During the trading session on the ASX (as on 19 September 2019, AEST 1:54 PM) the S&P/ASX 200 was at 6,701.9, up by 0.3 per cent or 20.3 basis points. Accordingly, the S&P/ASX 200 Financials (Sector) was trading at 6,463.0, up by 0.4 per cent or 25.8 basis points.

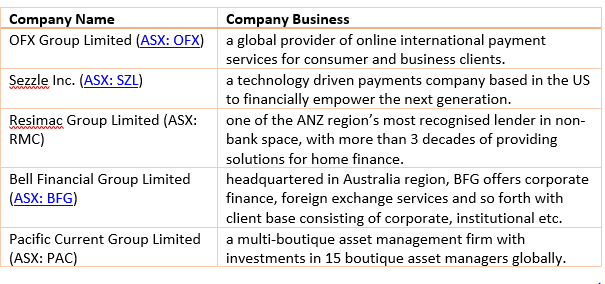

In this article, we would look at 5 financial sector stocks, and acquaint ourselves with their latest updates and stock performances:

OFX Groupâs Partnership with Link Market Services

On 18 September 2019, OFX notified on strategic partnership along with Link or Link Market Services Limited. As per the deal, the company would be Linkâs preferred collaborator in the Australian region for global payments including dividends/distribution and corporate action payments on Link Market Services Limitedâs platform (Investor Centre). The partnership is believed to be capable of making it easier and cheaper for offshore investors to transfer their funds globally.

As far as Link is concerned, the deal would provide an end-to-end digital over the border payments solution, which would have the support of the industry-leading service, assistance from client onboarding to execution and settlement. The Partnership would be for an initial term of 5 years and is likely to be launched in March 2020. Also, it would generate approximately $5 million in annual fee and trading income by FY22 and would be supported by a capital expenditure investment of approximately $2 million in FY20. OFZ would provide further updates on the same in its half year results in November 2019.

SZLâs Updates

On 16 September 2019, SZL intimated that 750,000 Options exercisable at US$0.05, which would expire on 1 October 2028 in SZL were due for release, from the ASX escrow on 1 October 2019. Besides, one of its Directors, Paul Lahiff acquired 81,967 CDIâs (direct and indirect interest) from personal account and disposed 81,967 to super funds at a value/ consideration of $1.22 per CDI. Post the change, he now holds 250,000 unlisted options exercisable at US$0.84 each and expiring on 24 July 2029-escrowed for a period of 2 years from the date of the SZLâs admission to the ASX being 30 July 2021.

Resimacâs Dividend Reinvestment Plan

On 17 September 2019, Resimac Group announced that the allocation price for the shares to be issued under the DRP for the final and special dividends, which is payable on 30 September 2019 is 87.91 cents per share. This allocation price was inclusive of a 2.5 per cent discount, which had been determined by the Directors in line, with the Dividend Reinvestment Plan Rules and were notified to the market as part of the Dividend notification in August this year. The shares pertaining to participants in the Dividend Reinvestment Plan would be issued on 30 September this year.

Bell Financial Groupâs Conference in Sydney

On 18 September 2019, Executive Chairman of BFG Alastair Provan, presented at the Bell Potter Emerging Leaders Conference in Sydney, and stated that the company was maintaining a deliberately flat management structure that is experienced, stable and has a substantial shareholding in the business.

Under the Bell Potter Securities realm, 325 Financial Advisers were servicing 500,000 clients and recorded $46.5 million in gross brokerage in 1H 2019 (retail and wholesale brokerage revenue). The PAS and Super solution gross revenue stood at $8.9 million in 1H 2019; whereas, on the ECM revenue front, there was $1.25 billion in new equity capital raised and $35.6 million in fee income earned across 75 transactions in 1H 2019 period.

The companyâs Third-Party Platform, which operates out of three locations in Sydney, Perth and KL, reported $8.6 million gross revenue, and $1.4 million profit before tax for 1H 2019. The Bell Potter Capital had $313 million cash book and $270 million loan book (at 30 June 2019). The flat performance was a consequence of the lower interest rate environment and repayment of outstanding loan balances.

The company has been thriving to be tech-savvy in the dynamic business climate and has a full-time technology team of 74 across the Group to support, maintain infrastructure and continuously develop and improve the proprietary applications and platforms, like IQ, FUSION and TPP.

The companyâs projected revenue for the 9 months to 30 September is $177 million and the projected profit before tax is $29 million.

BFGâs financial summary is outlined in the below image:

(Source: BFGâs Report)

Pacific Current Groupâs Updates

On 17 September 2019, the company intimated that it had received an originating application, seeking leave of the court to start a derivative action on behalf of PAC against a few current, and former directors of PAC seeking damages arising out of the 2014 merger that took place between PAC and Northern Lights Capital Group LLC.

The company had not received a copy of a draft statement of claim and would update the market once that is received. However, in the proposed proceedings, the company would be the plaintiff, as notified.

More recently, on 18 September 2019, PAC notified that FIL Limited and related entities became a substantial holder on 13 September 2019 with a voting power of 5.05 per cent.

Let us now browse through the stock performance and YTD returns of the discussed companies on the ASX, during the trading session on 19 September 2019 (AEST 2:33 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.