Despite, posting good results, some stocks were trading at the lower range of 52-weeks trading range. Meanwhile, there are few stocks which are quoting at 52-week high despite posting subdued financial numbers. We are providing two examples of negative co-relation of financial numbers with its current market price. However, investors should watch these stocks very closely and look for the upcoming update from these companies.

Aurizon Holdings Limited:

Aurizon holdings limited (ASX:AZJ) is an Australia based logistic company associated with bulk transport of mineral commodities, mining and industrial inputs, agricultural products, general freight etc. The company operates in the area of Queensland and Western Australia. The company has three operating segments â Coal, Bulk and Network.

Aurizon Holdings posted lacklustre FY19 numbers:

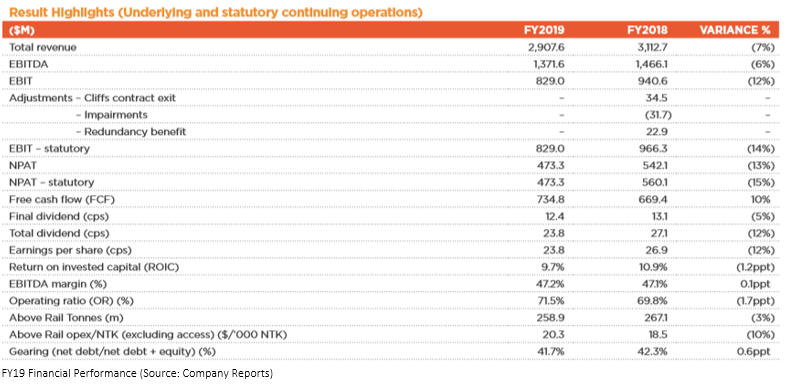

On 12th August, AZJ announced its FY19 financial performance. The operating performance of the company is summed up below:

Financial performance during FY19: AZJ posted revenue at $2,908 million, down by 7% from FY18 and underlying net profit of $473 million, down by 13% y-o-y. Underlying EBITDA plunged by 12% (y-o-y) at $829 million. EBITDA margin during FY19 stood firmly at 47.2% vs 47.1% y-o-y. ROIC stood at 9.7% against 10.9% y-o-y. However, free cash flow came higher by 10% y-o-y at $735 million due to higher realization from the termination payment from Cliffs. CAPEX during FY19 stood at $495m (in line with FY19 guidance).

Operating highlights: âCoalâ revenue came at $1,725 million, down by 5% y-o-y with 1% increase in volumes. FY19 EBIT for the segment came at $415 million, down by 3% from FY18 EBIT of $429 million. The total quantity of coal shipped during FY19 came at 214.3mt vs 212.4mt on FY18. Operating costs and depreciation during the year were up by 9% and 7% y-o-y at $643 million and $195 million, respectively.

Revenue from âBulkâ segment in FY19 was at $502 million, representing a dip of 19% y-o-y. EBIT for the segment came at $37 million, down 26% y-o-y due to higher operating expenses from growth volumes and cost escalation offset in part by ongoing benefits from the turnaround program. In FY19, total quantity shipped was at 44.6mt vs 54.7mt in FY18.

âNetworkâ revenue for FY19 stood at $1,118 million (down 8% y-o-y) followed by 17% y-o-y decline in EBIT at $400 million. âEnergy and fuelâ and Depreciation came at $109 million (up 24% y-o-y) and $321 million (down 4% y-o-y), respectively. Total quantity shipped came at 232.7mt, up marginally at 1% y-o-y.

Outlook: Management has given a CAPEX guidance of $520m - $550m during FY20. The major investing area would be âwagons for CQCNâ. EBIT guidance was in between $880 million â $930 million. For FY20, management is betting on operational efficiency by cost reduction strategies. Coal volume to remain within a range of 220 â 230mt.

The company has announced an annual dividend distribution of A$0.12400000 against each fully paid share held with the record date of 27 August 2019 and payment date of 23 September 2019.

Stock performance: Currently, stock of AZJ is quoting at $5.880, down by 1.5% from previous day closing as on 15th August 2019 at AEST 11:53 AM. The stock has given healthy returns of 20.61% and 31.5% in the last three and six months, respectively. At CMP, the stock is available at a P/E multiple of 24.260x with an annual dividend yield of 3.95%, as per ASX. The market capitalisation of AZJ stands at $11.66 billion. The total number of outstanding shares is at 1.99 billion. The 52-week trading range of AZJ was in between $3.900 to $6.090. Currently, the stock is priced near its 52-week high.

Reliance Worldwide Corporation Limited

Reliance Worldwide Corporation Limited (ASX:RWC) is engaged into designing and controlling of water delivery through highly automated manufacturing facilities located across Australia, China, France, Germany, New Zealand, UK, and the US. The company supplies reliable and premium branded water flow and have a presence in plumbing products like push-to-connect brass (PTC) fittings, PEX pipes, engineered plumbing support systems etc. The company is headquartered at Brisbane, Australia and was incorporated in 1949.

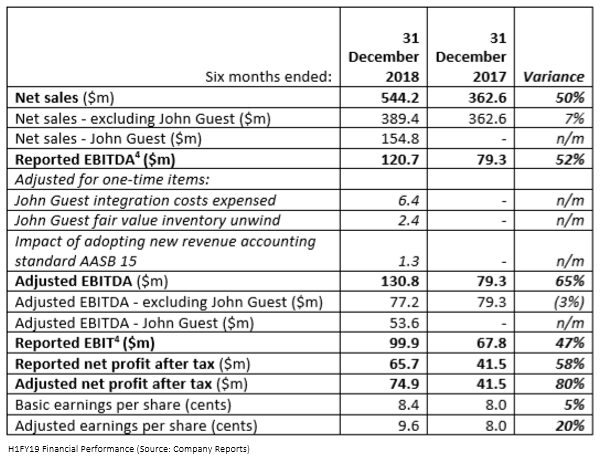

Financial performance: RWC has delivered strong performance in recent past with 50.1% y-o-y jump in H1FY19 revenue at $544.2 million, followed by reported net profit at $65.7 million, an increase of 58% y-o-y. H1FY19 Reported EBITDA was at $120.7 million vs $79.3 million in H1FY18, up by 52%.

Operations in the USA continued to improve with double-digit sales growth. Sales from the US was up by 14.3% in constant currency terms aided by higher demand for RWCâs core product. An expanded range of products well supported sales growth from construction and residential in Canada boosted sales for RWC. Asia pacific delivered sales growth of 7% during the period with reported EBITDA at $24.6 million, a decrease of 18% on y-o-y.

Outlook: Management expects momentum should continue across its US business during the second half of FY19. RWC remains a market leader across multiple product categories in key geographic segments. Management confirmed that higher US tariffs on Chinese products from 10% to 25% would have a marginal effect on the companyâs operation. The company is targeting to increase sales of its PTC products in the US. Management believes the potential market of this product is likely to remain high.

Stock update: At CMP as on 15th August 2019, RWC is available at a P/E multiple of 27.170x. 52-week trading range of the stock has been $3.105- $6.380. The stock has delivered negative return of 4.14% and 29.33% in last three and six months, respectively. The market capitalisation of the stock is at $ 2.7 billion. The stock has delivered an annualised dividend yield of 2.03%. RWC has 2.7billion shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice