Australian Healthcare System is one of the most comprehensive ones across the world. The health care industry is projected to witness significant growth in the next few years foreseeing several growth opportunities, while the spending in this sector is expected to increase at a CAGR of 5% in 2019-2023. Growing aging population, increasing prevalence of chronic diseases, latest technological developments are some of the driving factors that can have a direct influence on the growth of health care sector.

In this article we will be discussing the latest developments of three ASX-listed health care players- ANR, API, AHZ-

Anatara Lifesciences Ltd (ASX:ANR)

Health care company, Anatara Lifescience is engaged into the development & commercialisation of innovative, evidence-based non-antibiotic oral solutions for gastrointestinal (GI) health in animals and humans to address significant unmet need, with its prime focus on building a portfolio of human gastrointestinal health products. The company is committed to deliver real outcomes for patients and to create strong value for its stakeholders.

Anatara’s Human health product candidate -GaRP (Gastrointestinal Reprogramming)

GaRP is being developed to exclusively target 2 GI disorders in human namely IBD (Inflammatory Bowel Disease) and IBS (Irritable Bowel Syndrome) to restore and maintain gut health with outstanding in-vitro pre-clinical and in-vivo animal studies data.

Anatara provides summary of its pre-clinical studies for its GaRP dietary supplement

Anatara has provided a synopsis of the preclinical investigations for its GaRP dietary supplement conducted to date, as the company is targeting to initiate the human clinical trial in the second quarter of the fiscal year 2020, as announced on 22 January 2020.

Anatara’s decision to initiate the human clinical trials is strongly underpinned by the highly encouraging and successful in-vitro and in-vivo preclinical data reported to date for its GaRP dietary supplement.

The company is of the belief that its GaRP dietary supplement could be the breakthrough invention urgently required by patients suffering from chronic bowel disorders.

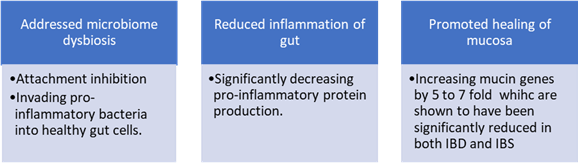

GaRP has been shown to fight the three underlying causes of chronic bowel conditions, backed by string preclinical scientific evidence-

GaRP’s Potential

- To provide an adjuvant impact in decreasing inflammation with the co-administration of disease-modifying medicines.

- Reducing the dosage of disease-modifying medicines that are known to have devastating side-effects.

It is important to note that GaRP has no impact on the uptake or efficacy of probiotics.

Stock Information

With a market capitalisation standing at around $17.2 million and nearly 49.86 million outstanding shares, ANR settled at $0.345 on 24 January 2020. ANR’s stock generated a positive return of 64.29% on a 3-months basis.

Australian Pharmaceutical Industries Limited (ASX:API)

Australian Pharmaceutical Industries is a leading pharmaceutical distributor that offers services including retail, marketing programs, wholesale product delivery, and business advisory. API is the parent company of Soul Pattinson Chemist, Priceline Pharmacy and Pharmacist Advice.

Highlights from 2019 AGM

API held its 2019 annual general meeting, wherein the company provided a brief overview regarding its 2019 financial results, outlining the complementary businesses portfolio as well as highlighting the key strategic initiatives that bolster the results.

Snapshot of financial results for FY2019 ended 31 August 2019

- Total Revenue - API Group’s total revenue while excluding the impact of PBS reforms & Hepatitis C Medicine, was reported at $4.0 billion, signifying a 4.1 % increase on the prior corresponding period (pcp).

- Underlying EBIT - Earnings before interest and tax (EBIT) amounted to $94 million, up 14.1% on the pcp and the underlying EBIT of $94 million went up 3.9 % on the pcp.

- Underlying NPAT - Net profit after tax (NPAT) amounted to $56.6 million, up 17.4 % on the pcp and the underlying NPAT amounted to $56.6 million, increasing 3.2 % on the pcp.

- Underlying ROCE – Underlying Return on Capital Employed was reported 16.29%.

- Total Dividend - Declared a fully franked final dividend of 4.0 cents/share, leading to a full year dividend of 7.75 cents/share.

- Pharmacy Distribution revenue- The pharmacy distribution revenue again excluding the impacts of PBS reform and Hep C amounted to $2.9 billion, representing an increase of 4.2 % on last year.

- Net Debt- API ended FY2019 with reported net debt valued $199.1 million in comparison to $55.9 million at the end of FY 2018.

API’s Complementary Businesses Portfolio

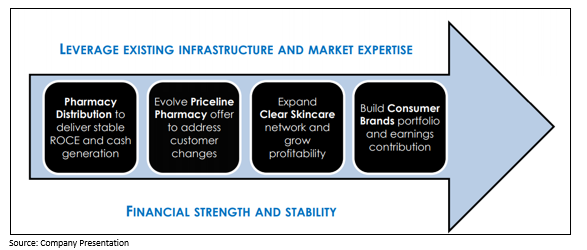

The Group is well-placed for the future with a suite of 4 complementary businesses that it expects will generate strong and stable cashflows and provide long term growth.

It is important to note that the four business units leverage the existing shared assets and proficiencies to deliver growth.

API’s Strategic Initiatives

The group believes in continuously innovating the products and services ensuring to continue to meet its customers’ requirements. One good example is the successful launch of Click and Collect in its Priceline Pharmacy network that complements API’s online delivery, offering clients with a complete range of alternatives in how to interact with the firm.

Stock Information

With a market capitalisation standing at around $652.77 million and nearly 492.66 million outstanding shares, API settled at $1.305, down 1.51% on 24 January 2020.

Admedus Ltd (ASX: AHZ)

Admedus Ltd is a structural heart company belonging to the health care sector that provides innovative and clinically superior solutions including development, investment & delivery of leading edge medical technologies, thereby helping healthcare professionals create life-changing outcomes for patients, with its prime focus on developing next generation technologies with world class partners.

Admedus Announces Approval of First-in-Human Surgical Aortic Valve Replacement (SAVR) trial

Admedus updated the market on 22 January 2020, that it has received green signal for first-in-human SAVR trial of its patented ADAPT® single-piece three dimensional (3D) aortic valve to be conducted at the University Hospitals, Leuven, Belgium, under the guidance of renowned heart surgeon Professor Bart Meuris MD, PhD.

The clinical trial protocol has been approved by the UZ Leuven Medical Ethics Committee. Below are the further details:

- A total of 15 subjects will be registered for the study to be followed up for six months post receiving the implantation of the ADAPT® single-piece 3D aortic valve.

- Study outcomes are anticipated between the first and the third quarter of 2021.

With over 250,000 procedures reportedly completed in Europe and North America in the year 2018, the SAVR market is forecasted to reach $US3 billion by 2023.

ADAPT® single-piece 3D aortic valve replacement Study in an ovine model

The proposal of human clinical trial was made after Professor Meuris’ showed confidence in Admedus’ prototype aortic valve following his recent examination of the ADAPT® single-piece 3D aortic valve replacement study that was conducted in an ovine model (sheep). Backed by positive and encouraging results in sheep, it is expected that the model will generate similar positive outcomes in humans as well.

Admedus’ patented ADAPT® bio-scaffold material is famous for its durability and zero calcification virtues demonstrated by 10 years of published and peer reviewed data.

Stock Information

With a market capitalisation standing at around $64.99 million and nearly 590.84 million outstanding shares, AHZ settled at $0.110 on 24 January 2020. AHZ’s stock generated an outstanding 12 months return of 175%.