In the recent events, Silver outperformed Gold in the international market and the prices breached the psychological level of USD 17.0. While the gold prices are encashing the leverage of global uncertainties, silver prices are riding high as a investment vehicle as well as a key component in the industrial applications such as renewable energy.

Letâs take a look at how the following Silver mining companies on the ASX have been fairing lately.

Silver Mines Limited

Silver Mines Limited (ASX:SVL), based in New South Wales (NSW), is engaged in the acquisition, exploration and development of quality silver deposits in Australia. The companyâs market capitalisation stands at around AUD 101.66 million with ~ 753 million shares outstanding. On 9 August 2019, the shares of Silver Mines closed the market trading at AUD 0.130, down 3.704% by AUD 0.005, with around 9.33 million shares traded.

In addition, SVL has generated high and positive returns of 200% in the last three months and 141.07% in the last six months.

June 2019 Quarter Highlights â In the recent quarterly report for the three months to 30 June 2019, Silver Mines reported Positive preliminary results from different Environmental Impact Statement (EIS) reports into the proposed development of the Bowdens Silver Project (100%-owned) situated in the Central Tablelands Region, NSW. The EIS, now in its final stage, is targeted to forwarded to the NSW Department of Planning and Environment somewhere during the latter half of 2019.

The key components of the EIS confirm favourable outcomes including minimal effects on surface water and groundwater; a new water pipeline to be built providing water for processing sourced from nearby coalfields, substantial local economic benefits for a high unemployment jurisdiction and the air quality and health parameters demonstrate no exceedances and are negligible during the life of the mine.

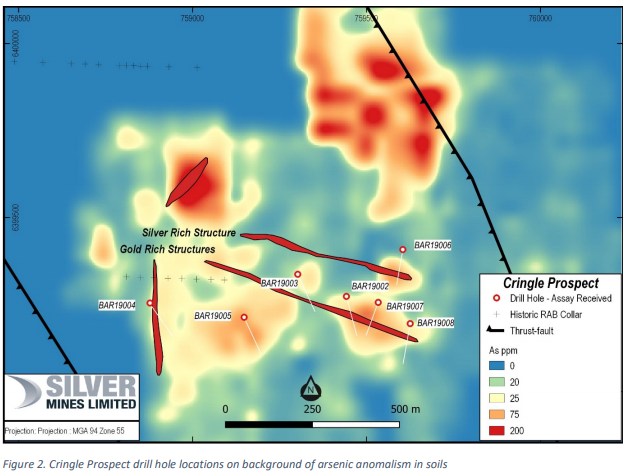

During the quarter, Silver Mines also received laboratory assay results from round one of round of drilling (9 holes totalling 1,861 m) at the Cringle and Kia Ora West prospects, where gold and base-metal mineralisation and high temperature alteration minerals were intersected, suggesting proximity to intrusive source.

Source: June 2019 Activities Report

Subsequent to the quarter-end, the company raised $ 2.75 million via placement to institutional, professional and sophisticated investors.

Golden Rim Resources Ltd

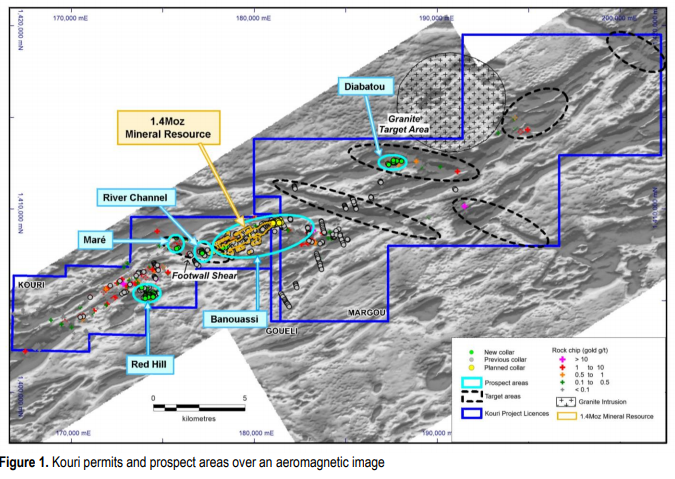

Golden Rim Resources Ltd (ASX:GMR) is a West Africa-based emerging gold developer engaged in the exploration and development of gold projects. The Companyâs project portfolio comprises â The Kouri Gold Project, in Burkina Faso with a JORC Indicated and Inferred Mineral Resource of 32 million tonnes at 1.4g/t gold for 1.4 Moz; and The Paguanta Zinc-Silver-Lead Project, in Chile, is under consideration to be divested and has had USD 35 million of past expenditure.

Source: Quarterly Activities Report

The companyâs market capitalisation stands at around AUD 13.92 million with ~ 773.22 million shares outstanding. On 9 August 2019, the GMR stock last traded at a market price of AUD 0.019, up 5.55% by AUD 0.001. The stock has delivered a positive return of 63.64% in the last three months.

Recently on 5 August 2019, the company informed the stakeholders that exceptional high-grade gold had been intersected during the ongoing reverse circulation (RC) drilling program at the Kouri Gold Project. The new results are near surface and inlcude - 7m at 121.2g/t gold from 41m in hole MRC008 and 3m at 7.2g/t gold from 56m in hole MRC008 at Diabatou; and 4m at 9.2g/t gold from 44m in hole BARC347 and 15m at 3.8g/t gold from 53m in hole BARC347 at Maré.

Quarterly Update â During the three months to 30 June 2019, the company completed a transaction to acquire Goueli and Margou permits that are located adjacent to the eastern boundary of the Kouri permit. Besides, a 3.1 km of trenching were completed at Red Hill with assay results confirming the presence of multiple zones of gold mineralisation. Also, the company commenced a major drilling program at Kouri (17,000m RC drilling and 4,000m diamond drilling planned).

Core Lithium Ltd

Core Lithium Ltd (ASX: CXO), based in Adelaide, Australia, operates as a mineral exploration company focussed on lithium production through the development of its flagship assets being the Finniss Lithium Project located in the Northern Territory, Australia.

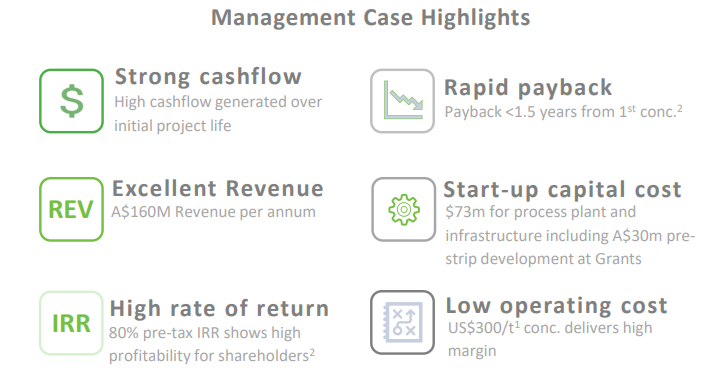

Source; Companyâs Diggers and Dealers Presentation

With a market capitalisation of around AUD 32.32 million with approximately 788.28 million shares outstanding, the CXO stock price settled the dayâs trading on 8 August 2019, at AUD 0.042, edging up 2.44% with ~ 1.06 million shares traded.

The company recently presented at the Diggers and Dealers Conference held in Kalgoorlie, Australia elaborating on the rising need for spodumene, a pyroxene mineral consisting of lithium aluminium inosilicate and that its medium- and long-term demand fundamentals are expected to outweigh any short-term oversupply. Also, Core Lithiumâs production would be characterised by low cost, low risk, high quality product - supply approach as the new producers in Australia experience high operating costs and difficulty sustaining customer quality.

Moreover, the project Definitive Feasibility Study also confirmed a robust, high-margin low-capex, lithium project.

DFS Highlights; Source: Diggers and Dealers presentation

June Quarterly Activities Update- On 26 July 2019, the company disclosed its highlights for the quarter ended 30 June 2019, where the focus remained on a number of initiatives aimed at further enhancing the value and potential of the Finniss Lithium Project. The key highlights inlcude â

- Completion and deliver of the DFS.

- Mineral Resource for the Finniss Project increased to 9.6Mt.

- A lithium royalty agreement worth $ 8.125 million signed with Lithium Royalty Corporation.

- Completion of the $ 3.3-million Share Purchase Plan (Oversubscribed).

- Receipt of the positive Assessment Report on Finniss from the NTEPA, subsequently forwarded to the NT Government.

Walkabout Resources Ltd

West Perth-based Walkabout Resources Limited (ASX:WKT) is engaged in active exploration of coal and graphite in Africa. The Company is principally focussed on exploration at Botswana and Tanzania with Namibia emerging as a target. With a market capitalisation of around AUD 85.55 million with ~ 316.85 million shares outstanding, the WKT stock price settled the dayâs trading on 9 August 2019, at AUD 0.270, with ~ 77,195 shares traded. In addition, WKT has generated positive return yields of 193.48 % YTD and 145.45% in the last six months.

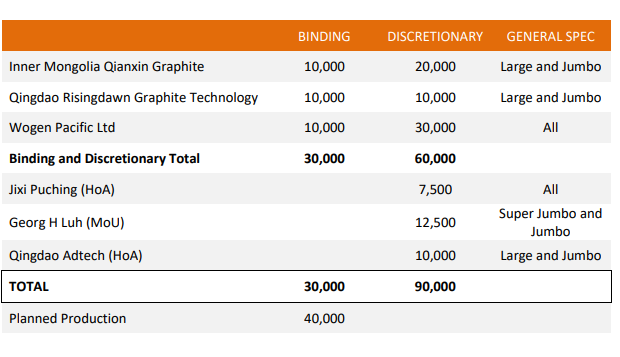

June 2019 Quarterly Update - On 30 July 2019, Walkabout Resources disclosed its activities report for the three months to 30 June 2019, informing that the company is advancing activities at its 100% -owned high-grade Lindi Jumbo Graphite Project in South East Tanzania and embarked on an international debt fund raising exercise to secure the USD 30 million required to construct the Project.

The company executed a number of key Binding Offtake and Marketing Agreements for the project tabulated as below-

Summary of Lindi Jumbo Marketing and Sales Agreements; Source; Quarterly Activities Report

Also, during the quarter, Walkabout Resources progressed the applications for Special Planning permissions with local councils and permissions from local landowners in the UK to enable drilling on selected SkyTEM targets within the Tyrone JV licence area. In addition, a regional soil sampling program over the previously unexplored and highly prospective Dalradian basement within the Antrim gold JV licence areas was completed. The assay results, when received, would indicate the next steps.

For the Namibian Eureka Lithium Project, quotes for drilling were received while funding activities are underway. Currently, the program has been deferred until the stakeholders can be updated on the progress and outcomes of the funding programme.

Kingsrose Mining Ltd

West Perth-based Kingsrose Mining Limited (ASX: KRM) is a metals and mining sector player that explores for and produces gold with its flagship asset being Way Linggo Project (85%-owned), located in Sumatra, Indonesia, and encompassing two mines - Talang Santo and Way Linggo, along with a 140 Ktpa Merrill Crowe gold circuit. The project is owned and operated by PT Natarang Mining, Kingsrose Mining 85%-owned Indonesian subsidiary, through a 4th generation Contract of Work (CoW) agreement with the Government of Indonesia over ~ 100 km2 of the Project.

With a market capitalisation of around AUD 37.23 million and approximately 730.01 million shares outstanding, the KRM stock price settled the dayâs trading at AUD 0.050 on 9 August 2019, dipping 1.965 by AUD 0.001 with ~ 1.74 million shares traded.

In addition, KRM has delivered a positive return of 30.77% in the last three months.

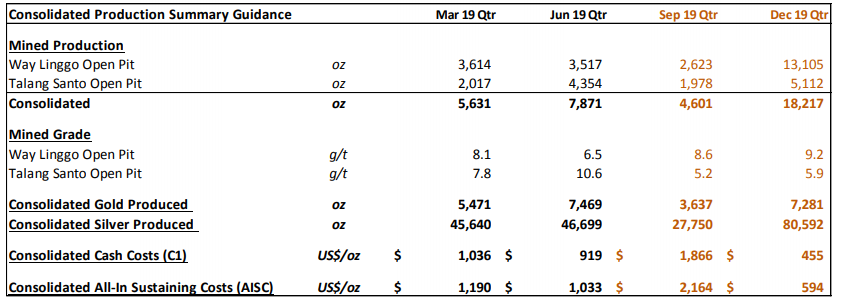

Recently on 8 August 2019, the company released its production guidance for the Way Linggo Gold Project for the six months to 31 December 2019. Kingsrose expects to produce 9,500 oz â 11,000 oz in the concerned period at an all-in sustaining cost of USD 1,000-USD 1,200 per oz. Kingsrose Mining is targeting completion of Phase 1 of the drilling program in the next six months, to finalise the resource for studies to support future underground mining at both the mines. The company mentioned that the Way Linggo wall failure towards the end of June has impacted the production outlook for the September quarter (see figure below).

Source: KRM Guidance Note August 2019

Presently, the mining at Way Linggo open pit is targeted to continue until December 2019 (gold production from the stockpiled ore until June 2020) while the mining at Talang Santo pit would continue till December 2019 (gold production until June 2020).

Besides, the processing plant is expected to continue operations at its full capacity, having commenced on 4 August 2019 through to Q4 2020, as per the current mine plans.

Kingrose Mineralsâ latest Quarterly activities update can be READ here.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.