While looking for investment assets, every investor looks for growth as well as return. Growth generally means creating value in terms of money and earning the trust of investors. In this article, we will be discussing about some growth stocks, which have established their business very efficiently in the past years and have posted lucrative results.

Let us have a look at five such stocks with their recent updates below:

BINGO Industries Limited

BINGO Industries Limited (ASX: BIN) provides solutions related to waste management for commercial and domestic businesses. It also operates state of the art recycling centres as well as is involved in the manufacturing of bins.

The company has recently appointed a new board Director, Elizabeth Crouch AM, who has previously served many ASX-listed and private companies, non-government organisations, not-for-profit organisations and state-owned corporations.

Divestment of Banksmeadow Facility

As per the release dated 25th September 2019, the company updated the market about its Banksmeadow facility:

- The company stated that it has executed sale agreement for selling its Banksmeadow facility for consideration of $50 million to CPE Capital, previously known as CHAMP Private Equity.

- CPE Capital (CHAMP Private Equity) has been approved as a buyer of Banksmeadow facility by the Australian Competition and Consumer Commission.

- The company anticipates completing the sale before 9 October 2019.

Financial Performance

The company has recently published a release, wherein it communicated about its operational and financial performance for the 12 months ended 30th June 2019:

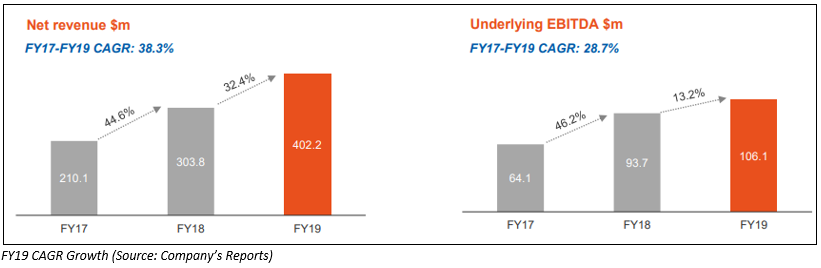

- The company reported underlying EBITDA amounting to $106.1 million, reflecting a rise of 13.2% on a YoY basis.

- The company also recorded a net revenue of $402.2 million, substantially higher than the revenue of $303.8 million in FY18.

- It added that the underlying EBITDA was in accordance with the guidance, which was comprised of $13.6 million from Dial a Dump Industries and $92.5 million from the BINGO business.

- The company is well placed for further growth in the financial year 2020 with an annual contribution from Patons Lane, DADI (Dial a Dump Industries) as well as West Melbourne.

When it comes to the performance of the stock, BIN traded at a price of $2.180 with a rise of 5.31% on 4th October 2019. It has delivered a return of 28.17% in the time frame of six months. On Year to date basis, the stock produced a return of 13.42%.

Austal Limited

Austal Limited (ASX:ASB) is in the business of designing, manufacturing as well as supporting high performance vessels for commercial and defence customers globally. The company recently announced that it will be conducting its Annual General Meeting (AGM) of shareholders on 1st November 2019. As per the release dated 2nd October 2019, ASB update the market with the issue price of $4.19 per share for the shares which are to be allocated under its Dividend Reinvestment Plan.

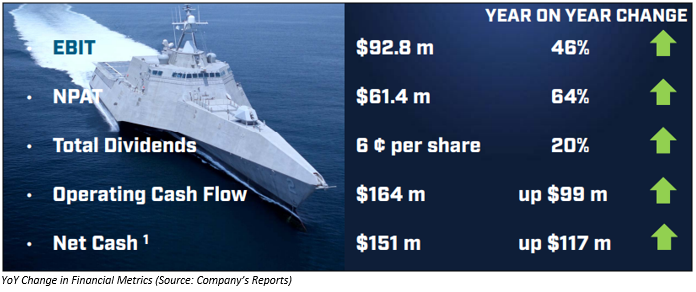

A Look Back at Financial Year 2019

- The company possesses order book amounting to $4.9 billion by which company is securing work to 2024. The company mentioned that the work includes 54 vessels, which are currently under the phase of construction or scheduled throughout 7 shipyards in Australia, the USA, Philippines, China and Vietnam.

- For the financial year 2019, the company reported revenue amounting to $1.85 billion, reflecting a rise of 33% and recorded EBITDA of $92.8 million with a rise of 46%.

- When it comes to profit, ASB delivered net profit after tax of $61.4 million, with a robust increase of 64%.

- The company declared unfranked final dividend amounting to 3 cps, which took its full year dividend to 6 cps.

When it comes to the performance of the stock, Austal Limitedâs stock traded at a price of $4.130 with a rise of 0.98% on 4th October 2019. It has improved by 86.58% in the time frame of six months. On Year to date basis, the stock has produced a substantial return of 125.65%.

Monadelphous Group Limited

Monadelphous Group Limited (ASX:MND) provides diversified services and operates in the infrastructure, energy and resources industry sector.

A Look back at Financial Year 2019

The company on 20th August 2019 updated the market with its results for the financial year ended 30th June 2019. Take a look at the key highlights of the report below:

- The company reported revenue amounting to $1.608 billion for the period, which was in accordance with guidance provided to the market, and delivered an underlying net profit after tax (NPAT) of $57.4 million.

- It added that this result represents significant growth in its Maintenance and Industrial Services division. The company also experienced growth in its renewable energy and water businesses.

- It achieved a record annual revenue of $998.4 million in its maintenance and industrial services division, up by 19% as compared to the prior year. This was a result of growth in activity of offshore oil and gas markets, as well as strengthened demand for its services more broadly.

Update on New Contract

- As per the release dated 20th August 2019, the company updated the market that it has been awarded a major construction contract at new Kemerton lithium hydroxide plant of Albemarle Lithium Pty Ltd.

- Under the terms of contract, the company would be delivering the pyromet structural, mechanical and piping package of work, as well as associated piping fabrication for lithium hydroxide plant.

When it comes to the performance of the stock, Monadelphous Group Limitedâs stocks traded at a price of $14.840 per share with a rise of 0.54% on 4th October 2019. It has fallen by 20% in the time frame of six months. On Year to date basis, the stock has produced a return of 8.13%.

McMillan Shakespeare Limited

McMillan Shakespeare Limited (ASX: MMS) is engaged in the provisioning of asset management, salary packaging, novated leasing and related financial services and products. Through a release dated 1st October 2019, the company updated the market with regard to the basis of computation of the Tax Market Value for the Off-Market Buy-Back. The Off-Market Buy Back Booklet highlighted that the company would not keep the Buy-Back Price at a level higher than the Tax Market Value. It further stated that the Tax Market Value is the price used by the Australian Taxation Office to determine the estimated market value of the companyâs shares when the Buy-Back takes place.

Issue of Securities

- The company has recently announced that it has issued 334,337 performance rights on 23rd September 2019.

- The performance rights have been issued to staff under the Long Term Incentive Plan.

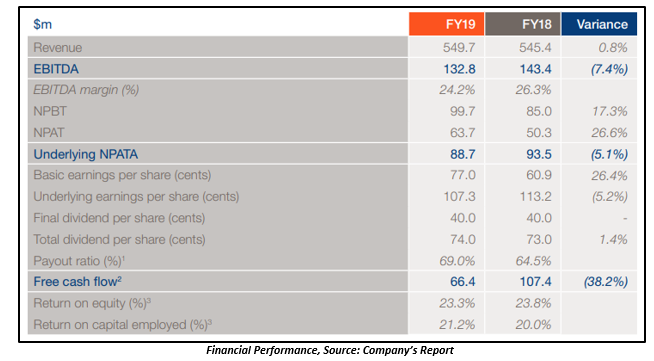

Highlights of Financial Year 2019

- For the full financial year ended 30 June 2019, the company posted an underlying net profit after tax and acquisition amortisation (UNPATA) amounting to $88.7 million.

- The group revenue stood at $549.7 million, reflecting a rise of 0.8% as compared to the previous period.

- In FY19, the company declared fully franked dividend amounting to 74 cents per share, which reflected a rise of 1.4%.

When it comes to the performance of the stock, McMillan Shakespeare Limitedâs stock traded at a price of $15.760 per share with a rise of 0.44% on 4th October 2019. It has improved by 28.61%i n the time frame of six months. On Year to date basis, the stock has produced a return of 14.36%.

Virgin Australia Holdings Limited

Virgin Australia Holdings Limited (ASX:VAH) is into the operation of a domestic and international passenger as well as into the cargo airline business.

Notice and Agenda of 2019 Annual General Meeting

The company has recently announced that it will be conducting its 2019 Annual General Meeting on 6th November 2019 and the following will be the key business items:

- Resolution 1-To receive and consider the Financial Report.

- Resolution 2-Election and re-election of Directors.

- Resolution 3-Adoption of the Remuneration Report.

- Resolution 4-Allocation of equity-based long-term incentive to the CEO.

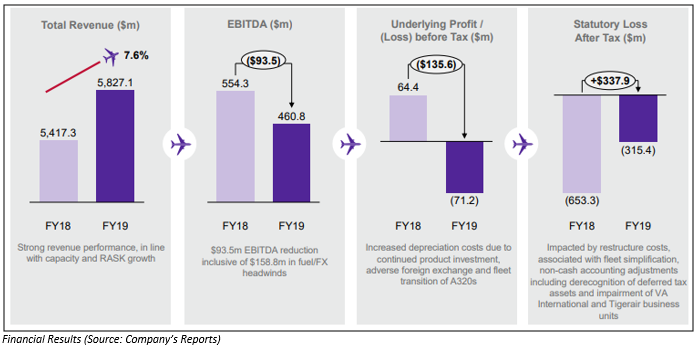

Financial Health of VAH

- During the year ended 30 June 2019, the group reported the underlying loss before tax amounting to $71.2 million, which represents the effect of negative market conditions in 2H FY19, new route investments, as well as $158.8 million in fuel and foreign exchange and fuel headwinds.

- Despite the deterioration in revenue trading conditions in 2H FY19, the group posted a total revenue of $5.8 billion with a rise of 7.6%.

When it comes to the performance of the stock, Virgin Australia Holdings Limitedâs stocks traded at a price of $0.165 per share with a rise of 3.125% on 4th October 2019. It has produced a negative return of 13.51% in the time frame of six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.