The COVID-19 pandemic has created havoc globally. The infectious disease has led the governments to implement lockdown, ban travel, and impose restrictions on non-essential activities, among other measures. However, there were some exceptions for essential products and services.

One industry that offers essential products includes the infant formula industry. Despite the detrimental impact of SARS-CoV-2 on the global economy, the infant formula industry has benefited from the scenario with the products witnessing decent growth in demand in the past few months, and most of the companies have ramped up their production to meet the growing demand.

Do Read: How these agricultural stocks are performing?

The companies associated with this industry are optimistic about their future growth as their recent trading period has shown impressive revenue and volumes. Let us have a look at the performance of some companies from the infant formula industry:

The A2 Milk Company Limited (ASX:A2M)

The A2 Milk Company Limited is a dairy nutritional company, which is focused on the products containing A2 beta-casein protein type.

Strong Revenue Growth

Recently, the Company has notified the market with the trading performance and outlook for FY20, wherein, it outlined the following:

- A2M has continued to witness robust revenue growth in all key regions, primarily for infant nutrition products sold in China and Australia.

- The revenue for Q3 FY20 had surpassed the expectations. The revenue growth showed the effect of changes in purchasing behaviour of consumers amid the COVID-19 pandemic. An increase pantry stocking of A2M’s products, mainly via reseller channels and online mode also supported revenue growth.

- The China segment revenue, transacted in US dollars, witnessed a favourable impact due to significant depreciation of the New Zealand dollar to the US dollar during Q3.

On the outlook, the Company stated that anticipations for revenue and earnings are uncertain considering the COVID-19 situation.

- A2M expects continuing revenue growth throughout its key regions underpinned by increased marketing investment in the US and China.

- For FY20, the Company expects revenue in the range $1,700 million - $1,750 million. The EBITDA margin is expected to be between 31% and 32%.

The A2M stock was trading at $18.410 on 7 May 2020 (at 12:26 PM AEST), a decline of 0.701% from its previous closing price. The market cap of A2 Milk stands at $13.72 billion, and the Company has ~739.93 million outstanding shares. The stock has generated returns of 9.83% and 32.24% in the last month and on a YTD basis, respectively.

Bubs Australia Limited (ASX:BUB)

Bubs Australia Limited is engaged in the manufacturing of infant milk formula. Recently, the Company has inked a new supply agreement with Coles Supermarkets Australia.

- Under the term of the agreement, the Company will distribute Bubs Organic® Grass Fed Infant Formula to 482 Coles supermarkets. The initial order for the same is to be processed in mid-May and on-shelf in early June 2020. This agreement would add a major contribution to the domestic revenue for Q4 FY20.

- The substantial expansion of the Bubs® portfolio throughout the Coles network would be supported by a strong trade media campaign in Coles media, and continued multi-media consumer brand campaign support.

For the third quarter ended 31 March 2020, the Company reported revenue amounting to $19.7 million, reflecting a rise of 67% over pcp. The Bubs® infant formula range reported robust performance with an increase of 137% pcp. The Company managed to close the quarter with positive operating cashflow of $2.3 million and a healthy cash balance of $36.4 million. Bub possesses financial flexibility to benefit from a vibrant and changing market.

The BUB stock was trading at $0.970 on 7 May 2020 (at 12:26 PM AEST), an increase of 2.105% from its previous closing price. The market cap of BUBS Australia stands at $532.28 million, and the Company has ~560.3 million outstanding shares. The stock has generated returns of 42.86% and 30.14% in the last month and last three months, respectively.

Nuchev Limited (ASX:NUC)

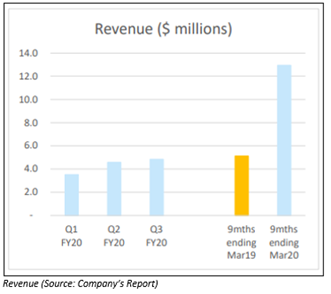

Nuchev Limited is engaged in developing, marketing and selling of numerous goat nutritional products. The Company recently released its business activities for the three months ended 31 March 2020 (Q3 FY20) and outlined the following:

- A sales momentum of Nuchev’s Oli6® goat-milk infant formula and nutritional products was witnessed by the Company during the period.

- The Company experienced record sales in March 2020. For the nine months ended March 2020, the volumes and net revenue went up by around 168% and 155% respectively over pcp.

- Increasing penetration throughout its key distribution channel has assisted the Company to deliver growth of 87% and 78% in volumes and net revenue, respectively during Q3 FY20.

- The Company had a cash balance of $13.0 million with no debt at the end of the quarter.

The Company has not experienced any negative impact from COVID-19, but it expects uncertainty regarding the longer-term effects of this pandemic. The Company’s priority revolves around building a long-term sustainable business based on its premium Oli6 brand offering.

The NUC stock was trading at $3.110 on 7 May 2020 (at 12:26 PM AEST), an increase of 0.323% from its previous closing price. The market cap of Nuchev stands at $139.5 million, and the Company has ~45 million outstanding shares. The stock has generated returns of 42.86% in the last month.

Longtable Group Limited (ASX:LON)

Longtable Group Limited is a producer, marketer and distributor of premium food and beverages.

Considering the economic impacts from COVID-19 pandemic as known to date (29 April 2020), the Company provided the following trading update:

- The first two weeks of April 2020 included the lead up to Easter, which was a significant trading period for each of its businesses. The Company added that this period had been negatively impacted by the COVID-19 pandemic and government-imposed restrictions to stay home.

- However, due to COVID-19, no significant disruption to its operations or supply chains was experienced until 29 April 2020.

- The Company launched a new “Cooking with Maggie” series on Facebook and Instagram.

The Group is well-financed by its $8.1 million cash reserves and undrawn debt facilities, along with a strong balance sheet, good liquidity and financial capacity for current and future growth.

The LON stock was trading at $0.130 on 7 May 2020 (at 12:26 PM AEST), in line with its previous closing price. The market cap of Longtable stands at $26.94 million, and the Company has ~207.26 million outstanding shares. The stock has generated returns of 62.5% in the last month.