The global oil market is under peril with lots of supply coming into the picture while demand remains muted in the wake of COVID-19 outbreak. However, there are certain forecasts such as from the International Energy Agency (or IEA), that anticipate oil demand to improve over the coming months and quarters.

So, does that mean that a bottom for oil is set?

Well as we have mentioned time-to-time, these are some unprecedented times, and many forecasts hitting the market, be it forecasts suggesting the possibility of a recession, forecasts optimistic on Asian economies, forecasts related to oil, are all taking a lot of qualitative assumptions into the picture, which might or might not turn out to be true over the long-run.

So, rather than asking if it is a bottom for oil or what could happen ahead, the right question would be to ask if one is willing to take the risk-to-reward profile the market has to offer in the status quo.

To Deep Analyse, Do Read: Oil Crisis: Should you Buy or Sell Some Oil Stocks?

In the status quo, the Australian LNG sector, which is immune to the shale boom of the United States across the continent is relatively performing better than their global counterpart in the present scenario of a global oil supply glut and halted demand.

To Know More, Do Read: Western Australia Gas Demand to Surpass Existing Production Capacity- Says AEMO Report

The recent quarterly report from LNG operators such as Santos Limited (ASX:STO) is to an extent validating that picture. Santos recently released its March 2020 quarter update and mentioned that the Company sold 851,000 tonnes of LNG during the period, which remained ~ 15.62 per cent higher against the previous quarter; however, the sales of other oil-related products took a hit.

Santos Limited (ASX:STO)

- STO Unveils March 2020 Quarter Activities Report

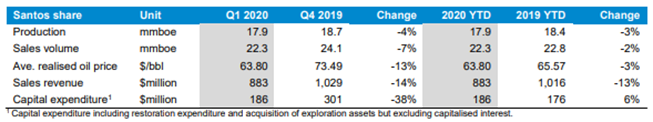

While the LNG sales surged by ~ 15.62 per cent, the overall sales took a hit of 7 per cent to stand at 22.3 million barrels of oil equivalent but remained largely in line with the previous corresponding period sales of 22.8 million barrels of oil equivalent.

The Company generated a revenue of $397 million from its LNG product, up by ~ 13.10 per cent against the previous quarter; however, realised a lower average price on its overall sales, leading to a plunge of ~ 14.18 per cent in the total sales revenue against the previous quarter, which stood at $883 million.

STO realised an average price of $63.80 per barrel during the period, down by 13 per cent against the previous quarter and down by 3 per cent against pcp.

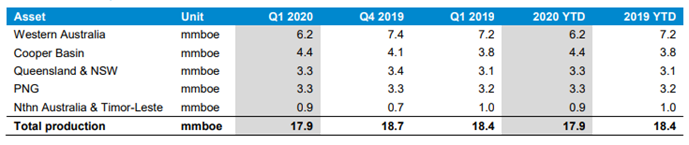

Over the production counter, Santos produced 17.9 million barrels of oil equivalent during the period, down by 4 per cent against the previous quarter and 3 per cent against pcp.

However, the Company trimmed a large capital expenditure which stood at $186 million for the period, down by 38 per cent against the previous quarter, as targeted.

To Know More, Do Read: ASX Oil & Gas Explorers Gain Momentum on ASX; -SXY, FAR, STO, and CVN

The Company’s performance for the period:

Source: Company’s Report

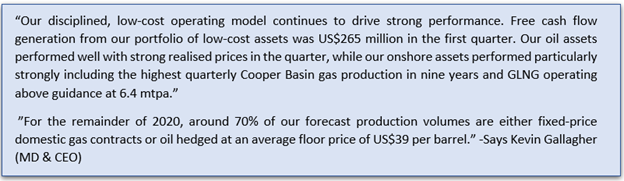

Santos managed to end the period with a strong operational performance with USD 256 million of free cash flow and liquidity of more than USD 3 billion, including USD 1.15 billion in cash after payment of the 2019 final dividend in March 2020 and USD 1.9 billion in committed undrawn debt facilities. STO targets the 2020 free cash flow with a breakeven oil price of USD 25 a barrel.

The Company also suggested that the production at the Cooper Basin was the highest in nine years due to strong flow rates from new well, and the prospect produced 17.6 million barrels of oil equivalent during the period.

Santos seems to be enjoying a balanced and diversified portfolio with 70 per cent of its volume at a fixed-price, consisting of fixed-price domestic gas sales contracts and 14 million barrels of oil hedge at an average floor of USD 39 per barrel with upside participation.

The Company also suggested that the decline in production was mainly due to unplanned domestic gas customer outage in Western Australia and the impact of Cyclone Claud, which was partially offset by the record production from the Cooper Basin gas production.

Source: Company’s Report

Over the COVID-19 condition, STO suggested that it has deferred growth projects until business conditions improve and the debt covenants have sufficient headroom and are not under threat at current oil prices for a number of years.

- 2020 Guidance

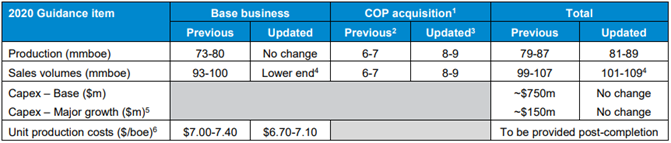

STO maintained the production guidance from its base business at 73-80 million barrels of oil equivalent for 2020, excluding ConocoPhillips acquisition; however, suggested that as per the current business conditions and the projected impact of COVID-19, sales volumes from the base business would remain at the lower end of the guidance range.

The Company previously announced a $550 million reduction in 2020 capital expenditure or a reduction of 38 per cent, which results in a base business capex guidance of ~ $750 million along with a major growth capex guidance of ~ $150 million.

STO also plans for a $50 million reduction in its cash production costs for 2020, leading to a unit production cost guidance of $6.70-7.10 per barrel of oil equivalent.

The snippet of future guidance is as below:

Source: Company’s Report

The stock of the Company last traded at $4.280, up by 7.268 per cent (as on 23 April 2020, 03:31 PM AEST) against its previous close on ASX.