Crude oil prices slipped in the international market yesterday amid sharp build-up in the United States crude oil inventory and global concerns.

The prices of August series Brent crude oil futures slipped from the level of US$62.27 (Dayâs high on 5th June 2019) to the level of US$59.45 in intraday; the prices recovered slightly to end the dayâs session at US$60.63, down by approx. 2.64 per cent from its high of US$62.27.

LCO DAILY Chart (Source: Thomson Reuters)

Since the opening of the series at US$61.64 on 3rd June 2019, the Brent oil August series marked a downside movement for the fourth consecutive trading session today; the prices of the contract is currently hovering at US$60.75 (as on 6th June 2019 AEST 12:58 PM), down by 1.44 per cent from its opening price of US$61.64.

U.S Oil Scenario:

The factor which exerted pressure on crude oil prices is a rapid increase in the crude stockpiles in the United States by 6.8 million for the week ended 31st May 2019, against the market expectation of a decline of 1.7 million.

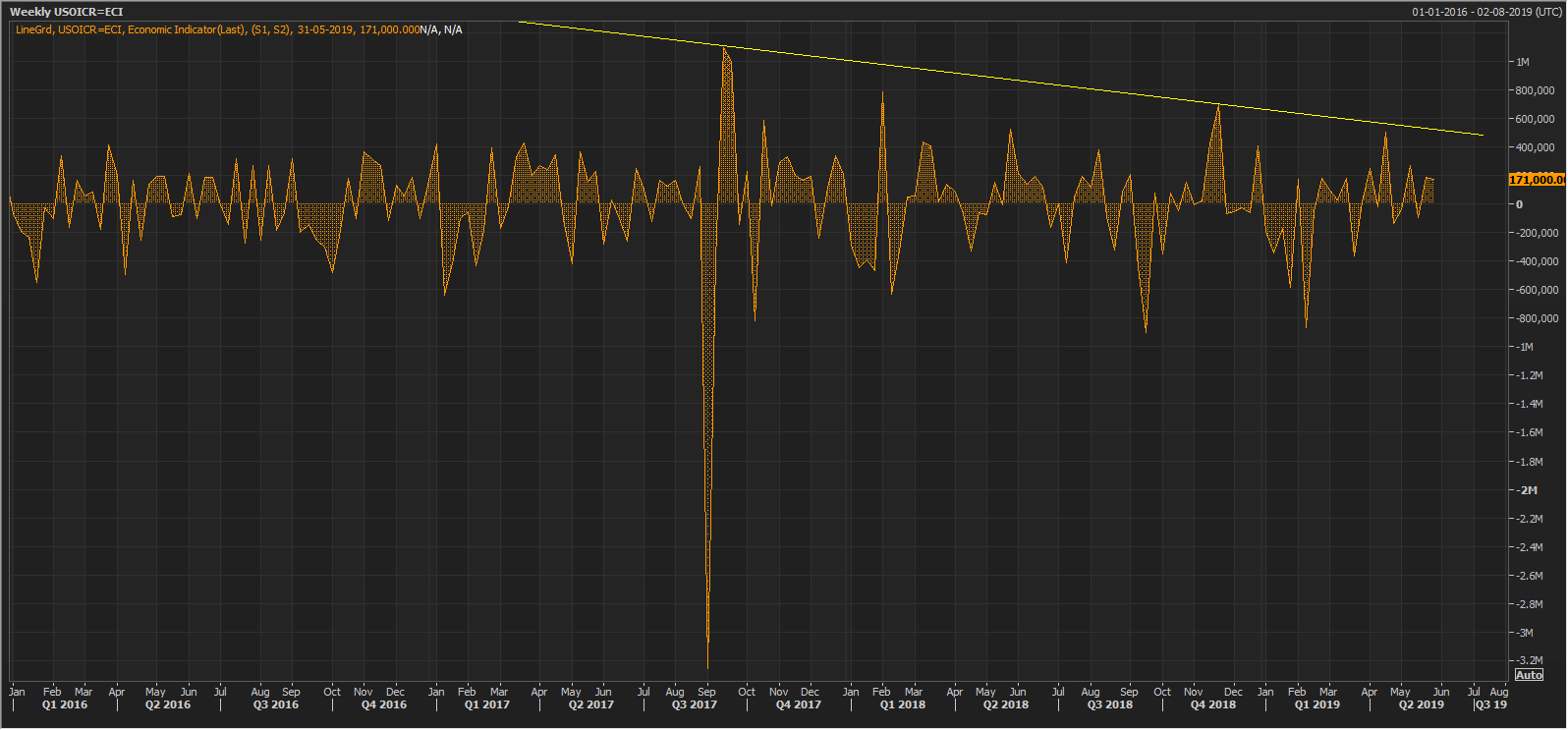

U.S. refinery processing marked a slight increase, and the refinery inputs averaged around 16.9 million barrels a day, up by 171,000 barrels, for the week ended 31st May 2019. Despite operating at 91.8 per cent of their operable capacity, the refinery inputs marked no significant change, and a higher crude import for the week ended 31st May indemnified the slight increase in the refinery inputs.

U.S. Refinery Inputs (Source: Thomson Reuters)

The oil import in the U.S. averaged at 7.9 million barrels a day for the week ended 31st May 2019, up by 1,065,000 barrels from the previous week.

The hike in imports and slower growth in the refinery resulted in the sharp build-up of the crude oil stockpiles, which in turn, exerted pressure on crude oil prices.

U.S. Weekly Crude Oil Inventory (Source: Thomson Reuters)

With oil prices feeling pressure from the global cues, the oil depended companies are showing a reaction to the oil spill through share price actions. Let us have a look over the share price actions of oil depended companies listed on the Australian Securities Exchange.

Oil Dependents on ASX:

Origin Energy Limited (ASX: ORG)

ORG is engaged in energy power generation and in the business of natural gas production. The business portfolio of the company consists of various exploration and production projects such as Bowen, and it operates in significant basins such as Cooper, Otway and Bass, etc.

Share Price Actions:

ORG shares increased in value from the beginning of the year 2019 from the level of A$6.300 (low in January 2019) to the level of A$8.050 (high in May). After a steep fall from the level of A$14.181 (high in September 2014) to the level of A$3.440 (low in January 2016), the share price of the company moved in an uptrend till the level of A$10.270 (high in July 2018).

Post rising till the level of A$10.270; the share price dropped till A$6.030 (low in December 2018) from where the prices recovered till A$8.050. However, over a significant decline in oil prices in the past month, the share price lost its value and is currently hovering at A$7.100 (as on 6th June 2019 AEST 2:32 PM).

Oil Search Limited (ASX: OSH)

OSH is among the largest oil mammoths operating in PNG (Papua New Guinea). The company holds 29 per cent interest of ExxonMobilâs operated PNG LNG Project and holds many other exploration and extensive appraisal prospects in its business portfolio.

Share Price Actions:

OSH descended on ASX from the level of A$9.270 (high in August 2018) to the level of A$6.700 (low in December 2018), from where the share price of the company improved and reached the level of A$8.460 (high in February 2019). However, the prices are again moving in a downturn from the level of A$8.460 from the past four months.

In the present month, the share price rose to the level of A$7.040 (Dayâs high on 5th June 2019); however, the prices again plunged and settled the dayâs trade at A$6.830 (as on 6th June 2019), down by 0.73%.

Santos Limited (ASX: STO)

STO was established in 1954 and is in the business of natural gas exploration and production, with a purpose to supply reliable, affordable and cleaner energy to provide its shareholders with sustainable returns. The company holds five significant operations in Australia across the Cooper Basin, Queensland, NSW, Northern Australia, and PNG.

Share Price Actions:

STO shares moved in a continuous uptrend from the level of A$2.870 (low in June 2017) to the level of A$7.480 (high in October 2018). Post making a top of A$7.480, the share price of the company dropped to the level of A$5.140 (low in December 2018).

However, the shiny increase in crude oil prices since the beginning of the year 2019 supported the share prices of the company along with various other factors, and the shares increased in value from the level of A$5.140 to the level of A$7.490 (high in April 2019).

The black month for the crude oil prices, i.e. May 2019 exerted the pressure on the share price, and the prices plunged in May 2019 from the level of A$7.390 (high in May) to the level of A$6.560 (low in June 2019).

Cooper Energy Limited (ASX: COE)

COE is an Australian Securities Exchange listed oil and gas producer and the company deals in hydrocarbons intending to generate sustainable returns to the shareholders. COE hosts various operations in the significant reserve basin- Cooper Basin for onshore oil production.

Share Price Actions:

COE shares rallied from the level of A$0.113 (low in February 2016) to the level of A$0.395 (high in March 2017). After posting a healthy rise for a year (2016-2017), the share price of the company retraced and fell to the level of A$0.255 (low in October 2017).

However, the share price gave an extended up-rally from the level of A$0.255 to the level of A$0.575 (high in May). The shares declined slightly in June to the level of A$0.505 (low on 4th June). COE closed the dayâs session at A$5.35 (as on 6th June 2019).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)