Industrial sector is one of the three sectors that make up an economy. Also called as the secondary sector, this sector is that section of the economy that is engaged in manufacturing finished products used by industries (manufacturing and construction). Growth in the industrial sector is reported only when there is enough demand in the market. If there is no demand for finished products, there would be no production and the concerned company will have to shut down the business.

Australiaâs industrial production grew by 1.90 per cent in the second quarter of 2019 compared to the corresponding quarter in the previous year, according to the Australian Bureau of Statistics (ABS). On average basis, industrial output in Australia stands at 2.33 per cent (from 1975 until 2019). This represents an all-time high of 12.60 per cent in Q4 of 1987 and a record low of 7.60 per cent in Q1 of 1983.

Let us have a look at two players from the industrial sector that are listed on the Australian Stock Exchange - BINGO Industries Limited and Monadelphous Group Limited.

BINGO Industries Limited

BINGO Industries Limited (ASX: BIN) is an Australia based waste management company that operates in Victoria and New South Wales. The company functions across building & demolition (B&D) and commercial & industrial (C&I) waste streams. Its motive is to make Australia, a waste-free country. The company is listed on the Australian Stock Exchange under the ticker âBINâ.

Agreement to Divest Banksmeadow Facility

On 25 September 2019, BINGO Industries updated the market regarding its decision to sell the Banksmeadow facility to CPE Capital. The purchaser of the facility has secured approval from the Australian Competition and Consumer Commission (ACCC). The company is expecting to complete the transaction before 9 October 2019. The deal is priced at $50 million.

Change in Substantial Holdings/Directorsâ Interest

Recently, the company made several announcements regarding the change in directorsâ interest and substantial holdings in BIN. On 9 September 2019, the company announced a change in interests of substantial shareholder The Capital Group Companies, Inc. from a voting power of 6.2474 per cent to a voting power of 7.2887 per cent (ordinary shares).

Additionally, Barry Buffier, one of the companyâs directors, made a change in its indirect holding in BIN after acquiring 20,000 ordinary shares at a consideration of $46,811.66. The number of securities held after the change is 80,000.

Further, Michael Coleman, another director in the company, acquired 15,000 ordinary shares, resulting in total 202,272 ordinary shares in his kitty (indirect).

FY2019 Financial Highlights

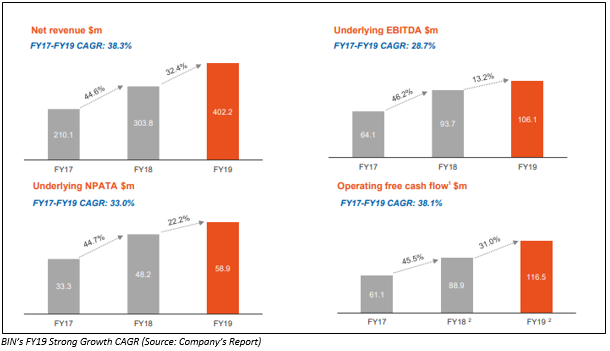

BINGO Industries announced results for the financial year 2019 for the period ended 30 June 2019. Below are few highlights from the release dated 22 August 2019.

- Net revenue increased by 32.4 per cent to $402.2 million compared to the previous corresponding year (PCP).

- Underlying EBITDA of the company grew by 13.2 per cent to $106.1 million from the same period a year ago.

- Underlying NPATA went up by 22.2 per cent year-on-year to $58.9 million.

- Cash conversion rate also increased to 109.8 per cent in Fy2019 from 94.9 per cent in FY2018.

- Net debt increased by 102.0 per cent.

Outlook for FY2020

BINGO Industries is expecting to register robust growth in FY2020 over the pcp, on the back of contributions from Patons Lane Recycling Centre and Landfill, DADI (recently acquired) and West Melbourne Recycling Centre together with associated synergies. The companyâs strategy for FY2020 is focused towards optimising its core businesses to reduce the operating costs of the business and boosting returns on the existing asset base by completing the integration of DADI and consolidating the VIC business for registering maximum ROCE.

The company is due to provide its guidance for FY2020 at the annual general meeting scheduled on 13 November 2019.

Stock Performance

The stock of BIN closed the dayâs trade at $2.200 on 27 September 2019, up by 3.509 per cent from its previous closing price. The company has a market cap of $1.5 billion, while the number of outstanding shares is approx. 656.02 million. The 52-week high and low value of the stock of BINGO Industries Limited is at $03.220 and $1.170, respectively. The stock has generated a positive return of 48.05 per cent in the last 6-month period and a positive return of 24.93 per cent on a year-to-date basis.

Monadelphous Group Limited

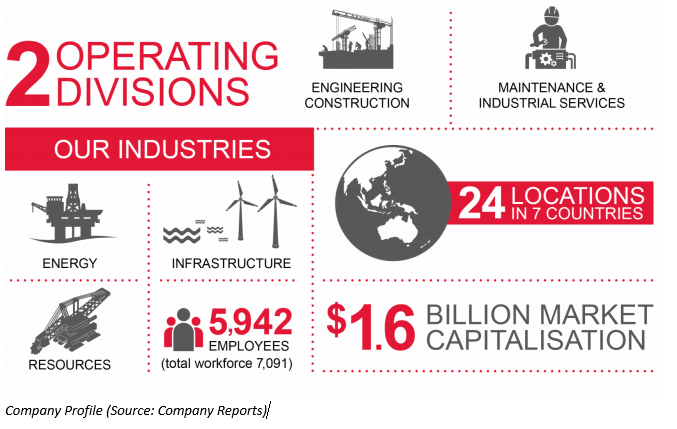

Monadelphous Group Limited (ASX: MND) is an Australia based, leading engineering group that provides services including construction, maintenance and industrial. Its services are catered towards sectors like resources, infra and energy. The company is working on some biggest and most complex projects and facilities in the country.

Dividend

The Board of Directors declared a final dividend of 23 cents per fully paid ordinary share for six monthsâ period ended 30 June 2019, taking the full year fully franked dividend to 48 cents per share. The dividend pay-out ratio for FY2019 stood at approximately 90 per cent of reported net profit after tax.

Consolidated Financial Highlights for the period ended 30 June 2019

- Total revenue of the company decreased by 9.85 per cent to $1,608.3 million compared to the pcp

- EBITDA declined by 10.3 per cent to $106.8 million

- Underlying net profit after tax of the company decreased by 19.6 per cent to $57.4 million

- Reported earnings per share also went down by 29.4 per cent to 53.7 cps

- Cash and cash equivalents of the company stood at $164 million

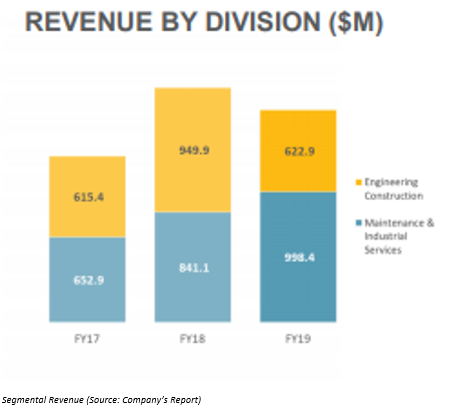

Segmental Revenue

- Engineering construction segment revenue decreased by 34.4 per cent to $622.9 million compared to the same period of the last year.

- Maintenance and industrial services division strengthen by increasing its revenue by 18.7 per cent to $998.4 million

Outlook

MND is expecting more favourable core market conditions in the near future, helping it to provide solid pipeline of opportunities. Maintenance activity of the company is anticipated to remain strong, with LNG prospects likely to be positive in the coming years. Additionally, the company is expecting increased project development activity, particularly in lithium and iron ore.

Revenue for FY2020 would be dependent on the timing of secured work and future awards.

Stock Performance

The stock of MND closed the dayâs trading at $15.750 on 27 September 2019, up by 0.897 per cent from its previous closing price. The company has a market cap of $1.47 billion, while the number of outstanding shares is approx. 94.29 million. The 52-week high and low value of the stock of Monadelphous Group Limited is at $20.070 and $12.510, respectively. The stock has generated a negative return of 9.66 per cent in the last six-month period and a positive return of 14.36 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.