Although the Australian securities marketâs benchmark index closed the trading session higher at 6654.9 points with a rise of 0.3 per cent, there were many ASX-listed companies that were trading ex-dividend on 12th September 2019. Most of the stocks of these companies either ended the trading session in red or did not traded at all. Before delving into the details of these companies, let us first understand the ex-dividend date below:

What is Ex-Dividend Date?

The ex-dividend date and the record date are the two important dates that determine whether the investor is entitled to the next dividend or not. The board of directors of the companies set a ârecord dateâ while announcing their dividends, which refers to the date by which investors must own shares of the company in order to be eligible for receiving dividends for a particular stock.

The companies also declare the âex-dividend dateâ along with the dividend, which is generally set at 1 business day before the record date. The purchase of the stock on or after this date makes an investor ineligible for receiving the declared dividend payment.

ASX-Listed Companies Trading Ex-Dividend

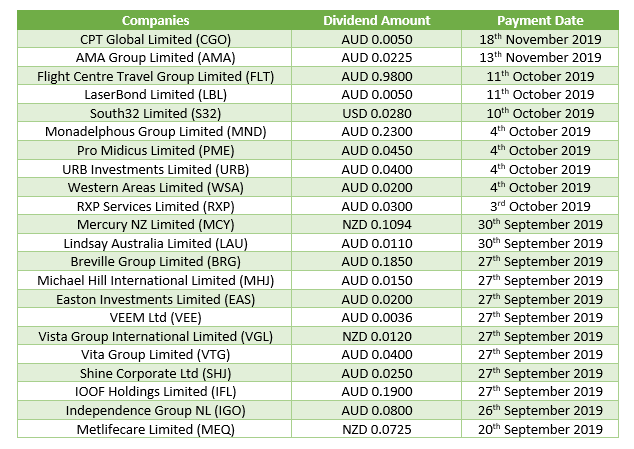

The below table summarises the names of some of the companies that were trading ex-dividend on 12th September 2019:

It can be seen that most of the companies trading ex-dividend on 12th September 2019 are likely to pay their dividends in September this year.

A Look at Financial Metrics

Most of the above cited companies declared their dividend on the same day on which they announced their financial results. Considering this, let us take a quick look at the financials of some of these companies below:

CPT Global Limited

CPT Global Limited (ASX:CGO) is an Australian-headquartered specialist IT consulting services company, which is a market leader in the provision of testing and digital consulting, performance tuning and capacity planning services. The company recently released its 2019 financial year results on the ASX, highlighting a 27 per cent improvement on FY18 in its profit after-tax to $1.0 million. However, the revenue of the company was 8 per cent lower than FY18 at $28.4 million, tempered by the performance of Australiaâs banking & finance sector.

IOOF Holdings Limited

One of the largest groups in the financial services industry, IOOF Holdings Ltd (ASX: IFL) released its FY19 results on 26th August 2019. The Underlying NPAT of the company improved by 3.4 per cent to $198.0 million in FY19, while the Statutory NPAT declined by 67.7 per cent to $28.6 million. The company announced a total fully franked dividend of 19 cents per share for the half year that included a special dividend of 7 cents per share and a final dividend of 12 cents per share.

Monadelphous Group Limited

The full year financial results of Australiaâs leading engineering firm, Monadelphous Group Limited (ASX: MND) were out on 20th August 2019. The company observed a decline of 9.85 per cent in its revenue to $1.608 billion, and a fall of 10.3 per cent in its EBITDA to $106.8 million in FY19. The company mentioned that it secured $1.35 billion worth of new contracts and extensions in the reported financial year.

Breville Group Limited

An Australia-based company engaged in the supply of small electrical appliances, Breville Group Limited (ASX: BRG) reported its FY19 financial results in mid-August this year. The company recorded strong growth in its revenue, EBITDA and NPAT figures during the period. The revenue and the EBITDA of the company were 17.5 per cent and 13.7 per cent up on pcp, at AUD 760 million and AUD 114 million, respectively in FY19. The NPAT of the company also improved substantially from AUD 58.5 million in FY18 to AUD 67.4 million in FY19.

In line with its strong financial performance, the company declared a revenue of 37 cents per share, which was 12.5 per cent higher than the previously announced divided.

Flight Centre Travel Group Limited

One of the largest travel agency groups of the world, Flight Centre Travel Group Limited (ASX: FLT) exceeded record FY18 result by almost AUD 2 billion and achieved 23rd year of TTV growth in 24 years since listing in FY19. The company saw an increase of 4.5 per cent in its total revenue from AUD 2,923 million in FY18 to AUD 3,055 million in FY19. The company also observed record TTV figures over all its geographic segments, mostly supported by corporate brands.

Easton Investments Limited

Australian-headquartered financial services company, Easton Investments Limited (ASX:EAS) released its FY19 financial results on 21st August 2019. The company recorded a significant rise of 54 per cent and 17 per cent in its Statutory Profit and Underlying Profit, respectively during the period. The revenue of the company was also 18 per cent up on pcp, at $59.8 million during the period. The company observed a growth in its dividends from 1 cent per share paid in May 2019 to 2 cents per share to be paid in September 2019.

Stock Performance

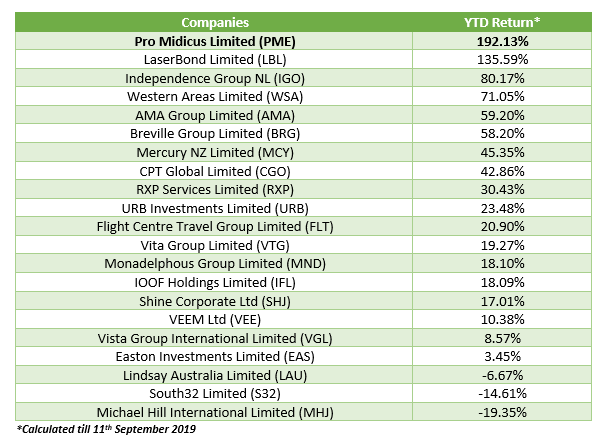

Let us now take a look at the YTD return of the companies that traded ex-dividend on 12th September 2019 in the table below:

Among all the companies mentioned above in the list, only VEEM Ltd (ASX: VEE) and Western Areas Limited (ASX: WSA) ended the trading session in green on their ex-dividend date, i.e. 12th September 2019. WSA closed the dayâs trade with a rise of 0.92 per cent at AUD 3.280, while VEE ended the dayâs trade with an increase of 2.56 per cent at AUD 0.600. Western Areas Limited has also reported about the identification of significant extension of mineralisation at the Stricklands Prospect on 12th September 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.