The Housing sector of Australia has been in the headlines for a few months now due to consistent downfall in the housing prices. The sliding house prices depict one of the weakest macro-housing conditions since February 2012 in the country. Different market experts are of distinct views as to whatâs in store for the Australian housing sector over the short to long term.

Overall, the national home prices slid 7.3 per cent over the last one year (in average weighted terms) and the growth in property prices fell by 9.4 per cent in Melbourne and 10.3 per cent in Sydney.

In addition, the total value of around 10.3 million residential dwellings in Australia stood at $ 6.6 trillion, plummeting by $ 172.7 billion in the March quarter 2019, according to the Australian Bureau of Statistics.

The mean price of dwellings in Australia now stands at $ 636,900, as of June 2019, having fallen for five consecutive quarters since December quarter 2017.

Recently in the month of May 2019, there was a decline of 0.4 per cent in the home prices from April 2019, lower than the 0.5 per cent fall from March to April. This slowdown in the pace of decline initiated in December 2018 when the home prices plummeted 1.1 per cent and the trend has continued since then.

The easing in the falling rates may be attributed to a lower reduction in housing prices for Sydney and Melbourne, that were earlier at the other end of the spectrum.

Though Australiaâs largest residential markets, Sydney and Melbourne, remain in a correction phase; as what goes up, must come down after experiencing an unprecedented growth cycle. Yet, the full price adjustment is uncertain, with several regulatory and political factors changing in the background. Continuous downward trajectory of the Australia housing market has caused wealth decay and affected the consumer confidence.

A majority of the market analysts such as Moody's Analytics are predicting that in the capital city regions of Sydney, Melbourne and Perth, the housing prices are expected to continue on their steep downward slope, deducting from the trend so far, with a possible rebound anticipated in the later part of 2019 or early next year. As per Moodyâs predictions, for Melbourne, the recovery of the home prices may take a longer time, starting around mid-2020 while for Sydney home prices would bottom out somewhere during the September quarter 2019, before picking up gradual recovery in 2020.

On the other hand, house prices have proven to be more resilient in Brisbane and Adelaide and are recording upward movement as Queensland continued to receive high levels of interstate migration and this is expected to continue and support Brisbane house values.

Miscellaneous Factors Influencing the Housing Market

Lending to Households and Businesses- A tight credit availability has been a major factor contributing to the price corrections in Sydney and Melbourne, which has been furthered by banks being responsive to the preliminary findings in the Royal Commission and are imposing more stringent lending standards.

According to the recent âLending to households and businessesâ data (seasonally adjusted) for April 2019, released by the Australian Bureau of Statistics, the value of lending commitments to households rose by 0.6% in April 2019, following a 3.3% fall in the prior month, perhaps driven by personal finance excluding refinancing (up 4.3%) and owner occupier dwellings excluding refinancing (up 1.0%). Meanwhile there was a 2.2% decline in the lending commitments for investment dwellings in April 2019.

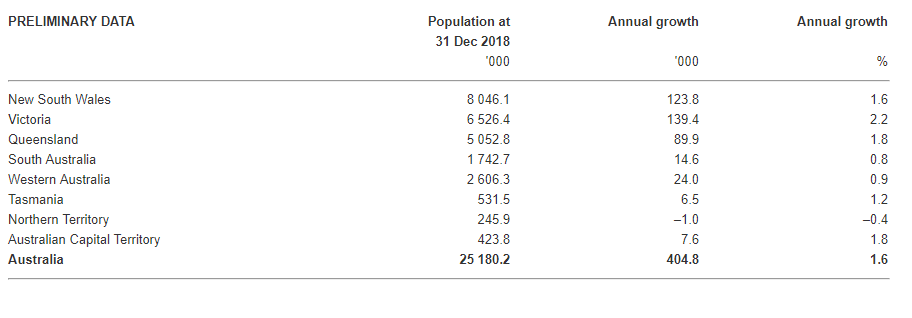

Changing Demographic landscape: In Australia, the population growth rate for 2018 has been around 1.6 per cent, according to the statistics disclosed by the Australian Bureau of Statistics (ABS). The number of births in 2018 reached an all-time high of 314,900, resulting in a steady growth of population to 25.2 million people at 31 December 2018.

Besides, the migration rate has been pretty high in the country, with the net overseas migration standing at 248,400 people for 2018, much higher than 241,700 as of 2017. Victoria continued to have the highest-level migration followed by Tasmania.

So as per the basic law of supply and demand, the trend suggests that, all else being equal, a high population growth would be accompanied by rising house prices.

Source: Australian Bureau of Statistics

Source: Australian Bureau of Statistics

Australian Economy: According to ABS, the Australian economy grew by 0.4 per cent (seasonally adjusted) during the June quarter 2019. While, government spending on disability, health and aged care services increased, there was a slowdown in household spending and the dwelling investments continued to detract during the period.

Lifestyle choices: With changing lifestyle preferences and varying disposable incomes, more and more families believe owning land is perhaps more expensive than just renting out their dream house. Besides, the consumers believe that especially during economic downturns, renting can be the safer alternative, and far more affordable than buying a house. So, it may be the case that the tradability trend of bricks and mortar assets has created an entire rental generation that prefers not to own property.

In the end, the housing market is highly susceptible to changing human behaviour while it also runs independently of, and in response to other commodities, such as Australiaâs resource ongoing boom.

With so many influential factors in the background, nothing can be clearly forecasted for the Australian residential market. The market participants including consumers, investors, governments and companies are keenly keeping a track hoping for recoveries in the home prices in the short to medium term.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.