Despite several challenges, the Australian stock market depicted decent performance in 2019. As per the observation of several market veterans, the Australian equity markets are likely to be trading at premium levels.

The beginning of 2019 was marked by highs and lows of macro and micro economic factors which drove the Australian stock market. The period saw disruptions due to the global economic concerns arising from the US-China trade war. The past few months have also been marked by the uncertainties at the time of Australiaâs general elections, which later turned out to be a positive contributor to the Australian stock market after the Coalition Government won the elections. In parallel, the declining housing market in Australia also posed further challenges to the performance of the stock market. Disappointing inflation figures, modifications in the latest statement on Monetary Policy and proposed plan to scrap 7% home loan buffer were a few other factors that impacted the market.

An amalgamation of the above factors made the market witnessed a period of highs and lows. Most of the Analysts suggest that given the improved outlook for the housing market and further anticipated cash rate cuts by RBA, the Australian stock market will further grow in the remainder of 2019.

Let us have a look at few stocks on ASX that witnessed an uplift during the period.

Afterpay Touch Group Limited (ASX:APT)

Afterpay Touch Group Limited (ASX:APT) is a multinational technology-driven payments company, which operates a Pay Later, Afterpay and a Pay Now business, Touchcorp. Telecommunication, Health and Convenience Retail are a few of the sectors that are served by the company. APT recently announced a change in substantial shareholding of Mr Nicholas Molnar. The voting power of the shareholder reduced from 10.33% to 8.09%. Another announcement on the change in the interest of substantial shareholding of Mr Anthony Eisen was made, wherein his voting power as well reduced from 10.33% to 8.09%.

The company recently completed a capital raising of $317.2 million through a fully underwritten institutional placement to be utilised in Afterpayâs mid-term plan. The placement was priced at $23 per share and will probably be followed by a Share Purchase Plan to raise approximately $30 million.

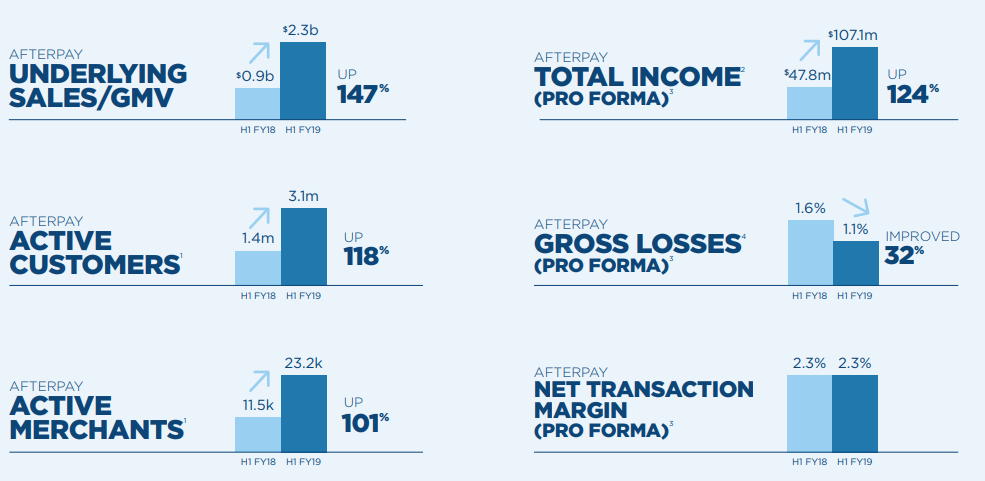

During 1H FY19, the underlying sales amounted to $2.3 billion, up 147% on the prior corresponding period (pcp). Total income during the period amounted to $116.1 million, up 91% on pcp. At the end of December, the company had approximately 23,200 active merchants, up 101% on pcp. The period also marked strong growth in the balance sheet with proceeds of $142 million from equity issue and diversification of bank funding, including warehouse funding facilities in Australia and new facilities under negotiation in the US. The companyâs growth in Australia and New Zealand markets continued to be strong.

Key Highlights of 1HFY19 (Source: Company Presentation)

On the stock performance front, the company generated a high return of 166.63% over a period of one year as on 20 June 2019. At the time of writing (21 June 2019, AEST 02:18 PM), the stock of the company is trading at a price of $23.220 with a market capitalisation of ~$5.93 billion.

Zip Co Limited (ASX:Z1P)

Zip Co Limited (ASX:Z1P) offers point-of-sale credit and payment solutions to consumers and also provides a variety of integrated Retail Finance solutions to merchants across various industries. On 4th June 2019, the company updated the exchange that Regal Funds Management Pty Ltd ceased to be a substantial shareholder of Zip Co. On 21 June 2019, the company notified about the appointment of David Franks as a new Company Secretary, effective immediately.

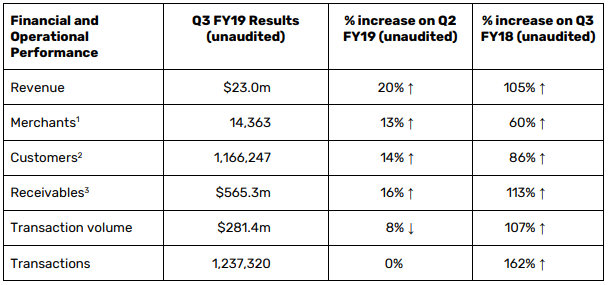

Looking at the financials, the company reported record performance during Q3 FY19 ended 31st March 2019. Revenue for the period amounted to $23 million, reporting a 20% increase on Q2. The period saw an increase in the number of customers to 1.2 million, up 14% on Q2. The company reported a market-leading credit performance with net bad debts going down from 1.81% in the second quarter to 1.75% in the current quarter. During the period, the company raised $56.7 million in equity capital to accelerate growth and tap the market opportunities.

Key Operational Metrics (Source: Company Reports)

Other highlights for the quarter included the wholesale agreement signed with Adyen, a global payments provider, which included marketing of Zip to their Australian clients. Zip was also launched officially in New Zealand, supporting the roll out of Super Retail Group.

The stock of the company yielded a high return of 286.98% over a period of one year as on 20 June 2019. The stock is currently trading at a price of $3.080, down 5.81% on 21st June 2019 (AEST 02:18 PM), with a market capitalisation of $1.15 billion.

Appen Limited (ASX:APX)

Appen Limited (ASX:APX) is engaged in the provision of quality data solutions and services for machine learning and artificial intelligence applications for global technology companies. On 18th June 2019, the company provided an update regarding the Change of Directorâs Interest Notice. Bill Pulver, Director of the company, who held interest in New Greenwich Pty Ltd as a trustee for New Greenwich Superannuation Fund, disposed of 392,819 ordinary shares for a consideration of $27.513 per share.

In March 2019, the company announced the acquisition of Figure Eight Technologies, Inc, a machine learning software platform, which will significantly increase Appenâs revenues and expand its customer base.

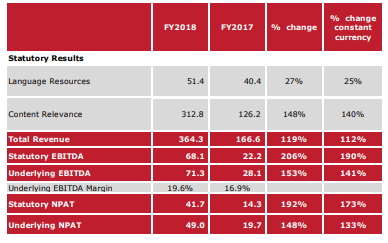

For the year ended 31st December 2018, the company reported revenues of $364.3 million, up 119% on pcp. Underlying EBITDA amounted to $71.3 million, reporting an increase of 153% on the prior corresponding period. Statutory EBITDA witnessed an increase of 206%, while underlying EBITDA margins also improved from 16.9% for the year ended December 2017 to 19.6% in the year ended December 2018.

Financial Summary in $AM â AUD Million (Source: Company Reports)

The company witnessed strong growth during the year due to the accelerating AI market and the growing demand for quality training data. Its Content Relevance division, including leapforce, continued to be the drivers of growth and were particularly strong in Q4. The company was able to achieve customer expansion and economies of scale, which led to growth and margin expansion.

The company intends to offer greater crowed productivity, increase data volumes and quality and cement its competitive position by enhancing its proven and highly scalable crowd-sourced delivery model with technology.

The stock of the company is currently trading at a market price of $27.810, down 1.313% on 21st June 2019 (AEST 02:18 PM), with a market capitalisation of ~$3.41 billion. Over a period of one year, the stock has generated a high return of 116.77% as on 20 June 2019.

Volpara Health Technologies Limited (ASX:VHT)

Volpara Health Technologies Limited (ASX:VHT) is engaged in the sale of VolparaEnterprise⢠software, a comprehensive cloud-based breast imaging analytics platform that delivers quality assurance and performance monitoring. On 17th June 2019, the company issued a notice for Change of Directorâs Interest. John Flower Diddams, holding interest in Whitfield Investments Pty Ltd and Galdarn Pty Ltd as a Sole Director and Shareholder, acquired 16,100 ordinary shares for a consideration of $1.50 each.

The company recently completed the acquisition of Seattle-based MRS Systems, Inc. The acquisition of MRS Systems will help the company save families from breast cancer by using AI imaging algorithms leading to early detection of breast cancer. The acquisition led to an increase in the US breast clinics from around 400 to over 2,000, providing it with a much stronger presence in the US market with accelerated sales, a significant increase in annual recurring revenue and increased potential average revenue through new products.

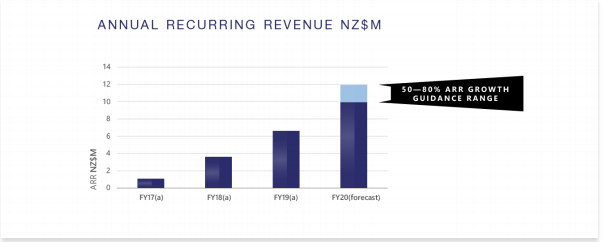

In the quarterly cash flow report for Q4 FY19, the company reported annual recurring revenue of NZ$6.63 million, up 86% on the prior corresponding period. The cash receipts from customers for FY19 stood at NZ$5.6 million, up 83% from FY18. The total contract value for the period amounted to NZ$15.8 million, up 42% on pcp. Q4 FY109 was marked as one of the strongest quarters in the companyâs history with 15 new customers signing the VolparaEnterprise platform, bringing the total number of customers to 128. For FY20, the company has forecasted an ARR growth in the range of 50% to 80% and gross margin to be 80%+.

Annual Recurring Revenue (Source: Company Reports)

The stock of the company is currently trading at a market price of $1.675 on 21st June 2019 (AEST 02:36 PM), with a market capitalisation of ~$353.99 million. Over a period of one year, the stock has yielded a high return of 115.66% as on 20 June 2019.

In order to choose the best stocks to buy, investors have to look at the combination of factors. On a short-term basis, the market is driven by the supply and demand imbalances. This involves the order flow on a daily basis, which occurs when investors buy or sell a stock. The forecast of this order flow involves a lot of technical analysis. Furthermore, the macroeconomic environment is another factor playing a major role in the choice of stock. These factors can be related to the changes in the interest rates, government policies, etc., as discussed at the beginning of the article. Understanding these aspects of the macro environment is very essential to pick up the right stock.

Finally, for the long-term, the stocks are driven by the fundamentals that include quantitative factors such as profit margin, return on equity and earnings growth; and qualitative factors such as operating environment, competition, political and policy environment. Hence, in order to pick the best stock to buy, an investor must do a thorough analysis of the factors mentioned above.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.