Lithium Chemical prices stabilised on the London Metal Exchange with lithium carbonate (Min 99.5% Battery Grade, Spot Prices CIF China, Japan & Korea) settling at USD 10.0 per kilo and lithium hydroxide (Min 56.5% Battery Grade, Spot Prices CIF China, Japan & Korea) settling at USD 12.00 per kg (as on 3 October 2019).

While lithium chemical prices have taken a breather from the free-fall mode, the ASX-listed lithium miners and chemical developers are scaling through the turbulent lithium markets and taking survival measures to lessen the impact of falling lithium prices.

To Know More, Do Read: ASX-listed Lithium Players Scaling Through The Turbulent Lithium Markets

The Lithium Shock Wave

The primary lithium market and the lithium-based chemical market took a hit amid high supply and slumped demand in the international market. While Australia bagged the number one spot in the production and supply chain, Chile and its key player- SQM are adopting measures to overtake Australia for the number one spot in the production and supply chain.

To Know More, Do Read: Chile And SQM Leap To Regain The Market Share Posses Headwinds For Australian Lithium Miners Ahead

However, despite the oversupplied conditions, the market participants and industry players are standing tall against all the odds and intrusting the much-anticipated EV and Giga factories penetration in the global market.

To Know More, Do Read: Why Are Market Players Clinching to the EV and Lithium Forecast?

Australia Lithium Scenario

There has been a lot of recent consolidation amidst turbulence in the Australia lithium industry with Wesfarmers Limited (ASX: WES) acquiring Kidman Resources Limited (ASX: KDR), Galaxy Resources Limited (ASX: GXY) securing senior loan facility of Alita Resources Limited (ASX: A40) and much more.

Do Read: Lithium Demand Plays Spoilsport; Alita, Galaxy and Pilbara Limits Production

The ASX-listed lithium miners and chemical players are adopting measures and taking considerable actions to sail out from the shock waves of the lithium industry.

ASX-Listed Lithium Miners and Chemical Developers

Piedmont Lithium Limited (ASX: PLL)

Piedmont is an ASX-listed lithium chemical company with a 100 per cent interest in the Piedmont Lithium project in North Carolina. The aim of the company is to become a significant lithium-based chemical supplier in the United States.

The primary market of the company, i.e., the United States could give them a strategic advantage as the United States is actively looking to reduce its lithium-based chemical dependency on China.

PLL recently noticed strong interest from the prospective lithium hydroxide customers, and the company decided to accelerate the development of its lithium chemical plant. PLL decided to compress the project timeline into a single-stage, which would target lithium chemical production in late-2022.

Push For Lithium Hydroxide Development

The new timeline, which would defer the mine/concentrator construction start date by a year will effectively accelerate the chemical plant development by one year resulting in integrated operations from day one.

The integration should improve project economics amid higher margins associated with lithium-based chemicals such as lithium hydroxide/lithium carbonate and eliminate spodumene concentrate sales into the Chinese market.

The near-term milestones planned by the company are as below:

- PLL anticipates receiving the key federal permit for the mine and concentrator in Q4 2019.

- The chemical plant pre-feasibility study is estimated by the company to commence in Q2 2020, and the lithium hydroxide testwork is anticipated to commence in Q4 2019.

- PLL targets Integrated definitive feasibility study (or DFS) and chemical plant permitting in Q4 2020.

- The company is also in discussions for offtake with numerous participants in the global battery supply chain.

- The by-product marketing chain related to products like quartz, feldspar and mica is well advanced, and the company is continuously evaluating the strategic partnering options.

The cash position of the company is strong at $21 million to accelerate the required work to commence construction of the integrated lithium hydroxide project to leverage anticipated shortfalls in lithium hydroxide supply beginning in 2023.

Pilbara Minerals Limited (ASX: PLS)

PLS is an ASX-listed lithium-tantalum producer under the ASX200 index, and the company operates the Pilgangoora Lithium-Tantalum Project with an aim to stand among one of the biggest lithium raw materials producers across the globe.

Hong Kong-based battery-grade lithium chemical giant- Contemporary Amperex Technology (or CATL) decided to purchase a stake in Pilbara by participating in Pilbaraâs $91.5 million capital raising programme.

CATL now received all necessary regulatory approvals required from the Peopleâs Republic of China for its $55 million strategic placement in Pilbara. The approvals from the Peopleâs Republic of China were one of the key outstanding conditions precedented under the Share Subscription Agreement between CATL and PLS.

The Placement by CATL would comprise of two tranches, according to the relevant approval conditions and settlement timetable, which are as below:

- The tranche 1 for $20.0 million post receiving the approvals from the Peopleâs Republic of China, is anticipated to settle by 11 October 2019.

- The tranche 2 for $35.0 million would remain conditional on Pilbara Mineralsâ shareholder approval as the number of shares Pilbara decided to issue under the tranche 2 is above the companyâs existing placement capacity under ASX Listing Rule 7.1.

- The company estimates the settlement to complete in approx. two business days after receiving shareholder approval.

The General Meeting for seeking the shareholdersâ support for the equity raising and the CATL Placement will be held at the University Club of Western Australia, on 16 October 2019.

Lithium Australia NL (ASX: LIT)

LIT is an ASX-listed lithium chemical developer which produces the lithium-based chemicals from all lithium silicates, including the mine waste via innovative extraction process. The company intends to produce advanced components for the lithium-ion battery industry and focuses on the recycling of spent batteries and e-waste.

The wholly-owned subsidiary of the company- VSPC Limited fabricated cathode material from recycled batteries via using lithium phosphate from spent lithium-ion batteries to create high-quality cathode material, which was then further used to create and test lithium-ferro-phosphate batteries.

Steps Involved

The Australian Nuclear Science and Technology Organisation (or ANSTO) recovered 99.9 per cent lithium phosphate from mixed metal dust produced from recycled lithium-ion batteries (or LIBs) via using the companyâs technology.

- Envirostream Australia Pty Ltd- in which LIT owns 18 per cent equity interest recovered the mixed metal dust commercially.

- After ANSTO recovered the lithium phosphate, it was shipped at the VSPCâs pilot plant in Brisbane, where VSPC proprietary nanotechnology was used to synthesise lithium-ferro-phosphate cathode.

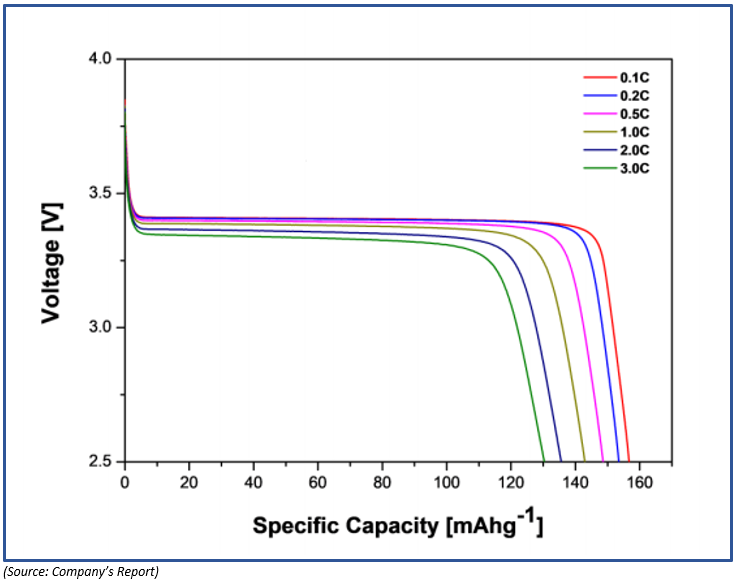

- By using the lithium-ferro-phosphate cathode material, VSPC created new 2032 coin-cell lithium-ion batteries and tested them electrochemically, which resulted in exceeded expectations.

The discharge curves for the coin-cell lithium-ion batteries are as below:

LIT is in several discussions with industry players in China and elsewhere to establish a supply chain for the lithium-ferro-phosphate cathode material.

As per the company, growth projection for such material is strong amid its suitability for various industrial applications in the replacement of automotive lead-acid batteries, largescale energy storage, etc.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.