The International Maritime Organisation (IMO) is all set to enact the Annex VI of the MARPOL Convention or the International Convention for the Prevention of Pollution from Ships, which aims to reduce the maximum sulfur content of marine fuel oil from 3.5 per cent of weight to 0.5 per cent of the weight.

The regulations would limit the sulfur in fuels for ocean-going vessel and would have implications for many fuel industry operators, such as vessel operators, refiners, and overall global oil market. The stakeholders to the new IMO 2020 would act in unprecedented ways to the regulations, which could shape the price formation for oil and petroleum products in the short- and long-run.

The high sulfur contents in the ship fuel produce sulphur dioxide, which typically disturbs the PH level of marine water, and makes it unsuitable for sea-borne species. The consortium of nations are these days joining hands to address such issues under the broader tag of “Climate Change” in lieu of Accord de Paris.

Accord de Paris: ORIGIN ENERGY JOINS THE CAUSE OF REDUCING CARBON FOOTPRINTS

Impact Across Stakeholders

Vessel operators across the globe now have two choices to comply with the IMO 2020, i.e., to either switch to lower-sulfur fuel or they can use scrubbers to remove pollutants from ships’ exhaust, which would allow them to use high-sulfur fuels. The vessel operators across the globe are also shifting towards LNG ships at the rabbit-pace.

The uncertainty over the cost, availability, and specifications of new IMO 2020 complied fuels makes the installation of scrubbers a more viable alternative for the vessel operators; albeit, the high-cost associated with scrubber installation could prompt the refineries to generate more low-sulfur fuel ahead.

The regulations are expected to move the refineries to generate more low-sulfur content; however, the fast adoption of scrubbers across some global fleet and equal adoption of low-sulfur fuels is putting the refineries in a dilemma, and the future of ship fuels is still yet a mystery, which would be resolved once the vessel operators set the trend to either go for scrubbers or use low-sulfur content fuels.

The United States Energy Information Administration anticipates the refineries in the United States to increase their run by 3 per cent from 2019 to reach a record level of 17.5 million barrels of oil production per day in 2020, which would also mark high utilisation rate of up to 93 per cent in 2020.

Impact on Australia Miners

The new regulations are expected by the market participants to impact the LNG industry, which derives its product prices against some of the heavy-sulfur content fuels in the international market. The LNG industry in Australia is booming; however, the IMO 2020 could have a slight impact on the LNG sector.

LNG Sector: AUSTRALIA TO JOSTLE QATAR FOR THE LNG CROWN; HOW LONG WOULD THE REIGN LAST?

While the negative part has been touched upon, the adoption by the vessel operators to comply with the IMO 2020 regulations could be beneficial for the LNG industry. The number of ships shifting towards LNG is growing fast, and being the number one exporter of LNG, the Australia LNG industry could take advantage of the new regulations; however, the clouded dynamic shift in the market is yet to get clear, before anything could be concluded with certainty.

Benefits of IMO for the Mining Companies: IRON ORE HITS 5-YEAR HIGH AS EXPORTS SLUMP; IMO 2020 BENEFICIAL FOR THE AUSTRALIAN MINERS

Impact Across Diesel Wholesale Market

The EIA predicts that the diesel wholesale margins would witness the highest impact of the new IMO 2020, and anticipates the diesel wholesale margins to surge by USD 0.61 per gallon in the first quarter of the year 2020.

The department also forecasts the ULSD (ultra-low sulfur diesel)- Brent crack spread to eventually increase due to the IMO 2020. The ultra-low sulfur diesel near-month futures price settled unchanged on 5 December 2019 against previous settlement at USD 1.93 per gallon on 1 November 2019. The ULSD-Brent crack spread fell by USD 0.04 per gallon to settle at USD 0.42 per gallon during the same period.

Albeit, the ULSD-Brent spread declined from the October level in November 2019, it remained above the five-year average.

Low and High Sulfur Spread

Source: EIA

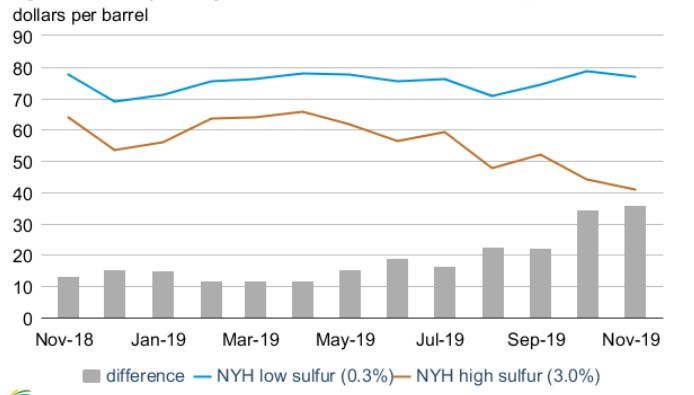

The spread between the low-sulfur content fuel and high-sulfur content fuel is widening over the upcoming IMO 2020, and it could be witnessed from the chart above that the prices of high-sulfur content have been falling for most of the year, but prices for low-sulfur residual fuel oil have remained steady, which further reflects how fuel market is getting future-ready in lieu with the new maritime regulations over emissions.

The prices of high-sulfur fuel (3 per cent) residual fuel oil in New York Harbor fell by USD 23.23 a barrel from this time last year to settle at USD 40.82 a barrel in November 2019. While the prices of low-sulfur (0.3 per cent) residual fuel across the same harbour fell by just USD 0.61 per barrel to settle at USD 76.91 a barrel (as on November 2019), which further suggests that the increasing spread between the high-sulfur fuel oil and low-sulfur oil fuel is largely due to the fall in high-sulfur fuel oil prices.

The EIA projects that the demand for high-sulfur fuel would eventually fall in the bunker oil market, and the demand for low-sulfur fuel oil would eventually rise over the IMO specification change.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.