There is a lot of optimism surrounding the outlook for the multi-billion-dollar global cannabis industry, which may not be still evident from the share prices but increasing number of nations are now introducing proper legal framework to back up consumption of medical as well as recreational marijuana.

A recent market forecast suggested that more cannabis would be sold in 2030 than soda drinks. The global cannabis market is expected to explode in value to $ 272 billion by 2028, suggests Barclays’ 2018 European Consumer Staples Report.

In a recent interview with Bloomberg, Curaleaf CEO, Joseph Lusardi informed that less than 10% of the cannabis transactions in the US were through regulated stores and there still remains work to be done concerning the convoluted licensing process for cannabis and reluctance expressed by the general physician community around the world to recommend or prescribe cannabis to patients.

Nevertheless, over the years, social acceptance has risen towards cannabis as the world got exposed to its benefits when consumed in moderate proportions.

Australia

Australia embraced medical cannabis cultivation in 2017 and went a step further to legalise marijuana exports in February 2018, positioning itself as a significant player in the global cannabis market.

The Australian medicinal cannabis sector is at the initial stage of growth and currently valued at ~$ 17.7 million and expected to generate around $ 1.2 billion in the next 5 years possibly touch $ 3 billion by 2028. In September 2019, the Australian capital city Canberra became the first to approve possessing and growing cannabis for personal use , clashing with federal laws. However, the laws will come into effect in January 2019 and the bold move caught the attention of critics globally.

The mushrooming, dynamic and well-positioned Australian cannabis market is maturing, and expected to challenge the existing European and Canadian dominance in this space.

Africa

Since time immemorial, Cannabis has been an important crop and a key ingredient in various traditional African herbal medicines, and its right to say that the world is, in fact, catching up.

Africa is one of the world’s largest producer as well as consumer of cannabis products with the major shortcoming being that its legal industry is still in early stages, leaving the continent lagging behind its competitors amongst the developed countries. The continent has a huge potential with the right production climate to go on becoming a major player in the global cannabis industry. To realise its full potential, the African nations will have to introduce pro-business legislation, implement standards and produce high-quality pharmaceutical offering for competing on the international front.

Nevertheless, several countries/jurisdictions, in North America, Europe, and South America, have relaxed controls on cannabis by legalising and/or legalizing some cases of possession, production use, and sales. African nations are also join in and slowly accepting this global wave of cannabis liberalization. The present period can be considered as the best time to invest in medicinal marijuana stocks as it is newly legal with increasing number of companies entering the market, demonstrating a compelling growth potential in the foreseeable future.

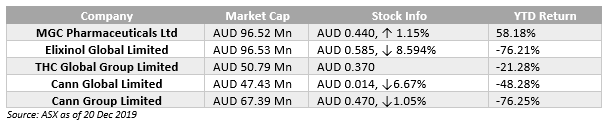

In the thriving Australian Cannabis space, let’s look at 5 pot stocks and the outlook for each for the year 2020.

- MGC Pharmaceuticals Ltd (ASX: MXC): A European based ‘Seed to Medicine’ bio-pharma company supplying phytocannabinoid derived medicines to patients globally was founded by key figures in the global medical cannabis industry. The company has a robust product offering targeting 3 critical medical conditions including epilepsy, dementia and IBS – and has further products in the development pipeline with a focus on medical markets of Europe, North America and Australasia.

For the quarter ended 31 October 2019, MGC Pharmaceuticals reported a total revenue of AUD 413,000 and stated that over AUD 400K more revenue would be received at the end of the period from the sales done as payment terms are up to 90 days. MGC is on track to deliver significant operating cash receipts with revenues from prescription numbers reported to date for September and October at 1,000 and expected to grow on trend in the coming months, along with over € 300,000 purchase orders.

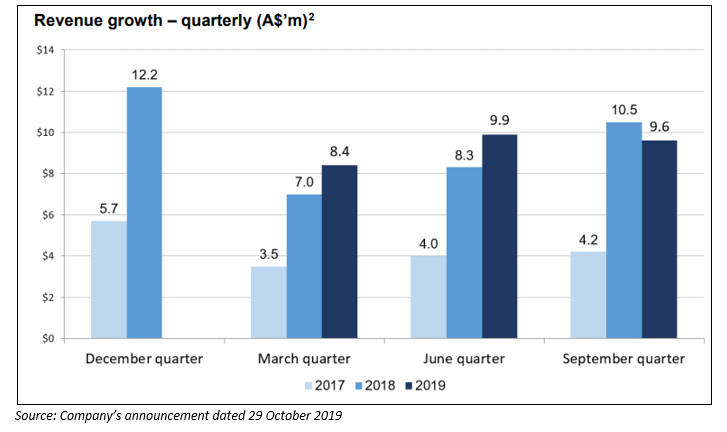

- Elixinol Global Limited (ASX: EXL) has a global presence in the cannabis industry through its subsidiaries. It is a global leader in the hemp derived CBD industry, innovating, manufacturing and selling hemp derived CBD products in the markets of Americas, Europe, UK as well as Australia. Elixinol delivered a revenue of AUD 9.6 million during the quarter ending 30 September 2019 (Q3 FY2019), depicting normalised revenue growth of 12% on the prior corresponding period (PCP) Q3 FY2018 AUD $ 8.6 million.

Group CEO stated with continued diversification of the business across a variety of channels and significant investments in people and operations in a various key geography, including strong headway in Europe, EXL Group well positioned to expand.

- THC Global Group Limited (ASX: THC): THC Global is well positioned to commence medicinal cannabis production for servicing both local patients and the international export market place with all 3 key cannabis licences being a Medicinal Cannabis Licence (Cultivation), Cannabis Research Licence, and two Manufacture Licences in place. Recently, THC Global completed maiden production of medicinal cannabis at its Southport Manufacturing Facility.

For Q3 2019, THC Global reported to have secured Controlled Substances and Prescription Drugs manufacture and wholesale licences for the commercial scale production of medicines at Southport Facility and its Canadian hydroponics equipment division reported YTD unaudited revenue of over $ 3 million with ~80% QoQ cash receipts increase.

The company achieved New Zealand product sales success with recent Endoca CBD product shipment under exclusive distribution sold out in October 2019 and product sales in New Zealand laying foundation for distribution of THC Global’s own Australian manufactured products in mid-2020.

- Cann Global Limited (ASX: CGB): Cann Global is a driving force in the hemp and medical Cannabis industries owing to its strength of competencies, expertise, and solid and strategic partnerships with experts in Australia, USA, Israel, Asia and Canada. The company is working under the relevant legislation to ensure that the future in Medical Cannabis and Natural Foods will enable medical practitioners, patients, and consumers to access right information along with safe, effective and sustainable products.

Recently, Cann Global executed a Heads of Agreement with South Africa-based Koegas Medicinal Herbs (Pty) Ltd for creating a JV (CGB to hold 70%) in medicinal Cannabis production and distribution in Africa. The Board and management are quite optimistic about the year ahead as demand for hemp seed and natural organic food products continues to be on the rise, especially from South-East Asian customers. Improvements in the company’s online and Specialty store retail outlets was also recorded in Australia for the new T12 food product range, creating a healthy business dynamic that should underpin a positive price environment.

- Cann Group Limited (ASX: CAN): Cann Group Limited is building a top notch business centred on medicinal cannabis for sale and use within Australia.

Recently on 19 December 2019, the Group announced that the first commercial medicinal cannabis product has been packed by IDT under cGMP conditions and will undergo stability testing ahead of release in the first quarter of calendar year 2020. has been packed by IDT under cGMP conditions. The product will undergo some stability testing before it is released in the first quarter of calendar year 2020.

The Group’s ongoing research initiatives; product development and manufacturing capabilities; distribution channels and market development programs are also expected to ensure that the company is in a very strong position to capitalise on the opportunity associated with both Australian domestic medicinal cannabis market and growth in overseas markets.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.