Australian Stock market observed a significant percentage loss on 03 December 2019 and ended with S&P/ASX200 witnessing a drop of 2.2%, or 150 points and settled at 6712.3, after U.S. President Mr Donald Trump declared to reimpose tariffs on steel import from Argentina and Brazil. The news resurfaced global trade worries indicating economic growth concerns, negatively impacting investors sentiments while also signaling that the trade war between U.S and its trading partner may perhaps continue to impact stock market at a global level. This unfavorable effect on global stock markets, in turn, negatively impact the Australian equity market.

Australian Health care sector also witnessed a downtrend with S&P/ASX 200 Health Care (Sector) stood at 40,912.7 after a decline of 1193.6 points or 2.92% compared to its last close. All Ordinaries ended the trading session at 6818.4, revealing a fall of 146.9 points or 2.15% from its last close.

Let us now have a look at the four health care stocks that have shown a downtrend on ASX (as on 3 December 2019)- Healius Limited (ASX:HLS), Pro Medicus Limited (ASX:PME), Nanosonics Limited (ASX:NAN) and Fischer & Paykel HealthCare Corporation Limited (ASX:FPH).

Healius Limited (ASX: HLS)

Healius Limited (ASX: HLS) is a leading health care entity with a network comprising of multi-disciplinary medical centres, diagnostic imaging centers and pathology laboratories, offering world-class services to the radiologists, general practitioners and other health care experts to deliver quality care to the patients.

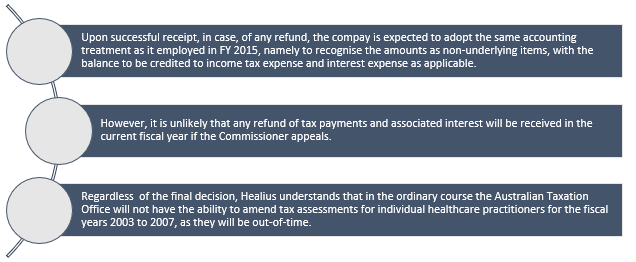

Healius’ Tax Case for Years 2003 to 2007 Update

- In a recent announcement dated 29 November 2019, the company provided update referring to the court case regarding tax treatment of healthcare practitioners’ lump-sum payments. It was informed that the Federal Court of Australia has decided the case in Healius’ favour.

- In 2015, it was advised that lump sum payments that were made by the company to healthcare practitioners for the fiscal years 2010-2014 were tax-deductible, subsequently Healius filed an application for similar tax deductions for the fiscal years 2003 to 2007, which was subject to the Commissioner of Taxation’s decision in permitting Healius to lodge an out-of-time objection.

- It was further informed that, following the Commissioner’s decision - not to allow the objection, Healius had begun legal proceedings which culminated in the Court’s decision in company’s favor. Nevertheless, the favourable verdict remains subject to the Commissioner’s right of appeal to the Full Court of the Federal Court of Australia.

- Given any such appeal is made, Healius can pursue tax payments refund & related interest, which was initially estimated to be $60 million, as revealed on 9 June 2015.

Stock Information

HLS shares last traded at $3.010, declined by 2.589% from its last close, as on 03 December 2019. The market capitalisation of the company stood at $1.92 billion and 622.74 million outstanding shares. The 52 weeks high of the stock was noted at $3.315, with an average (year) volume of 1,111,937. The company generated a year-to-date investment return of 26.64%.

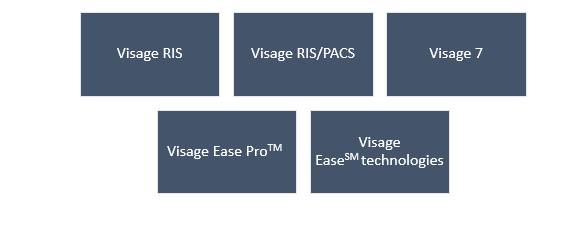

A global provider of radiology information systems, picture archiving and communication systems, and advanced visualization solutions, Pro Medicus Limited (ASX:PME) is focused on providing medical imaging products to health care companies, imaging centers and clinics. Pro Medicus’ wholly-owned subsidiary is Visage Imaging and PME’s products comprise of the following -

Another significant growth area for PME includes of the digital technology adoption by radiology providers.

Visage AI Accelerator Being Showcased at RSNA 2019

- Dated 28 November 2019, Pro Medicus announced that its wholly owned U.S. subsidiary, Visage Imaging, Inc., would showcase the Visage AI Accelerator solution & the new Visage created breast density classification algorithm at the Radiological Society of North America (RSNA) conference, to be held on 1-5 December 2019.

- A multi-faceted, end-to-end solution, Visage AI Accelerator translates AI ‘from research to bedside’ by incorporating Visage 7 AI research server, as well as specialised data curation and annotation tools including the new semantic annotation functionality to optimise curation and building of new AI models bridging the complete spectrum from research to diagnostic use via a single, unified platform.

- An open API enabling native integration of both Visage and 3rd party developed algorithms into the ProMedicus’ flagship Visage 7 product is the key to the accelerator solution.

- Collaborated with the American College of Radiology (ACR) to amalgamate Visage semantic annotations with ACR AI-LABTM.

- New breast density classification algorithm (to be demonstrated as Work in Progress) will also be highlighted at the conference. This algorithm was developed in partnership with Yale New Haven Health.

Stock Information

PME shares last traded at $24.010, declining by 3.225%, as on 03 December 2019. The market capitalisation of the company stood at $2.58 billion and 103.98 million outstanding shares. The 52 weeks high of the stock was noted at $38.39, with an average (year) volume of 450,678. The company generated year-to-date investment return of 118.17%.

Nanosonics Limited (ASX: NAN)

Specialised in the development and commercialisation of infection control solutions, Nanosonics Limited (ASX: NAN) has developed a breakthrough disinfection technology establishing the new standard of care worldwide for ultrasound probe reprocessing trophon®. It was reported that more than 1,000 ultrasound probes are compatible for use, with this a unique, automated device & nearly 70,000 patients are protected by decreasing the cross-contamination risk involving the latest HPV risk using Trophon sonicated hydrogen peroxide mist every day.

Change of Director’s Interest

As per the announcement on ASX dated 29 November 2019, Nanosonics Limited provided update on a change in one of the directors’ interest under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act. The date of last notice was 08 October 2019 and nature of change remains indirect.

It was reported that the company’s director Geoffrey Wilson changed his interest in the company while acquiring below-mentioned securities with effect from-

- 25 November 2019 - 860 Ordinary shares at a value of $5,990.20

- 26 November 2019 - 3,443 Ordinary shares at a value of $24,043.89

- 27 November 2019- 697 Ordinary shares at a value of $4,848.30

The number of securities held prior to the change were 3,237 Ordinary shares (Indirect) and the number of securities held after the change remains 8,237 Ordinary shares (Indirect).

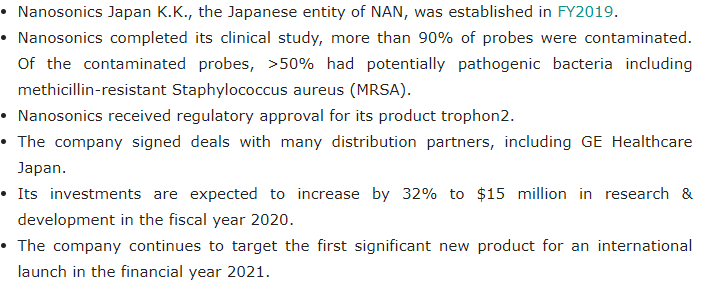

Highlights from 2019 AGM Presentation

NAN shares last traded at $6.53, declined by 3.687% against the last close, as on 03 December 2019. The market capitalisation of the company stood at $2.04 billion and has 300.36 million outstanding shares. The 52 weeks high of the stock was noted at $7.6, with an average (year) volume of 1,103,567. The company generated a significant year-to-date investment return of 143.88%.

Fisher & Paykel Healthcare Corporation Limited (ASX:FPH)

A leading designer, manufacturer and marketer Fisher & Paykel Healthcare Corporation Limited (ASX:FPH) provides products and systems used in respiratory care, acute care, surgery and the treatment of obstructive sleep apnea with products being sold in more than 120 countries around the globe.

FPH Reported Strong Half Year Result with Net Profit Up 24%

- Net profit after tax grew 24% to a record $121.2 million.

- Interim dividend grew 23% to 12 cps as compared to the interim dividend for FY2019 declared of 9.75 cps.

- Operating revenue soared 12% to a record $570.9 million with the growth in constant currency of 9%.

- Hospital revenue growth was noted at 19% with 17% growth in constant currency.

- The new applications consumables comprising products used in non-invasive ventilation, Optiflow nasal high flow therapy, and surgical applications, accounting for 63% of Hospital consumables revenue noted a 23% growth on a constant currency basis.

- Homecare operating revenue noted growth of 2% with 1% fall in constant currency.

- OSA masks also recorded 1% decline in constant currency revenue.

- The company invested 9% of revenue in R&D amounting to $54 million.

Stock Information

FPH shares last traded at $20.240, slipping by 2.879% compared to its last close, as on 03 December 2019. The market capitalisation of the company stood at $11.97 billion and 574.39 million outstanding shares. The 52 weeks high of the stock was noted at $21.16, with an average (year) volume of 379,738. The company generated a significant year-to-date investment return of 72.83%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.