An ETF is a basket of securities that is attached to an underlying asset, be it stocks, bonds, or commodities. Commodity ETFs can be understood as an asset class, which invests in a single commodity or a basket of commodities diversifying or minimising the particular risk. Commodity ETFs indirectly invest in different kind of commodities, being underlying assets such as agriculture, oil, precious metals, etc. At the time of buying a commodity ETF, investors do not buy or own the respective physical asset, instead they invest or own a bundle of contracts, which is backed by the related commodity. Letâs look at a few commodity ETFs listed on the Australian Stock Exchange (ASX):

Betashares Agriculture ETF-Currency Hedged (ASX:QAG) offers exposure to the performance of a basket of the most globally substantial agricultural commodities. The ETF is basically exposed to soft commodities such as corn, wheat, soybeans, sugar, etc. To avoid any significant movement in the currency, in turn, impacting the performance of the ETF, the fund uses the currency hedging in the AUD/USD exchange rate. The fund is liquid and available for trade on ASX like securities.

The S&P GSCI Agriculture Enhanced Select Index â Excess return comprises of the four most significant agricultural commodities on a world production basis, namely corn, soybeans, sugar and wheat. These constituents provide diversification across the agricultural commodity sector. Agricultural commodities are primarily used in the production of foodstuff, drinks and textiles, and more recently, in the production of bio-fuel.

Key Facts: Net asset value (NAV) per unit as on 04th July 2019 stands at $5.88, with a net asset value of $3,117,016 and units outstanding of 530,005. Management cost for the fund is 1.44% per annum. The issuer of this ETF is BetaShares Capital, and fund administrator and custodian are RBC Investor Services. The fund was incepted on 30th November 2011.

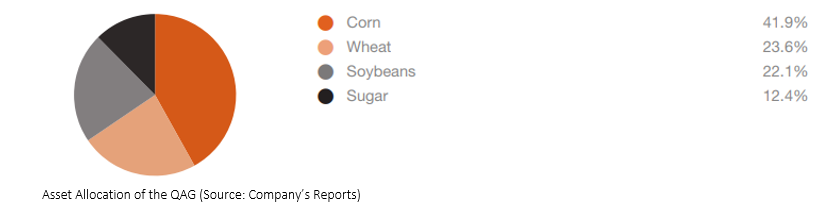

Looking at the asset allocation of QAG ETF, corn is comprised of the major chunk, accounting for 41.9%, followed by wheat, soybeans and sugar at 23.6%, 22.1% and 12.4%, respectively.

Benefits of QAG: The ETF provides easy access to agriculture performance as simple as buying a security on an exchange. Through buy and selling QAG, one can avoid the unnecessary costs related to the transaction of future positions and complications of storing physical commodities. Being priced in US currency, the exposure towards the US currency is hedged back to the AUD.

QAG Performance: The ETF has given an absolute return of 8.38% and 2.0% in last three month and one month, in-line with the index return of 8.37% and 2.03% for the same period, respectively. On the six months and one-year basis, the ETF posted negative returns of 2.08% and 13.38%, respectively (as on 31 May 2019, Source: Fact Sheet).

On ASX, QAG is trading at the current market price of $6.000, with gains of 5.45% in the last three months.

Betashares Gold Bullion ETF - Currency Hedged (ASX:QAU) is aimed to chase the price movement of gold bullion. The hedging of currency is also used to reduce the significant movements in AUD and USD ForEx rates. As the fund is backed by physical gold bullion, it offers investors to invest in the gold indirectly without the hassles connected with the direct buying, storing and selling the physical gold bullion. Gold, being a US currency denominated asset, the fund uses a hedging strategy for its U.S. Dollar to alleviate the deep impact of currency movement, if any.

Key Facts: Net asset value per unit for the fund stands at $14.35, with a net asset of $87,727,839 and units outstanding at 6,114,537. Management costs for the fund comes in at 0.59% per annum. The issuer for the ETF is BetaShares Capital with RBC Investor Services being fund administrator and JPMorgan Chase acting as a custodian. The inception date for the fund is 3rd May 2011.

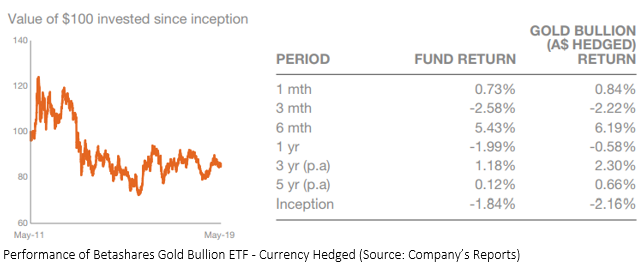

Performance of QAU: Fund returns are calculated in Australian dollar by using NAV per unit at the beginning and end of the specified duration, which do not include any fees or costs incurred while transaction of these units on ASX. These returns are after the fund costs and do not take into account the income tax. Looking at the fund performance, one-month and six months performance have been positive at 0.73% and 5.43%, respectively, whereas three months and one year period saw a decline of 2.58% and 1.99%, respectively (as on 31 May 2019, Source: Fact Sheet).

Coming to the allocation, the fund invests 100% in gold bullion. The fund can be used to implement a variety of investment strategies such as to defend the portfolio from uncertainties (gold, generally being understood as a safe haven asset) and to diversify a portfolio, etc. The fund is cost effective as it incurs a meaningfully lower cost as compared to the costs and expenses of buying, handling, storing and insuring physical gold.

QAU is available to trade on ASX and is currently trading at the current market price of $14.220, down 1.387% as on 08 July 2019. QAU is currently trading toward the higher end of its 52-week high of $14.620. In the last one-year, the QAU has gained ~11.18% on ASX.

Betashares Commodities Basket ETF-Currency (ASX:QCB) offers the investor an easy method to have exposure to the performance of a wide range of commodities under one roof. The fund aims to track the performance of an index, which is before fees and expenses and is comprised of commodity futures. Additionally, the commodities being US dollar-denominated, hedging the exposure of US dollar back to Australian currency is adopted to avoid any unforeseen foreign exchange risks.

The S&P GSCI Light Energy Index Excess Return is a broadly inclusive index, which is comprised of twenty four commodities from the overall commodity space, 6 commodities from energy products, 7 from metals space, 8 from agricultural and 3 commodities from livestock products. This broad range of constituents provides a high level of diversification across the commodity sector.

Key Facts: NAV per unit for the fund comes in at $8.17 as on 4th July 2019, with net asset valued at $8,426,319 and units outstanding at 1,031,926. Management cost is 1.29% per annum and swap cost is -0.5% to 0.8% per annum. 12-months distribution yield comes in at 9.8%. The fund was incepted on 13th December 2011.

Fund Performance: The fund has given negative absolute returns with one-month, three-months, six-months and one-year returns coming in at -3.55%, -3.38%, -2.45% and -14.61%, respectively (as on 31 May 2019, Source: Fact Sheet).

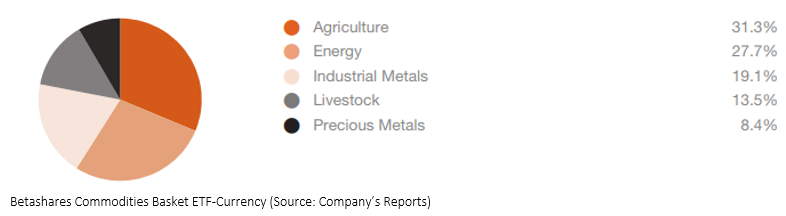

Coming to the asset allocation as of 31st May 2019, Agriculture accounts for the major chunk of the total asset at 31.3%, followed by Energy at 27.7%, Industrial Metals at 19.1%, Livestock at 13.5% and Precious Metals at 8.4%.

QCB is currently trading at $8.2000, closer to its 52-week low, with an annual dividend yield at 9.56%.

Betashares Crude Oil Index ETF-Currency Hedged (ASX:OOO) offers the investors to invest indirectly to take advantage of the movement in oil prices. The fund aims to track the performance of an index that offers an exposure to crude oil futures. In addition, the US dollar exposure of the fund is hedged back to Australian dollar to evade the foreign exchange risk.

The S&P GSCI Crude Oil Index Excess Return tracks the performance of WTI (West Texas Intermediate) crude oil prices in futures traded on the NYMEX (New York Mercantile Exchange). WTI is the pricing benchmark for more than 160 internationally traded crude oils.

Key Facts: NAV per unit for the fund come in at $15.63, with net assets of $25,895,713 and 1,657,096 units outstanding. The management cost is lower at 0.69%, with 12 months distribution yield of 1.8%.

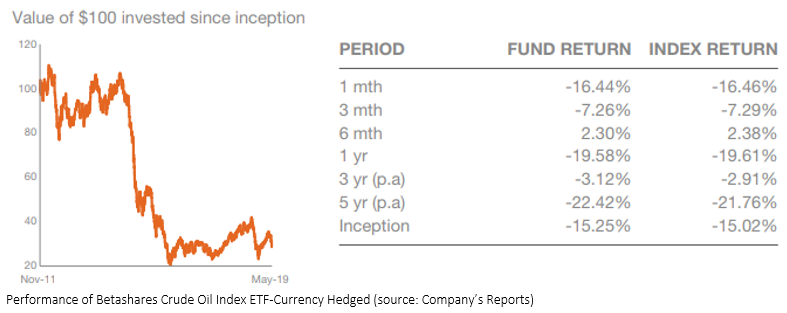

Coming to the fund performance, the one-month, three months and one-year performances are -16.44%, -7.26% and -19.58%, respectively, with six monthsâ performance positive at 2.30% (as on 31 May 2019, Source: Fact Sheet).

The fund is 100% allocated to the crude oil.

On ASX, OOO is currently trading at $15.680, up 1.489% as on 08 July 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.