Exchange Traded Funds

Exchange Traded Funds are actively traded on stock exchanges, often leading to discount or premium to its Net Asset Value. ETFs are now largely being used as a compelling investment product in pursuing passively driven strategies.

ETFs are relatively more liquid in nature compared to traditional closed-end investment vehicles. Moreover, the active trading feature of ETFs allow the investors to have a liquid investment across managed funds.

Status quo in the managed funds market has seen the escalating prominence of ETFs in the markets among investors. ETFs have a relatively lower cost, which offer investors an affordable diversified investment vehicle.

Investment vehicles in the managed fund category have minimum investment requirements, while some of the ETFs have waived off this criterion, which allow investors to start investing as little as they can.

As ETFs have come out as a prominent investment vehicle over time. Meanwhile, the ETFs market has grown with a range of actively traded ETFs.

Some categories of the ETFs are as follows:

Long ETFs â Most of the ETFs fall in this category of classification. Long ETFs pursue long-only strategies and seek to match the returns of the underlying benchmark indexes. Long-only strategies mean to invest in the available assets in anticipation that the price will rise in the future.

Short ETFs â Popularly known as Inverse ETFs, Short ETF should be utilised as short-term short strategies only and seek to match the return of underlying benchmark inversely. In short strategies, the investor sells the borrowed asset at prevailing prices in anticipation that the price of the asset will fall in the future.

Gold ETFs â Gold ETFs also seeks to replicate the performance of the underlying asset, which could be gold bullion or gold producing companies. These have come into prominence due to the increasing demand for gold, as a safe asset among others, and Gold ETFs have provided much more convenient and economical investment vehicle.

Sector ETFs â Sector ETFs invest in sectors that host various industries. Sector ETFs allow the investor to focus on a specific investment. Some of the popular sectors include Financials, Health Care, Technology, Mining, Energy etc.

Leveraged ETFs â Leveraged ETFs seeks to amplify the return generated by the underlying asset with the use of geared investment, which could be derivatives, including listed, non-listed, structured etc. For example, if the underlying asset has generated a 3% return during the period, the leveraged ETF would deliver the return in excess of the return generated by the underlying asset. Similarly, if the underlying asset has generated -3%, the leveraged ETF would head south by more than -3%.

Currency ETFs â Currency ETFs seeks to match the return generated by the underlying currencies in the portfolio, and these ETFs could be currency specific.

Bond ETFs â Bond ETFs are similar to every other stock ETFs, and investing in fixed income securities is the main distinguishing feature of these type of ETFs.

Some of the Australian ETFs are mentioned below:

BetaShares Australia 200 ETF (ASX: A200)

A200 by BetaShares seeks to invest in 200 largest listed companies on ASX on the basis of their market capitalisation. The ETF allow investors to allocate capital in the Australian equities at a comparatively lower cost. It closely tracks the returns of Solactive Australia 200 Index.

According to BetaShares, the fund charges management costs of 0.07 percent per annum, which is the lowermost among the Australian securities ETF. A200 ETF enables the investors to diversify their portfolio with an exposure to the Australian shares.

A200 does not have minimum investment criteria, and it distributes income on a quarterly basis. As of 18 September 2019, Commonwealth Bank of Australia (ASX: CBA), BHP Group Limited (ASX: BHP), CSL Limited (ASX: CSL), and Westpac Banking Corporation (ASX: WBC) features among the top allocated positions in the A200 fund.

On 19 September 2019, A200 last traded at $113.7, slightly up 0.548% relative to the previous close. The year-to-date return of the ETF stands at +21.87%, and in the last one month, the fund has delivered a return of +4.22%.

iShares S&P 500 ETF (ASX: IVV)

iShares S&P 500 ETF is an index ETF, closely tracking returns of the US index â S&P 500 index, which hosts large-capitalisation US equities. The fund charges a management fee of 0.04%, and it is an Australian domiciled ETF since September 2018.

IVV distributes income on a quarterly basis, and the base currency of the fund is AUD. As of 18 September 2019, the fund had 21.82% weight in the Information Technology sector, followed by Health Care, Financials, Communication, Consumer Discretionary with 13.56%, 13.10%, 10.43%, 10.06%, respectively.

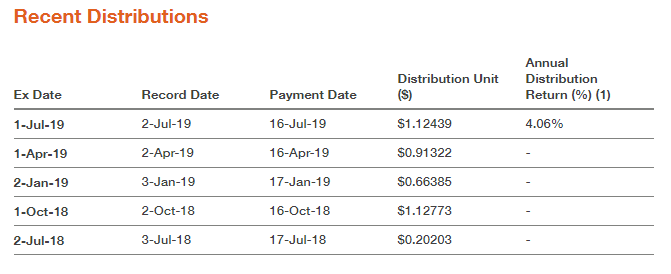

Concurrently, Microsoft Corp held 4.19% weight in the fund, followed by Apple Inc, Amazon.com Inc, Facebook Class A Inc, Berkshire Hathaway Inc Class B. Some recent income distribution by the fund:

On 19 September 2019, IVV last traded at $444.48, up by 0.741% relative to the previous close. Over the year-to-date period, the return IVV has been +23.39%, and in the last three months, the return stands at +3.59%.

BetaShares Gold Bullion ETF - Currency Hedged (ASX:QAU)

QAU is a gold bullion ETF, actively tracking the price and performance of gold bullion. It also applies currency hedging against the AUD/USD exchange rate. It is backed by physical bullion gold, which is held at the custodian.

It provides a convenient course of investing in gold, and access to the performance of gold bullion ETF as simple as buying a share. Gold ETFs are relatively cheaper than investing in physical gold.

Exposure to gold denominated investment assets allows an investor to opportunistically take part in the ongoing value creation by gold, specifically amid increasing volatility in the other investment asset classes. Concurrently, gold can be used as a hedge against inflation.

QAU can be purchased and traded like any other investment product on ASX. At the same time, QAU does not require an investor to have minimum investment funds while initiating investments.

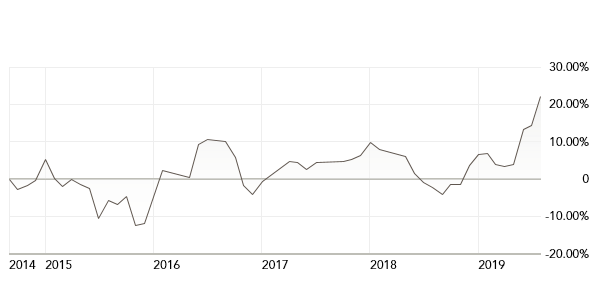

Long Term Performance (Source: BetaShares Website)

On 19 September 2019, QAU last traded at A$15.16, down by 0.329% relative to the previous close. Over the past one year, the return of QAU has been +22.86%. In the year-to-date period, the return of the stock has been of +16.20%.

UBS IQ Morningstar Australia Dividend Yield ETF (ASX: DIV)

DIV seeks to closely track Morningstar® Australia Dividend Yield Focus IndexTM (before fees and expenses) performance. It allows investors to gain exposure to a diversified portfolio of the Australian equity investments, which, according to the index administrator, are believed to be distributing sustainable income, and franking credits.

The underlying index consists of 25 securities, which are rebalanced semi-annually. Reportedly, the fund holds 25 securities, charges management cost of 0.3%, and it pays a dividend on a quarterly basis.

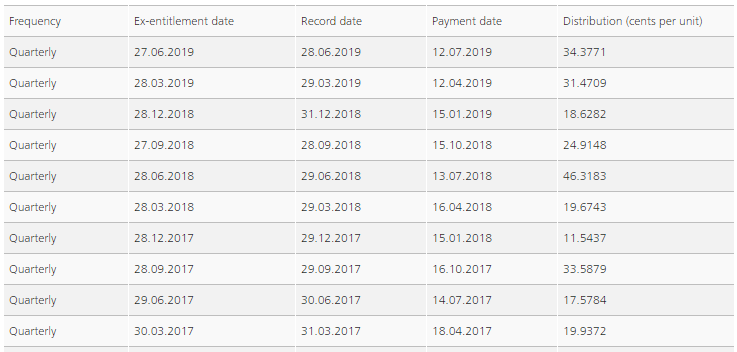

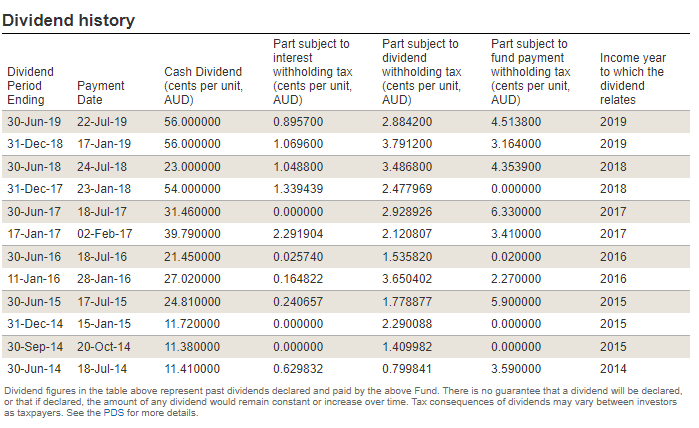

Previous Distribution (Source: UBS Website)

As of 16 September 2019, the largest holding of the fund was Wesfarmers Limited (ASX: WES) with 9.8%, followed by Woolworths Group (ASX: WOW), Transurban Group (ASX: TCL), and Aurizon Holdings (ASX: AZJ).

Concurrently, Consumer Staples, Industrials, and Financials had a weight of 22.1%, 22.1%, and 25.3%, respectively. According to the latest release on ASX, DIV is expecting to announce dividend on 24 September 2019.

On 19 September 2019, DIV last traded at $22.56, up by 1.622% relative to the previous close. Over the past one year, the return of fund has been +7.71%. In the year-to-date period, the return has been +21.31%.

VanEck Vectors Australian Equal Weight ETF (ASX: MVW)

MVW allows investing in a diversified portfolio of securities publicly traded on ASX. It tracks the MVIS Australia Equal Weight Index, which hosts the largest and most liquid companies on ASX across all sectors.

In addition, the index considers offshore companies, which have at least 50% of their revenue streams from the Australian market. More importantly, the index has a criterion of equal weight given to each company in the index, and companies are ranked based on the free-float market capitalisation.

As of 31 August 2019, the fund was holding 18.3% of assets in Financials sector, followed by Materials, Industrials, Real Estate, Energy, Consumer Discretionary, and more.

Reportedly, the fund charges management cost per annum of 0.35%, and it pays dividends semi-annually. Some of the relatively largely allocated companies in the portfolio of the fund include Amcor PLC (ASX: AMC), Lendlease Group (ASX: LLC), Afterpay Touch Group (ASX: APT), and Treasury Wine Estates Limited (ASX: TWE)

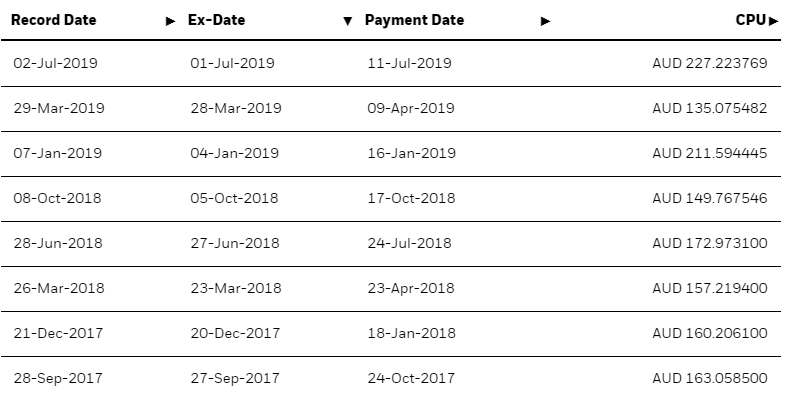

Some of the latest dividends distributed by the fund are:

Previous Distribution (Source: UBS Website)

Previous Distribution (Source: UBS Website)

On 19 September 2019, MVW last traded at $31.160, up by 0.711% relative to the previous close. Over the past one year, the return of fund has been of +6.14%. In the year-to-date period, the return has been of +21.67%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.