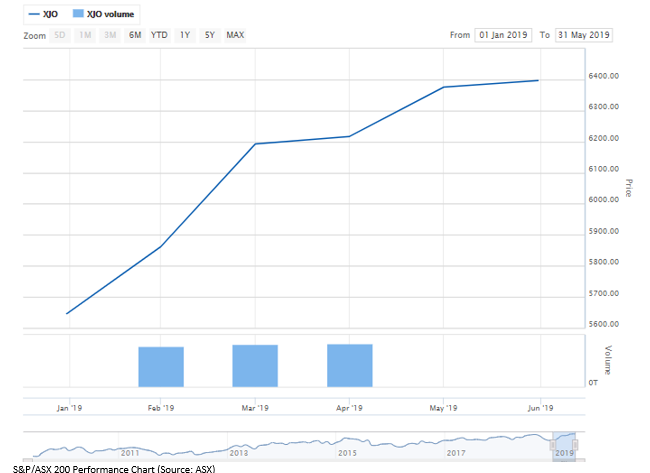

In 2019, the Australian stock market has demonstrated strong performance despite facing global economic concerns, arising mainly from US-China trade war. The S&P/ASX 200 Index has provided a year-till-date return of 15.66 percent as on 17 June 2019. Certain market analysts believe that the broader Australian equity markets are trading at premium levels.

There were a lot of uncertainties this year at the time of Australiaâs general elections, however, when the coalition government won the elections there was a positive impact on the Australian stock market. Moreover, the Australian stock market has performed strongly despite of facing challenges from the declining housing market.

With the anticipation of further cash rate cuts by RBA and improved outlook of the housing market, certain analysts are expecting the Australian share market to further inch up in the rest of the year.

Recently, two leading banks NAB and Westpac released reports in which they forecasted further cash rate cuts by Reserve Bank of Australia in the near future to improve the momentum of the Australian Economy. As per market expectation, the reduction in the cash rate will improve the Australian economy and the stock market. There has been a lot of speculation that the US might also reduce their interest rate in the coming times for the betterment of their economy.

In the light of the above-mentioned scenario, let us take a look at few ASX stocks that have gone up a lot in this year.

Afterpay Touch Group (ASX:APT)

Technology-driven payments company, Afterpay Touch Group (ASX: APT) has provided significant shareholder returns this year. APT has provided Year-till-date return of 68.92% as on 17 June 2019. Afterpay is a major player of âbuy-now-pay-laterâ industry. The company recently completed a $317.2 million Capital Raising, proceeds of which will be used to underpin Afterpay's mid-term plan.

The popularity of âBuy Now Pay Laterâ platforms have increased significant in recent times, which is why technology-driven payments companies like Afterpay Touch Group are receiving a lot of attraction from investors.

In the first half of FY19, Afterpayâs underlying sales witnessed an increase of around 147% as compared to the previous corresponding period. Consequently, the total income of the company increased by 85% from $60.7 million in 1H FY18 to $112.3 million in 1H FY19. Further, the Group achieved pro forma EBITDA of $17.0 million and reported a statutory loss for the period of $22.2 million.

In last one-year, APT has provided a return of 127.75% as on 17 June 2019. At market close on 18 June 2019, APT settled the dayâs trade at a price of $21.310, up 5.13% with a market capitalization of circa $5.12 billion.

ZIP Co. Limited (ASX:Z1P)

Another major participant of Australiaâs âbuy-now-pay laterâ industry, ZIP Co. Limited (ASX: Z1P) has also provided significant shareholders returns in 2019. Z1P has provided a year-till-date return of 160.91% as on 17th June 2019. Apart from strong stock performance, the company has also reported strong operational and financial performance in recent times.

In 2019 March quarter, the company reported record quarterly revenue of $23 million which was 20% higher than 2018 December quarter. The transaction volume increased by 107% on year on year basis and reached to $281.4 million in Q3 FY19.

During the period, the company raised a total of $56.7 million in equity (before costs), proceeds of which will be used to accelerate various growth initiatives and strengthen the Companyâs balance sheet.

The company recently announced a partnership with Kmart Australia Ltd to help Kmart customers with a better way of making payments for their everyday products and purchases

In last one-year, Z1P has provided a return of 247.88% as on 17 June 2019. At market close on 18 June 2019, Z1P traded at a price of $3.010,up 4.88% with a market capitalization of circa $1.01 billion.

Altium Limited (ASX:ALU)

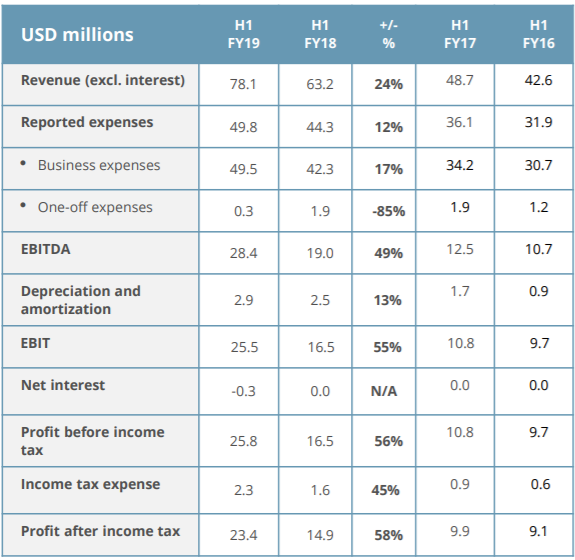

Australian multinational software corporation, Altium Limited (ASX: ALU) has seen its share price rise by ~ 51% in 2019. In the first half of FY19, the company produced strong financial results with revenue growth of 24% and an EBITDA margin of 36.3%. During the period, the company performed strongly across all key metrics.

Half Year Results Key Metrics (Source: Company reports)

China has been a stand-out for Altium over the first half with 49% revenue growth while the companyâs TASKING and Octopart businesses delivered outstanding performances with 35% and 80% revenue growth respectively. The company believes that it is on track to achieve its $200 million revenue target with further improvement in profit margins.

In last one-year, ALU has provided a return of 40.28% as on 17 June 2019. At market close on 18 June 2019, ALU settled the dayâs trade at a price of $32.480 with a market capitalization of circa $4.26 billion.

Pro Medicus Limited (ASX:PME)

Leading health imaging company, Pro Medicus Limited (ASX: PME) has seen its stock jump by over 111.23% (YTD basis) in 2019. In the recent past, the company has made strong strategic progress which includes the signing of 7-year contract with Duke Health, the largest health system in the state of North Carolina and signing A$3 million-plus extension to the contract it has with a large German Government Hospital network.

In the first half of FY19, the company reported an after-tax profit of $9.1 million, up 184.3% year-on-year while all its divisions, Australia, Europe and the US, delivered increased operating results . During the half year period, cash flows from operations of $6.4 million with cash balance at the end of the period of $24.7 million.

In last one-year PME has provided a return of 212.45% as on 17 June 2019. At market close on 18 June 2019, PME settled the dayâs trade at a price of $24.380, up 1.5% with a market capitalization of circa $2.49 billion.

Jumbo Interactive Limited (ASX:JIN)

A Leading digital retailer of official government and charitable lotteries, Jumbo Interactive Limited (ASX: JIN) had a strong run in the past six months, with its stock soaring by 136% in the respective period. Last month, Jumbo announced a fully franked special dividend of 8 cents per share (cps) and is expecting to pay a final dividend of 18 cents per share for FY2019.

In the first half of FY19, the company reported a TTV (Total transaction volume) growth of about 62% with revenue growth of 53%, in comparison to the previous corresponding period (pcp). The companyâs EBITDA increased by 91% in the half year period to around $37 million. During the half year period, the company acquired a large number of customers and as a consequence of it, it now expects benefits from those customers to start arising in the second half of FY19.

In last one-year, JIN has provided a return of 294.86% as on 17 June 2019. At market close on 18 June 2019, JIN settled the dayâs trade at a price of $18.960 with a market capitalization of circa $1.14 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.