As the globe undergoes an energy transition, the demand for rare earth elements is growing and is likely to expand further in the next several years. The rare earth elements are used as constituents in high technology devices, comprising computer hard disks, smart phones, digital cameras, fluorescent and LED lights, computer monitors, flat screen televisions and electronic displays. An abundant quantity of rare earth elements is also utilized in clean energy and defense technologies.

But do you know what are Rare Earth Elements?

The rare earth elements are a cluster of 17 chemical elements that occur collectively in the series of the periodic table, consisting of scandium, yttrium and fifteen lanthanide elements. These chemical elements are usually found in the Earthâs crust and are necessary components of a range of products across multiple applications. Their unique luminescent, magnetic and electrochemical properties enable the manufacturing of high-end technologies, creating a substantial demand for such elements.

Rare Earth Elements: Global Demand and Supply Dynamics

The prices of rare earth elements have jumped tremendously over the past decades, driven by enormous demand and limited supply. Although the rare earth elements are not rare, they are dispersed across the planet in quite low concentrations. However, certain regions have a lot of them, particularly China, which is the leading producer of rare earth elements.

The larger part of the global supply of rare earth elements is met by China, with some other countries like Australia contributing to the supply. Few market experts expect the supply of rare earth elements to get affected by the ongoing US-China trade war. They believe that as China supplies most of the rare earth elements to the world, it may use it as a weapon in the trade war by completely restricting the export of these elements.

As there are no real substitutes available for such elements, the expected supply constraint has become a cause of concern for people. Amidst this scenario, discussing the other sources of rare earth elements becomes an important subject matter.

As Australia also possesses some richest rare earth element deposits, the mining companies in the country have begun to re-evaluate already existing rare earth deposits and explore for new ones. Considering this, let us discuss some of the ASX-listed Rare Earth companies below:

Lynas Corporation Limited (ASX: LYC)

ASX-listed Lynas Corporation Ltd (LYC) is the second largest producer of rare earth materials of the world, having resource deposit in Mt Weld, one of the worldâs highest-grade rare earth mines located in Western Australia. The rare earth oxides are initially processed and mined at the companyâs Mt Weld Concentration Plant. The company then ships the materials to the Kuantan industrial port in Malaysia, further transporting them to Lynas Advanced Materials Plant in Kuantan.

Lynas Records Annual Net Profit of $80.0m in FY19

In its recently released consolidated annual financial report for the period ended 30th June 2019, the company reported an annual net profit of $80.0 million relative to $53.1 million recorded in FY18. The company informed that the production of Neodymium-Praseodymium (NdPr) that was Ready for sale was 5,898 tonnes in FY19, in comparison to 5,444 tonnes in FY18.

The company also achieved record Rare Earth Oxide (REO) production in FY19, with its total ready for sale production being 19,737 tonnes as compared to 17,753 tonnes in FY18.

The other key financial highlights were as follows:

- Profit from operating activities at $56.4 million in FY19, while $81 million in FY18.

- FY19 EBITDA at $100.7 million, while $121.9 million in the prior corresponding period.

- Net sales revenue steady at $363.5 million, despite volatile Rare Earth market in FY19, driven by e US-China trade tensions.

- Cash flows from operating activities fell to $104.1 million in FY19 from $118.5 million in FY18.

- Total Group debts got reduced to $193.0 million from $225.1 million in FY18.

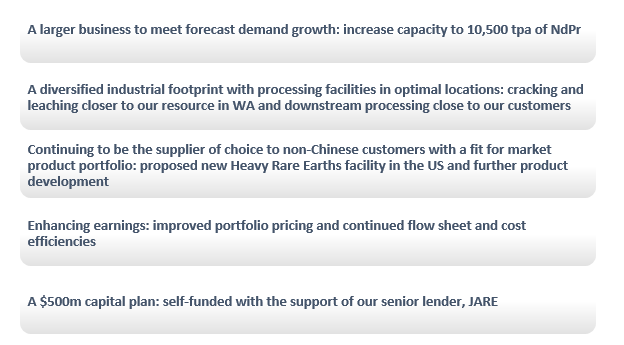

The company also announced its 2025 growth plan, which included the following components:

As on 18th October 2019, LYC closed the trading session at $2.53, with a fall of 2.7 per cent relative to the last closed price. The stock has delivered a return of 69.4 per cent on a YTD basis and a return of 198.9 per cent in the last five years.

Northern Minerals Limited (ASX: NTU)

Focussing on the development of heavy rare earth projects, Northern Minerals Limited (ASX: NTU) aims to become the next significant producer of dysprosium outside of China via the development of itâs Browns Range project. The Browns Range Pilot Plant Project that was officially opened on 27 July 2018, is well positioned to turn into a considerable new source of high value dysprosium.

Northern Minerals Limited Reports Transformational Financial Year

In its recently published financial report for the period ended 30th June 2019, the company notified that FY19 financial year was transformational for the company as it shifted from construction to the operational and commissioning phase at Browns Range.

As per the company, the Browns Range project milled 14,500 tonnes during the reporting period, along with producing a total of 46 tonnes of rare earth carbonate in the second half of the year. The companyâs first shipment left Australiaâs shores in December 2018.

The company achieved a number of milestones on financing front in FY19, including:

- Raised $33.5 million via equity placements at a price of 5.1 cents per share.

- Raised $11.5 million in two separate unsecured convertible notes.

- Closed the Brevet R&D facility and the Lind Facility

The company mentioned that one of the brighter notes of FY19 was the improvement in rare earth prices, particularly of terbium and dysprosium. The company noted that the price of dysprosium increased by 73 per cent to USD 279/kg, and price of terbium rose by 40 per cent to USD 582/kg, over the course of the financial year.

Northern Minerals reported a total income of $2 million and a net loss after tax of $64 million for the period ended 30th June 2019.

On 18th October 2019, NTU ended the dayâs trade at $0.053, with a fall of 3.6 per cent in comparison to the previous closed price. The companyâs stock has delivered negative returns of 17.8 per cent and 22.5 per cent during the last six months and three months, respectively.

Peak Resources Limited (ASX: PEK)

With an aim to become one of the lowest cost producers of NdPr, Peak Resources Limited (ASX:PEK) is engaged in the development of Ngualla Project, which is one of the worldâs highest grade and largest undeveloped NdPr rare earth projects.

Peak Advances the Development of Ngualla Project

Peak published its annual report for the year ended 30th June 2019 recently on the ASX. The company notified that it focussed on the development of its 75 per cent owned Ngualla Rare Earth Project during the financial year.

The company primarily focussed on securing the final permitting for UK refinery site, investigating financing avenues to give it a 100 per cent ownership and control of the Ngualla project and off-take negotiations with critical rare earth consumers across the world.

The company informed that it is set to achieve 100 per cent ownership of the Ngualla Project as it executed a Binding Heads of Agreement with International Finance Corporation and Appian Pinnacle Hold Co Limited post the end of the year, to roll up their ownership interests in Peak African Minerals (PAM).

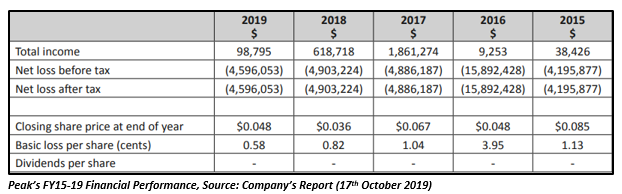

The company reported a loss after tax of $4.6 million in FY19 against a loss of $4.9 million in FY18. The company also mentioned that its net assets declined from $31.2 million in FY18 to $28 million in FY19. Peak had $2.15 million cash at the bank as at the end of the reporting period.

Peakâs stock ended the trading session at $0.036 on 18th October 2019, with a fall of 2.3 per cent relative to the last closed price. The stock has delivered a massive return of 52 per cent on a YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)