Report)

On the outlook front, the company notified that it was in line, with its plans for continued growth in FY19. The User Acquisition spend is expected to range around 25% to 28% of the total Digital revenues. Moreover, ALL is expecting a further 100 - 150bps reduction in the itâs effective tax rate over FY18.

Stock Performance and Returns: On 16 August 2019, the ALLâs stock was trading at A$28.045, trading up by 0.125%. The market capitalisation of the company is A$17.89 billion and with ~638.54 million outstanding shares. With an annual dividend yield of 1.75 percent, the stock has generated returns of 9.41% and 13.13% in the last three and six months, respectively. The YTD return of the stock is 33%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.