Buy Now, Pay Later - An overview

In the contemporary era, new technologies are evolving on a day to day basis to help people in every aspect of life. Nowadays, there are several issues faced by the customers, which prove to be key drivers for the shopping basket / cart abandonment rate, that are quoted widely across the e-commerce space. On the payment mode front, the market is dominated by debit and credit cards, however, new services are giving these established payment companies a tough competition in earning their bread and butter.

An Edge over Credit Cards

The concept of BNPL or buy now, pay later did not even exist a few years ago, and now it has become one of the emerging technologies, which allows a customer to buy the goods and pay the amount later. Under this new concept, customers must pay a fraction of the total money and rest of the amount in instalments for a specific period. The buy now, pay later companies are not categorised as a credit provider as they do not generally charge the interest.

The option that allows consumers to buy now, pay later, at no cost to themselves, is obviously very attractive. Customers have an added advantage for buy now, pay later companies, as they do not have to pay any interest for the goods they had purchased. Credit card companies generally charge interest from customers at the time of the repayment. Credit card companies say that as long they are providing credit, they should be regulated like any other credit provider. In a review conducted by the Australian Securities and Investment Commission in November 2018, it was found that the use of BNPL concept has increased five times since 2015.

Let us look at a few stocks in buy now, pay later space.

EML Payments Limited

EML Payments Limited (ASX:EML) is a fintech company, engaged in the provision of prepaid payment services throughout the Australian, European and North American regions. The company offers prepaid disbursements and funding card programs for gaming pay-outs and government disbursements.

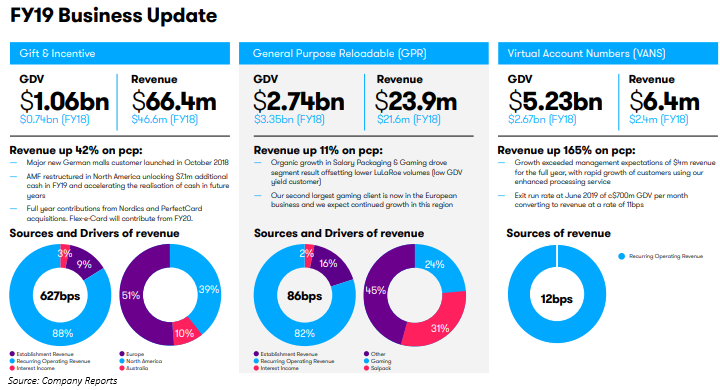

Financial Summary for FY 2019

On 21 August 2019, the company announced the FY 2019 results, closed 30 June this year, and a few highlights are mentioned below:

- The company recorded an underlying EBITDA of $29.1 million compared to 40 per cent growth over the last year (FY 18) period.

- Revenue rose up by 37 per cent to $97.2 million.

- Exceeded guidance range on both EBITDA and Revenue.

- The company recorded $0.6 million acquisition cost, principally relating to Presend and Perfect card.

- Cash overheads was decreased by 45.1 per cent of revenue.

- Cash on hand stood at $33.1 million.

- AASB15 had no impact on the FY 2019 period.

- Gross profit margin remained consistent with pcp at 75.1 percent.

- Five-year CAGR graph showed an upwards movement with CAGR at 82 per cent.

Stock Performance

The stock of EML was trading at $3.76 on ASX, on 20 September 2019 (AEST 12:46 PM), high by 0.267 per cent from its previous closing price. The company has a market cap of $957.97 million and approx. 255.46 million outstanding shares. The 52-week low and high value of the stock is at $01.210 and $04.010, respectively. The stock has generated a positive return of 107.76 per cent in the last six months and 150.00 per cent on a year-to-date basis.

Splitit Payments Ltd

Splitit Payments Ltd (ASX : SPT) was founded in 2012, is engaged in payments solution business. The company is headquartered in New York and its other offices are situated in London and Australia. The company has a global footprint with 500 merchants in 27 nations across the world. SPT has over 1000 merchants and offers its services in more than 200 countries.

Recent Updates

On 19 September 2019, the company notified that its co-founder, Gil Don had made a decision to withdraw from his designation as Chief Executive Officer and assume as General Manager of EMEA. The new Chief Executive officer of the company will be Mr Brad Paterson w.e.f 1 October 2019.

On 11 September 2019, the company signed an agreement with Shaked Partners Fund, L.P to provide the company with an interim finance facility to grow its merchant business model. The facility is for up to US$ 8 million and has a flexibility to draw down in 3 tranches in next 11 months to 10 August 2020, maturing 24 months after each draw drawn.

On 3 September 2019, the company announced that its annual general meeting will be held on 30 October 2019.

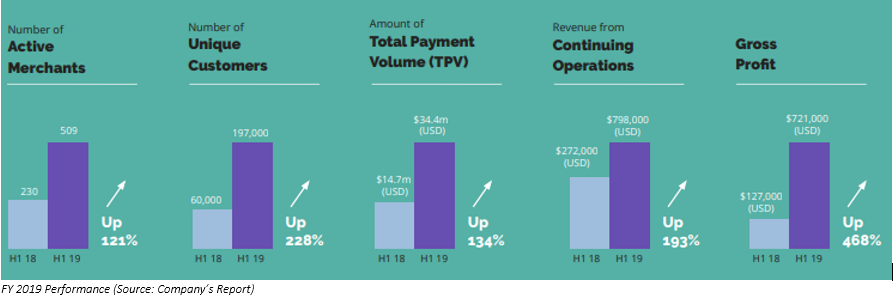

Financial Summary for H1 2019

On 30 August 2019, SPT declared the half-year report closed 30 June this year. A snapshot of it is as follows:

- The revenue increased by 293 per cent to $1.14 million compared to the prior corresponding year.

- Gross profit increased by 550 per cent to $1.03 million compared to PCP.

- Cash in Hand stood at A$33.9 million

- The company formed a new partnership with Ally Commerce (commercial).

- Active merchants increased by 121 per cent to 509.

- The company reported net loss of US$3.8 million compared to US$1.2 million in H1 FY18.

Outlook

The company anticipates a strong growth rate in active customers and transaction volume, leading to an increase in merchant fees in H2 2019. New partnerships are expected to scale up the business globally. Further, it would continue to invest in marketing and platform innovation to add product features. Also, the company feels that it has a strong balance sheet to take advantage of the opportunities it has in its kitty.

Stock Performance

The stock of SPT was trading flat at $0.505 on ASX, on 20 September 2019 (AEST 01:03 PM). The company has a market cap of $155.3 million and approx. 307.53 million outstanding shares. The 52-week high and low value of the stock is at $2.000 and $0.305, respectively. The stock has generated a negative return of 63.86 per cent in the last six months.

Afterpay Touch Group Limited

Afterpay Touch Group (ASX: APT) is a fintech company which provides payment services globally. The company offers a digital payment platform for its customers. The company has its presence in Australia, New Zealand, Europe, and the United States. It is listed on Australian stock exchange under the ticker APT. The company has ~4.3 million active consumers and ~30.6k active retail merchants involved with it.

Financial and Operating Performance for the FY 2019

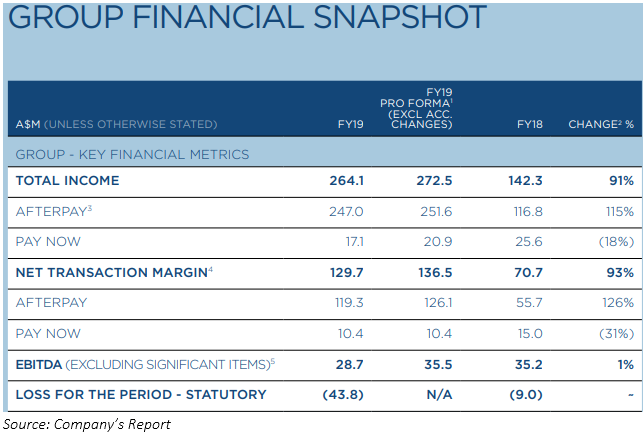

On 28 August 2019, the company declared its financial results for the FY 2019 closed 30 June this year; a few pointers from the same are as below:

- Pro forma total income for the group rose by 91 per cent to $264.1 million.

- Gross profit increased to 204.6 million compared to 114.1 in FY 2018.

- Group receivables increased by $213.6 million in FY 2019.

- Cash in hand stood at 231.5 million.

- The debt got decreased by $111.4 million or 69 per cent from the previous year.

- Capital raising proceeds had been used to repay warehouse debt with a corresponding rise in liquidity.

Outlook

The company will accelerate its growth in the US, build its business in the UK and consider exploring new markets. By 2020, the millennials will have the highest spending power, and the company is uniquely positioned to benefit from this shift. The company would continue investing in the growing global merchants, consumers and such, so that they can expand rapidly.

Stock Performance

The stock of APT was trading at $33.340 on ASX ,on 20 September 2019 (AEST 01:08 PM), up by 1.677 per cent. The company has a market cap of $8.28 billion and approx. 252.64 million outstanding shares. The 52-week high and low value of the stock is at $34.280 and $10.360, respectively. The stock has generated a positive return of 58.94 per cent in the last six months and 173.25 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.