The disruptions in production and supplies due to the ill-effects of the coronavirus has left consumers in a spot of bother. The uncertainty concerning the entire scenario has led to the stocking of products that individuals deem essential. Infant milk formula is one such product with Australia witnessing a surge in demand for these products as more and more mothers look to stock unsure about how the supply might be in the future.

According to ABS, infant milk formula demand has increased swiftly, primarily in China. As per market estimates, the global market for infant milk formula business is likely to grow at a CAGR of 3 per cent (2019 - 25). With the growing demand for milk-based baby formula during coronavirus, the related businesses can aim high.

ALSO READ: Needle on dairy stocks, Are there any opportunities?

Let us look at three ASX-listed stocks that are under the radar: A2M, BUB and BKL.

The a2 Milk Company Limited (ASX:A2M)

Founded in 2000 in New Zealand, a2 Milk is involved in producing milk-based products which contain the A2 protein type.

Increased investment in Synlait Milk:

On 23 March 2020, a2 Milk notified the market that it had increased its stake in Synlait Milk Limited (ASX:SM1) from 17.4 per cent to 19.84 per cent. Also, the Company mentions this move as the completion of its strategic holding, and it has no intention to further grow its shareholding in SM1.

A2M had explored the opportunity of a recent decline in the share price of SM1 and acquired shares at NZD 4.95 per share. This price was lower than the average entry price for a2 Milk’s interest in SM1.

A2M partnership with Agrifoods:

On 12 March 2020, A2M announced that it had entered into an exclusive licensing agreement with Canada based Agrifoods Cooperative. Under this agreement, production, delivery, advertising and selling of a2 Milk™ branded liquid milk would be carried out in the world’s second-largest country.

Under this partnership, the following are the roles of each entity:

- Agrifoods will launch the product distribution across Canada by leveraging its considerable capabilities in the market. Also, it holds a prime responsibility to fund this venture.

- In return, A2M will give Agrifoods the access of its marketing assets, IP, proprietary systems and technical know-how concerning processing and sourcing of its products.

Additionally, it is most likely that a wide variety of liquid milk products of A2M would be introduced to Canada market later this year.

In the half-year FY 2020 result for the period ended 31 December 2020, the top-line increased by 32 per cent on the prior year. Also, EBITDA and bottom-line witnessed an increase of 21 per cent each on pcp basis. A2M holds $618.4 million of cash on hand with basic earnings per share of 25.15 cents.

Provided the uncertain situation due to the COVID-19 pandemic, the company mentioned that it is evaluating the level of trade marketing activation and discretionary marketing investment in China for the remaining year.

Stock performance: On 16 April 2020, A2M’s stock was trading at $18.650 (at 03:57 PM AEST), an increase of 3.039 per cent compared to its previous close. A2M stock delivered a significant positive return of 29.10 per cent on a YTD basis.

Bubs Australia Limited (ASX:BUB)

Incorporated in 2006 in Sydney, BUB offers a wide variety of infant nutrition products. Its products cater to all development stages ranging from new-born to childhood.

COVID-19 Update:

In the COVID-19 update released on 18 March 2020, the Company mentioned that it had incorporated all measures to withstand a continuous supply chain across Bubs Organic Cow Milk and Bubs Goat Milk formula. BUB aims to fulfil the enhanced demand of proactive parents to ensure the availability of infant milk formula under the prevailing situation.

The products are extensively available throughout Australia and exported to China, the Middle East and South-East Asia. As per the recently released 1H20 report, it was noted that domestic sales contribute to nearly 70 per cent of BUB’s total revenue.

BUB intends to safeguard continued delivery and supply of its newly launched Bubs Organic 365-days product range along with its current range of Goat Milk infant formula. Recently, BUB has operated with its retail partners, namely, Big W, Coles, Chemist Warehouse and Woolworths.

Robust Q3 FY 2020 result:

On 14 April 2020, Bubs Australia reported third-quarter result for the period ended 31 March 2020. Key highlights include:

- As of 31 March 2020, BUB holds $36.4 million of cash reserves and $2.3 million of positive operating cash flow.

- On a YTD basis, gross revenue stood at $48.5 million.

- BUB embarked a record in quarterly gross revenue at $19.7 million, which is an increase of 67 per cent and 36 per cent on pcp and QoQ basis, respectively.

- Bubs® portfolio increased by 123 per cent on pcp basis.

- Bubs® Infant Milk Formula delivered a strong performance with 137 per cent and 33 per cent upsurge on pcp and QoQ basis, respectively.

- Bubs® Organic Baby Food witnessed an increase of 17 per cent on pcp basis, signifying 4 per cent of Q3 gross sales.

- Adult Goat Dairy declined by 30 per cent on pcp basis.

- By region, Australia and China witnessed an increase of 34 and 104 per cent on pcp basis, respectively.

Stock performance: On 16 April 2020, BUB’s stock was trading at $0.895 (at 03:57 PM AEST), a decline of 1.186 per cent compared to its previous close. BUB stock has delivered an astounding return of 105.62 per cent in the last month.

Blackmores Limited (ASX:BKL)

With an experience of 85 years in natural health products, Blackmores offers formula containing essential minerals and vitamins to fulfil the nutritional requirements of babies.

New Appointment: On 26 March 2020, BKL notified the market that Mr Nimalan Rutnam had been assigned as BKL’s Joint Company Secretary with immediate effect.

On 25 February 2020, the Company released its first half FY 2020 results for the period ended 31 December 2019, with following key highlights.

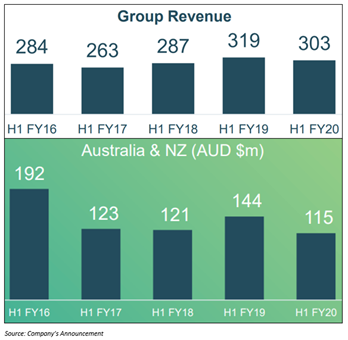

- Revenue stood at $303 million, a dip of 5 per cent on the prior corresponding period.

- Underlying net profit after tax was $18 million, a decrease of 48 per cent on pcp basis.

- Blackmores was able to maintain its number 1 VDS brand in Australia and 14.8 per cent of domestic market share.

- BKL declared no dividend to be distributed for 1H20 period so that cash is saved for business operations.

- In October, BKL concluded the purchase of Braeside manufacturing plant.

- Increased packing and material costs, as well as operational expenses, had impacted 1H20 results.

Stock performance: On 16 April 2020, BKL’s stock was trading at $77.650 (at 03:57 PM AEST), an increase of 1.08 per cent compared to its previous close. BKL stock has delivered a positive return of 15.64 per cent in the last month.