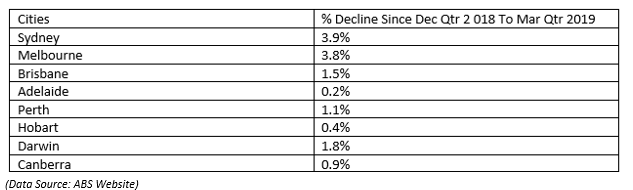

As per official stats, Australian real- estate market has been trending down. Property prices in significant cities as that of, Melbourne and Sydney continue to face the highest falls.

As per the recently released figures by the Australian Bureau of Statistics (ABS), the March quarter for the year 2019 depicted a fall of 3 per cent in the price-weighted index for residential properties in eight of the dominant capitals in Australia and a decline in residential dwellings by $172.7 billion to $6.6 trillion in March 2019.

Fall in housing property prices:

However, the market analysts believe that RBA cash rate reductions and concession of the 7 per cent serviceability buffer on home loans initiated by APRA could put a conclusion to the ceaseless downtrend in the real estate sector.

Let us now look at the two property-related stocks with their recent advancements

Dexus, formerly Dexus Property Group (ASX: DXS) listed on the Australian stock exchange, is one of the leading real estate investment trust managing a high-quality property portfolio in Australia. The portfolio is valued at $28.9 billion, of which, around $13.9 billion is directly owned by the company. The remaining $15 billion is from the third-party clients.

On 26 June 2019, Dexus announced $250 million or circa 1.6% increase in their owned portfolio before the recorded values on 30 June 2019, valued externally. As a probable outcome of the Independent valuation, the company's net tangible asset backing (NTA) per security is expected to rise by 23 cents. The release also stated the dropping of weighted average capitalization rate across the total portfolio including the office and industrial portfolios by ten basis points over the past six months to 5.26% with the critical contributions of Sydney and Melbourne office portfolios. The steady pace drove the office portfolios in rental growth, whereas the capitalization rates have dropped further. The Weighted Average Capitalization rate of the office portfolio reduced by 7 basis points to 5.15% at 30 June 2019 and industrial portfolio Weighted Average Capitalization rate dropped by 22 basis points to 5.92%.

The CEO of the firm Darren Steinberg highlighted the contribution of the rental growth in the upliftment of the office portfolios in the regions of Sydney and Melbourne and sought to maintain the firm's leading position in the housing sector.

A glance into the stock performance of the firm

Letâs have a look into the stock performance of the firm, and its recorded returns since the past few months. On the Australian stock exchange on the day of writing (Friday, 28 June 2019), the stock of Dexus opened at $13.050 and settled the daysâ trading at $12.980, down by 1.067 per cent as compared to the previous close with a market capitalization of $14.39 billion. Today, it reached dayâs high at $13.130 and recorded dayâs low at $12.980, with a daily volume of 3.8 million. The price to earnings ratio was recorded at 9.150x, while EPS was recorded to be $ 1.433. Its 52 weeks high price stands at $13.760 and 52-weeks low price at $9.600. Its 3-month, and 6-month return has been recorded at 2.74 per cent and 18.63 per cent respectively.

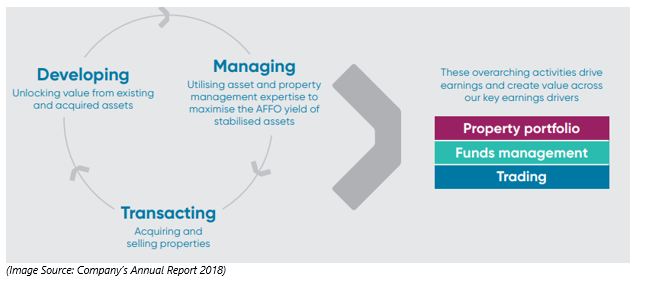

Cromwell Property Group (ASX: CMW) included in the S&P/ASX 200 and the FTSE EPRA/NAREIT Global Real Estate Index, a real estate investor managing its commercial properties across three continents as on 31 December 2018, it had a total assets under management of $11.5 billion spread across Australia, New Zealand and Europe.

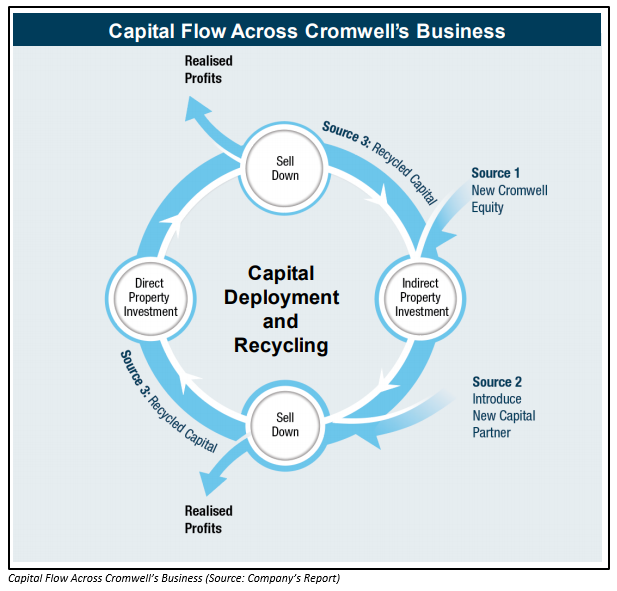

On 27 June 2019, Cromwell announced on the ASX that it raised $375 million via institutional placement as a component of its growth strategies and development opportunities across its real estate portfolio. The agreement took place at the issue price of $1.15 per new security executing its 'Invest to manage' strategy. The fund raised will help the company to envisage an AUD 1.0 billion of identified acquisition opportunities which are in exclusive due diligence and advanced negotiations. Whereas the direct property investment has over AUD 1.0 billion of value-add development opportunities directing to deliver medium-term growth across its real estate portfolio.

The 'Invest to Manage' strategy of the company involves growing the fund's management platform by warehousing assets and then seeding new funds by selling down equity stakes to new capital partners.

The firm also announced the undertaking of a non-underwritten $30 million security purchase plan (SPP) for eligible shareholders. The security purchase plan incorporates solicitation for the shareholders who are qualified according to the terms and conditions to sign up for a maximum of $15,000 worth of new securities without any restrictions of brokerage and transaction fees.

"The Equity Raising will provide certainty of funding to pursue these opportunities, strengthen the balance sheet and allow for growth in distributions," said the CEO Paul Weightman.

Subsequent to the completion of $375 million institutional placement, today, 28 June 2019, the company announced to the exchange that it has executed a new Euro 225 million three-year syndicated facility agreement. The company re-affirmed its recently revised, through the cycle target gearing range of 30-40%.

A glance into the stock performance of the firm.

On the Australian stock exchange on the day of writing (28 June 2019), the stock of CMW closed at $1.155 down by 0.431 per cent as compared to the previous close with the market capitalization of $2.59 billion. The price to earnings ratio was recorded at 9.78x, while EPS was recorded to be $ 0.119. Itâs 52 weeks high price stands at $1.270 and a 52-week low price of $0.980. Its 3-month, 6-month return and year to date returns are on a positive side with 4.98 per cent, 16.00 per cent and 17.77 per cent respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.